African Ventures Raised USD 782.6 Mn in September 2021

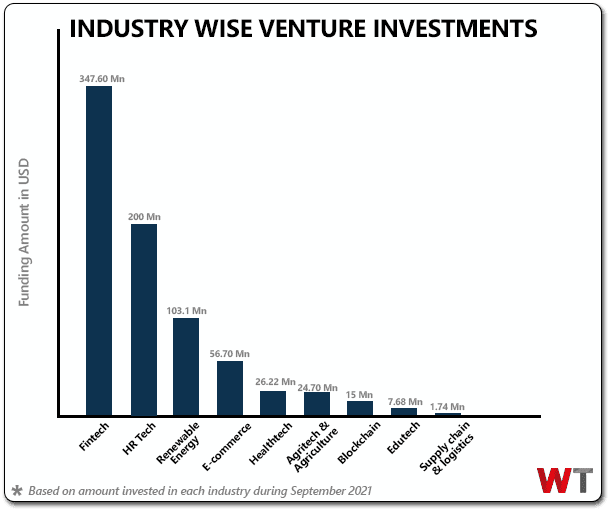

African ventures raised a total of USD 782.6 Mn across 38 disclosed funding deals in September 2021. The amount is distributed among 10 industries, with Fintechs taking the significant chunk of the funding pie; USD 347.6 Mn across 9 deals, representing 44% of the total amount raised in the month.

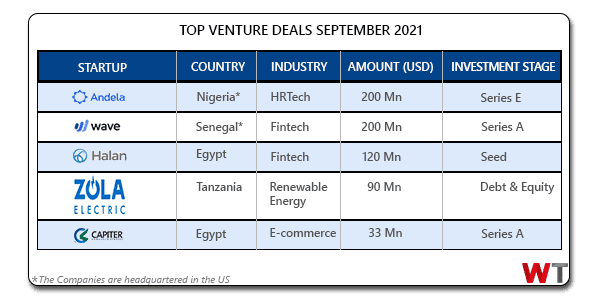

An interesting observation is that more than 50% of the total funding amount came from just two deals- Africa focused Fintech Wave and HRtech company Andela.

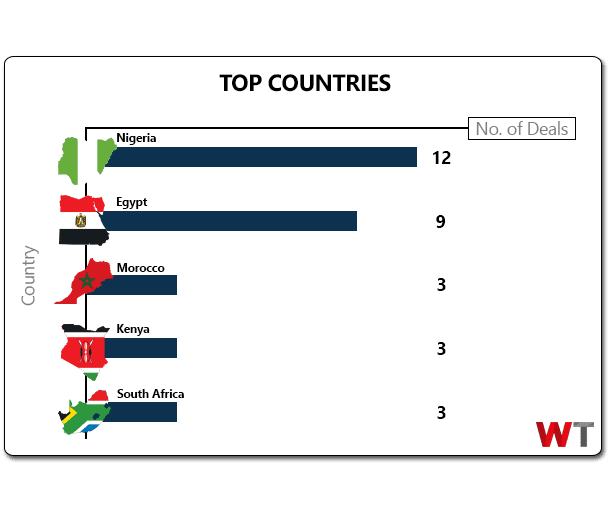

Although Nigeria showed more activity in terms of the number of startups funded (12), Egypt held the front by recording the highest amount raised; USD 178.25 Mn across 9 deals (if we remove Andela funding from Nigeria).

Fintech startup MNT-Halan recorded the highest amount in the country with USD 120 Mn funding. Capiter (E-commerce) and Dopay (E-commerce) both raised more than USD 15 Mn (USD 33 Mn and 18 Mn respectively). Investors in these rounds included Quona Capital, MSA, FMO, and Force Over Mass Capital.

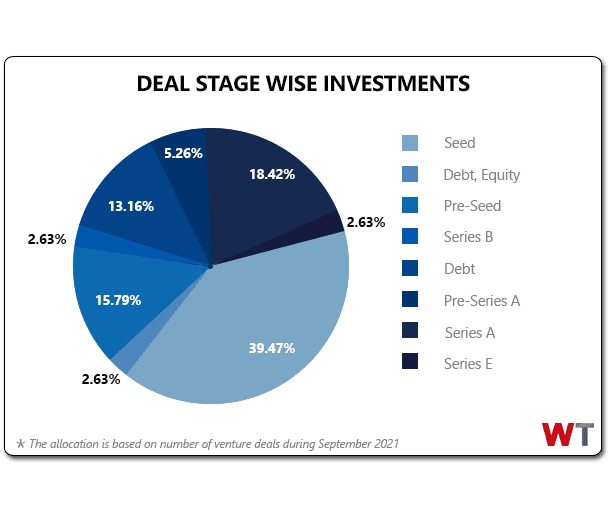

15 startups received a total of USD 130.96 Mn in seed funding while Series A rounds recorded the highest amount (USD 286.5 Mn), representing 37% of the total amount raised. Wave (USA), Capiter (Egypt), Dopay (Egypt), Yellow Card (Nigeria) raised the largest Series A rounds of more than USD 10 Mn each.

Fintechs grossed the maximum amount riding on the high sentiments prevalent on the continent. Other well-performing industries include; Renewable Energy (USD 103 Mn, 5 deals), E-commerce (USD 56.7 Mn, 7 deals). Although deal in the renewable sector was a mix of debt & equity.

Senegal-based fintech Wave raised USD 200 Mn in its Series A round, the highest amount raised among fintech. Investors in the round included Sequoia Heritage, Founders Fund, Stripe, Ribbit, Partech Africa, and known angel investors.

Andela’s Series E round placed HRTech as the second most funded industry with USD 200 Mn raised from Softbank Vision Fund 2, Whale Rock, Generation Investment Management, Chan Zuckerberg Initiative, and Spark Capital.

Zola Electric’s USD 90 Mn funding round placed Tanzania in third place. The amount was a combination of debt and equity of USD 45 Mn each. The round was led by TotalEnergies Ventures, DBL Partners, Helios Investment Partners, and Vulcan Capital.

MERGERS & ACQUISITIONS

There were significant buying activities in September as the trend of African startups acquiring their counterparts gained popularity. Five major acquisitions happened in September; however, the financial specifics of the transactions were not disclosed. Saudi Arabia’s logistics startup, DIGGIPACKS, acquired Egyptian e-commerce startup FWRUN. Nigerian automotive technology company, Autochek acquired Cheki Kenya and Uganda from Ringier One Africa Media.

Australian Fintech Zip acquired South Africa’s Payflex as it looks to expand into Africa. Egypt’s automotive marketplace, Contactcars.com, acquired its Egyptian counterpart Sa3ar. Fintech startup Finclusion Group acquired HelloHR, a South African payroll software startup in a move to provide employers with holistic financial wellness products such as wage-streaming, financial wellbeing, and insurance.

FUND LAUNCHES

September saw the launch of three major funds; Pan-African VC Lofty Inc Capital launched its third USD 10 Mn fund, LoftyInc Afropreneurs Fund 3, for tech startups in Africa. The limited partners in the vehicle included, FBNQuest Funds, The Green Investment Club, Andela CEO Jeremy Johnson, and HNIs from multinationals like Google, Facebook, and ExxonMobil.

The Amethis Mena Fund II, managed by Amethis, raised USD 100 Mn to support growing small and medium-sized firms in Africa. Participants in the fundraising included European Investment Bank (EIB), Proparco, the European Bank for Reconstruction and Development (EBRD), and IFC. Flat6Labs announced the close of its USD 10 Mn Anava Seed Fund for Tunisian startups. Sawari Ventures was the latest addition to the Fund’s investors.