After Giving Up On 3 Countries, This Is What ‘Africa’s First Tech Unicorn’ Is Up To

Jumia has launched in South Africa, quietly.

African e-tailer, Jumia, has quietly launched its e-commerce business in South Africa amid the COVID-19 pandemic.

After shutting down its business in three African markets last year — a move that was thought of as efforts aimed at scaling back on e-commerce and, by extension, arresting mounting losses — Jumia has formally launched in South Africa. Before now, Jumia had only been operating an online fashion store known as Zando in South Africa since 2012.

Jumia first announced this development in a press release dated April 8, 2020, though, as CEO of Jumia and Zando in South Africa, Grant Brown, confirmed to WeeTracker, Jumia has been live in South Africa since late last year, albeit in test mode.

“Jumia has been live (test mode) in South Africa since late last year, however, it has been a process of building the assortment and connecting with sellers so that we can ensure a full cross-section of general merchandise goods at discounted prices are available to our customers,” Brown revealed in an emailed response to queries.

In the company’s earlier statement, Jumia announced the launch of its portal in South Africa to “help consumers access essential products at the lowest price.”

“The launch of the Jumia portal will provide a steady supply of hygiene and sanitary products such as diapers, soap bars, disinfectants, and liquid hand wash at affordable prices. It will also enable brands and vendors of essential products to reach consumers at a time where distribution in retail is challenging,” the statement reads.

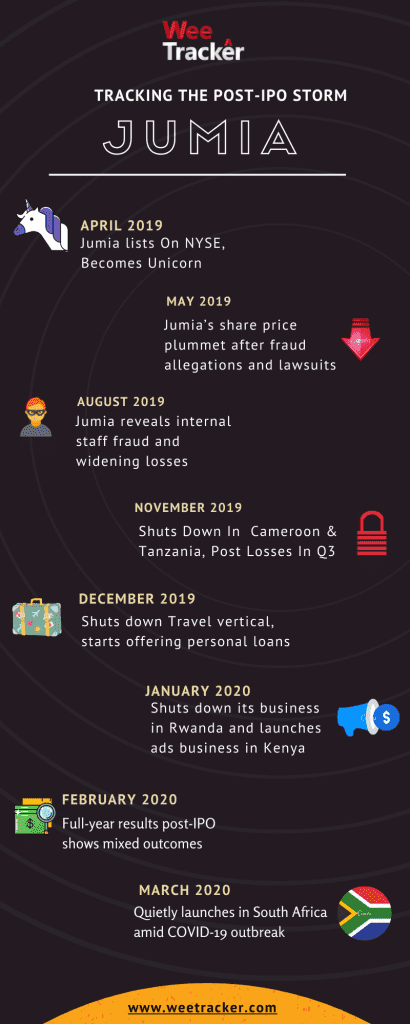

A year ago, Jumia became a tech unicorn after a historic Initial Public Offering (IPO) on the New York Stock Exchange (NYSE). The company’s share price was trading well above the USD 14.50 opening price until a report by Citron Research, a firm owned by known short-seller, Andrew Left, alleged wrongdoings within Jumia.

Those allegations tanked Jumia’s share price and invited lawsuits, and things have never quite gotten better. Jumia shares currently trade at around USD 3.00, the company has since lost its billion-dollar valuation, and amid huge losses, the e-tailer closed its businesses in Cameroon, Tanzania, and Rwanda last year.

Also, Jumia has since given up its Jumia Travel vertical to Travelstart, and moves have been made for Kenya’s ads space, the fintech space in Africa, and micro-lending in Nigeria as part of restructuring efforts.

Earlier this month, Jumia’s parent company, Germany’s Rocket Internet, made it known that it had sold its stake in Jumia and, by extension, severed ties with the company.

But that notwithstanding, Jumia now appears to be gunning for Africa’s second-largest e-commerce market where there are over 30 million customers currently.

But is it a good time?

South Africa was among the first countries in Africa to respond to the spike in COVID-19 infections by announcing a nationwide lockdown that has stalled normal economic activities. The lockdown order exempts only essential services.

In South Africa, online retailers are prohibited from selling or delivering any non-essential goods during the lockdown. This has forced many e-commerce platforms operating in the country to basically become suppliers of toiletries, sanitary products, food, baby products, and healthcare products.

And these measures have impacted e-commerce businesses in South Africa. While there’s sort of a general consensus that e-commerce is booming across the globe amid the pandemic, South Africa’s biggest e-tailer, Takealot, is facing a cash crunch.

The Naspers-backed e-commerce company has seen its revenues plunge by over 80 percent since the lockdown took effect on March 27. Takealot’s CEO, Kim Reid, said the company lost up to USD 20 Mn during the first two weeks of the lockdown alone. The e-tailer is seeing only 15 percent of its usual sales volume because of the restrictions placed on what items can be traded during the lockdown.

The current situation makes for scarce encouragement but Jumia has opted to launch anyway. The e-tailer has adjusted its South Africa launch and its offerings in the country with the current realities in mind.

“Due to the necessary regulations implemented during the lockdown in South Africa, we have made the pivot towards listing only essential goods and provide an important service to consumers during this context,” Brown told WeeTracker.

There’s a mountain to climb too

The African e-tailer claims to have partnered with brands such as Dettol, Harpic (Reckitt Benckiser), Pampers, Always, and Arie & Gillette (Procter & Gamble) in order to enable the launch of the platform. It was also revealed that the newly-launched platform will leverage the existing infrastructure of Zando.

“We have utilized the local Zando team and built on the relationships we had with existing partners both locally and across the entire Jumia network,” said Brown.

While the company has opted to officially step into the market at this time when the ongoing pandemic and its containment measures have made the provision of essential goods a top priority, Brown said Jumia has come to stay in South Africa and will continue to operate with an expanded offering post-COVID-19.

However, a relatively less-formidable Jumia would, for what seems like the first time, find itself actually playing catch up in a market where it has a presence. South Africa’s USD 3 Bn e-commerce market is dominated by Takealot which employs over 2,000 people and also owns clothing store, Superbalist, and food delivery service, Mr. D Food.

As Takealot’s CEO claimed in 2019, the company makes around four times more than Jumia, which equates to around USD 473 Mn per year and over USD 36.8 Mn in revenue per month. It’s a big climb from its turnover of USD 121 Mn in 2017 when it claimed to have processed over 2.9 million transactions from around 1 million customers.

On the other hand, Jumia reported revenue of around USD 147.5 Mn in 2018 and USD 174 Mn in 2019 across all of its verticals in 14 African countries at the time. (Jumia currently has operations in 12 African markets, including South Africa).

By contrast, Takealot only operates in South Africa where it has formed a sort of stronghold. Other e-commerce platforms like BidorBuy, Loot, Planet54, Ubuy, and Zasttra make for fierce competition.

Jumia, thus, has its work cut out for it in claiming a sizeable market share in South Africa, though it would refer to its exploits with one of SA’s leading online stores, Zando, and the idea that it already knows the lay of the land as points in its favour.

Featured Image Courtesy: The Washington Post