Rocket Internet Has Finally Given Up On Jumia After Dumping Its 11% Stake

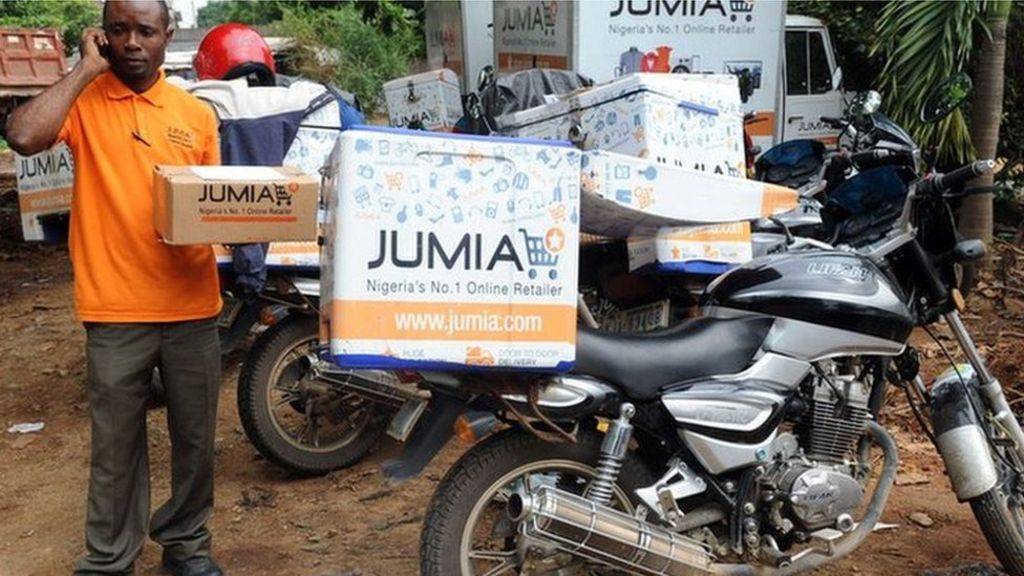

Rocket Internet, the German tech investment firm behind African e-tailer, Jumia, has sold its stake in the beleaguered African e-commerce business.

The German tech investor appears to have taken the option of divesting and severing ties with Jumia which has seen its shares fall steadily since going public last April.

It is understood that Rocket Internet held an 11 percent stake in Jumia as of November 8 last year and the firm sold its stake in Jumia between then and the onset of the COVID-19 crisis.

This is according to Bettina Curtze, the firm’s head of finance and investments, who Reuters said spoke to journalists though she declined to be more precise.

Curtze also elected not to reveal what proceeds Rocket Internet made from the sale but said they were included in the USD 2.30 Bn of net cash the company had as of March 31.

After listing on the New York Stock Exchange (NYSE) last year, Jumia shares soared remarkably but the progress was cut short when a report put out by short-seller Andrew Left’s Citron Research alleged fudged numbers in its sales figures.

That sent Jumia shares crashing down and things haven’t quite gotten really better since then. Some months later, Jumia did reveal that members of its J-Force sales team in Nigeria had indeed tampered with the numbers, though the company maintained that it wasn’t significant.

Since last April, quarterly results have reflected mounting losses and Jumia has since moved to downsize its e-commerce business, exiting some African countries and scaling down in others.

Jumia’s parent company, Rocket Internet, now appears to have given up on the business. The Berlin-based Rocket firm has helped set up a raft of startups, which it has later listed, eventually selling down most of its stakes.

Over the years, Rocket Internet has also earned a reputation as a “German startup cloning machine” due to its knack for copying and replicating successful business models in new markets, mostly outside the United States.