African Startups Raised USD 605 Mn In November 2021

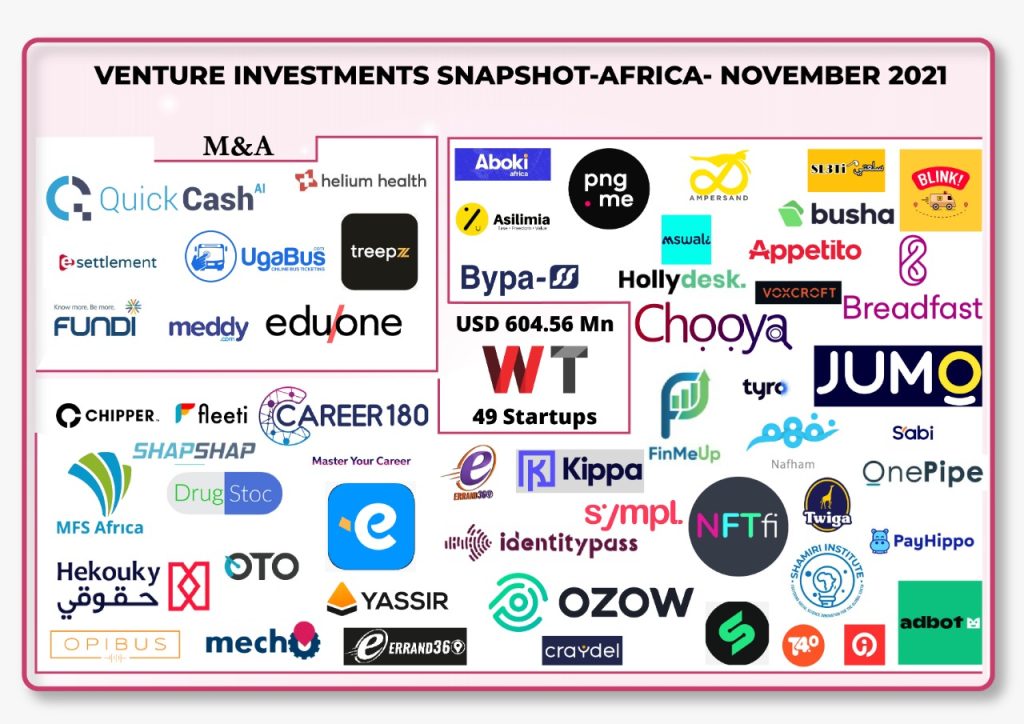

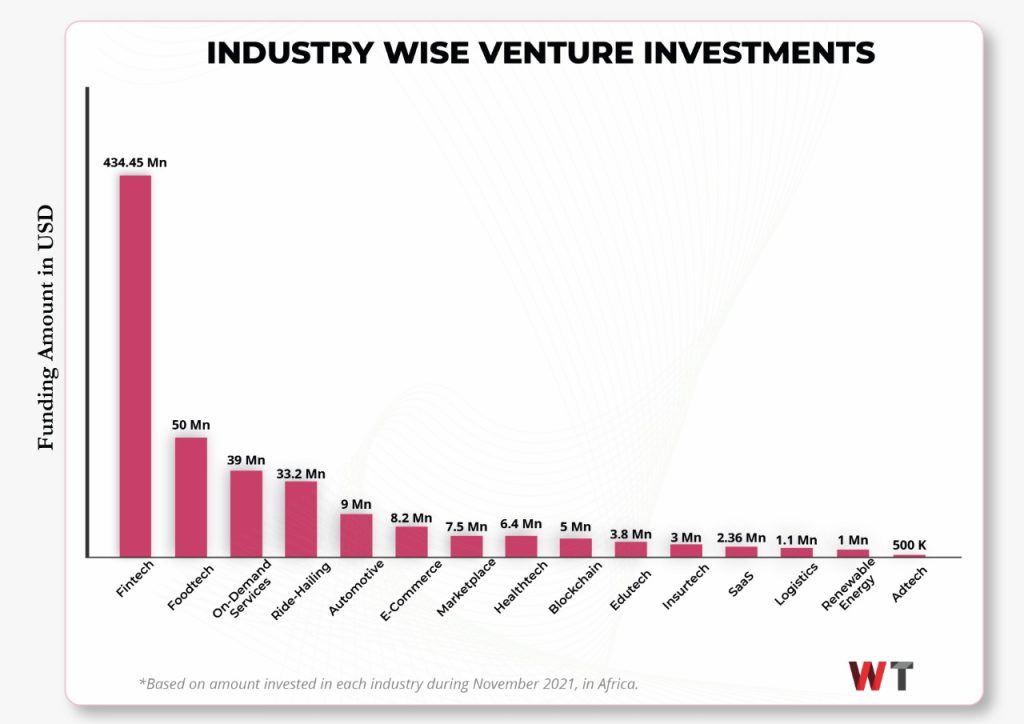

The month of November saw 49 African startups raise USD 605Mn, an increase of almost three times from the USD 252.15Mn raised in October by 41 startups, but still behind the record USD 782.6Mn raised in September. Fintechs continued their dominance, raising USD 434.45Mn or 72 percent of the entire amount across 14 deals.

FoodTech came up in second place, raising USD 50Mn. This entire amount was raised by Kenyan startup, Twiga Foods in its Series C. Other industries that did well include On-demand services (USD 39Mn) and Ride-hailing (USD 33Mn). EduTech, despite having 7 startups raise financing, could only manage USD 3.8Mn.

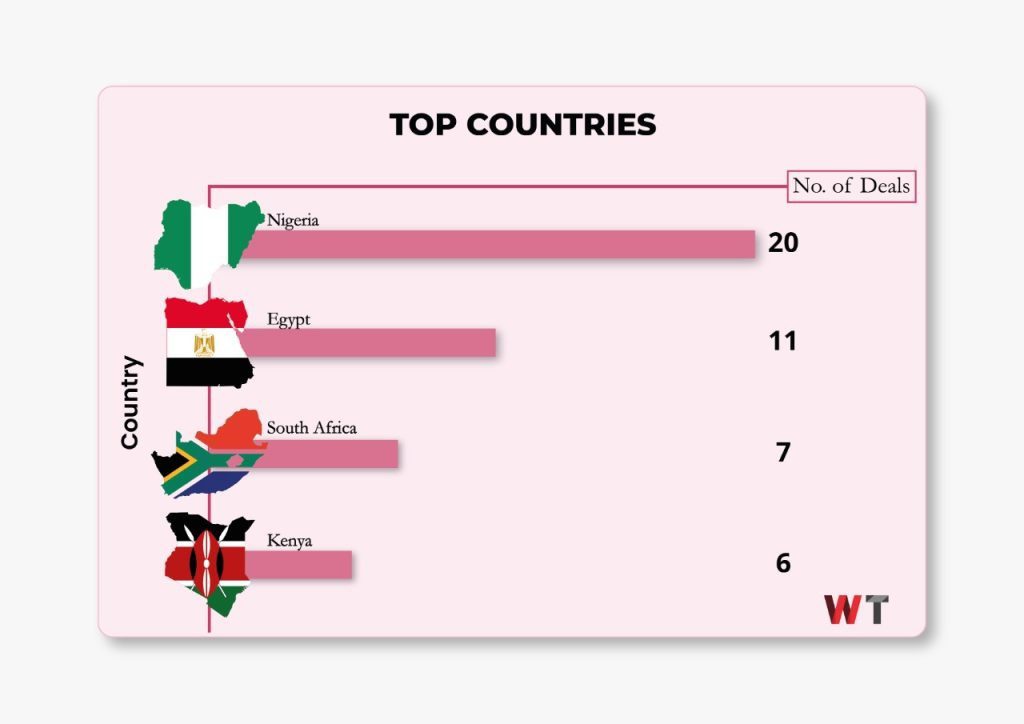

South Africa, powered by Jumo’s USD 120Mn Seed round and MFS Africa’s USD 100Mn Series C toppled Nigeria as the most popular destination for funding in November, pulling in a total of USD 273.5Mn. Nigeria came second with 186.2Mn raised followed by Kenya (USD 61.5Mn) and Egypt (USD 41.9Mn). There was a rare appearance from Algeria in the top 5 with USD 30Mn going to the North African country. This entire amount was raised by the ride-hailing startup Yassir.

But Nigeria continued its stronghold on first place in terms of startups funded with 20. Egypt followed with 11, South Africa with 7 and Kenya with 6.

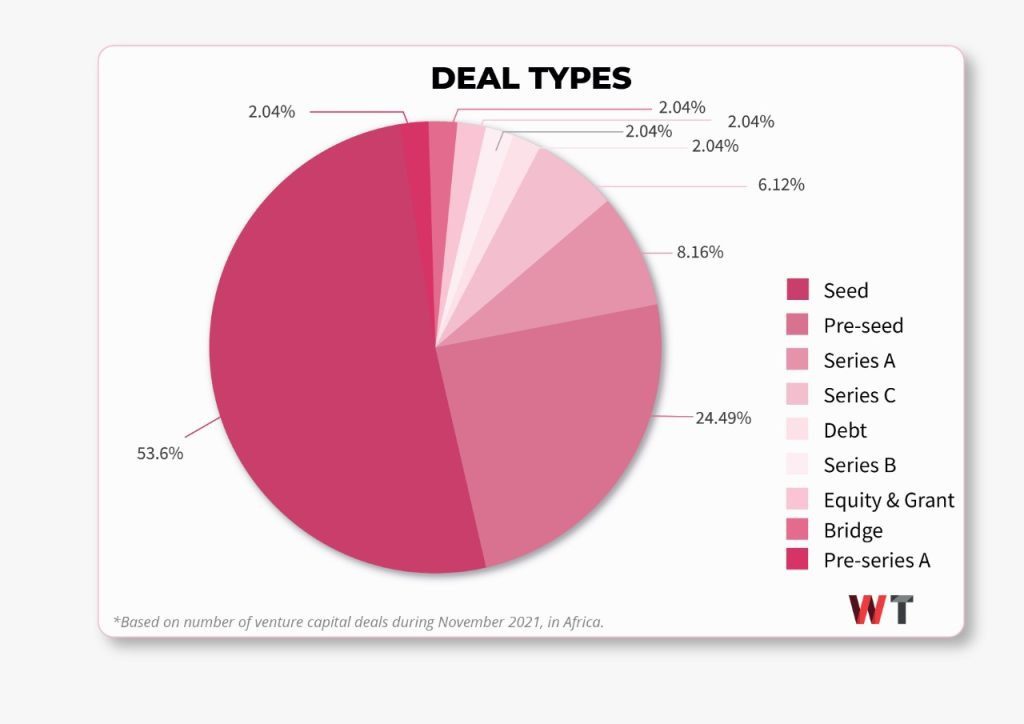

Seed rounds accounted for 53.6 percent (25) of all funding rounds recorded while Pre-Seed rounds were 24.49 percent (12). There were just 4 Series A, 3 Series C, 2 Pre-Series A and solitary Series B, Debt round and Bridge rounds

The 3 Series C rounds accounted for 49.59 percent (USD 300Mn) of the entire amount raised while the 25 Seed rounds collected USD 151Mn. Series A was third in total funding amount accounting for USD 62Mn while the solitary Series B was worth USD 48Mn. Chipper Cash raised the highest funding round with its USD 150Mn Series C which came at a USD 2Bn valuation.

The top 5 Funding Rounds of November 2021

1. Chipper Cash ( USD 150Mn, Series C)

Chipper Cash raised the largest funding round in November after it closed out its Series C with USD 150Mn at a valuation of USD 2Bn, becoming Africa’s sixth unicorn after Interswitch, OPay, Flutterwave, Andela and Wave. It was led by Sam Bankman-Fried’s FTX. Other investors included SVB Capital, Deciens Capital, Ribbit Capital, Bezos Expeditions, One Way Ventures and Tribe Capital.

2. Jumo (USD 120Mn, Seed Round)

South Africa-based JUMO came in second with a USD 120Mn Seed round at a valuation of USD 400Mn. This funding round was led by Fidelity Management and Research Company. Other investors included VISA and Kingsway Capital. Jumo is a fintech that offers financial services to entrepreneurs and businesses in emerging markets.

It has operations in Ghana, Tanzania, Kenya, Uganda, Zambia and Ivory Coast. It will use this capital to expand into Nigeria and Cameroon, improve and increase its financial product offers to Small and Medium-sized Enterprises as well as offer longer-term lending to merchants and bigger businesses.

3. MFS Africa (USD 100Mn, Series C)

MFS Africa raised a USD 100Mn Series C which was USD 70Mn equity and USD 30Mn debt. This funding round was led by AfricInvest Five and Goodwell Investments and LUN Partners Group. Other investors were Allan Gray Ventures, Endeavor Catalyst, Endeavor Harvest, Lendable and Norsad.

MFS Africa will use these funds to open up more regional offices across the continent and also in USA and China. It will also continue to invest in other African startups. In April, MFS Africa led Numida’s USD 2.3Mn seed round.

4. Twiga Foods ( USD 50Mn, Series C)

The 4th biggest funding round of November was raised by Twiga, the Kenyan B2B food distribution platform. Its USD 50Mn Series C was led by Creadev with other investors including TLCom Capital Partners, IFC Ventures, DOB Equity, OP Finnfund Global, Endeavour Catalyst Fund and Juven. Twiga Foods will use the funds to expand into Uganda and Tanzania.

5. Ozow (USD 48Mn, Series B)

Ozow is a digital payments gateway platform in South Africa. Chinese tech giant, Tencent led its Series B funding round putting in USD 20Mn of the USD 48Mn. The rest came from Endeavour Catalyst Fund and Endeavor Harvest Fund.

Ozow will use these funds to drive fintech regulation to ensure that more people access payments services. It will also expand its team from 100 to 250, hire employees for its new European office and expand to Namibia, Ghana, Nigeria and Kenya through mergers and acquisitions.

Mergers and Acquisitions

There was significant activity in terms of acquisitions in November. Nigerian Fintech group, E-Settlement (E-SL) acquired Ivory Coast’s QuickCash, electronic payments and money transfer company. This is part of E-SL expansion into Francophone countries like Ivory Coast, Burkina Faso, Niger and Tog0.

Another Nigerian startup, Helium Health acquired Qatar based E-health startup, Meddy in a rare Africa-Middle East acquisition. The amount was not disclosed. Egyptian edTech startup, Tyro acquired Nafham, a social startup that has free crowd-sourced educational content and is offered under a share-swap agreement.

Other acquisitions included Treepz, the mobility startup accepted into Techstars Toronto program this year, acquiring Ugandan bus-ticketing company UgaBus. UgaBus will now rebrand into Treepz Uganda. Fundi, an education finance and fund management solution specialist, also acquired EduOne, a South African edTech startup.