South Africa’s Former Biggest Non-Food Retailer Is Hungry For Acquisitions

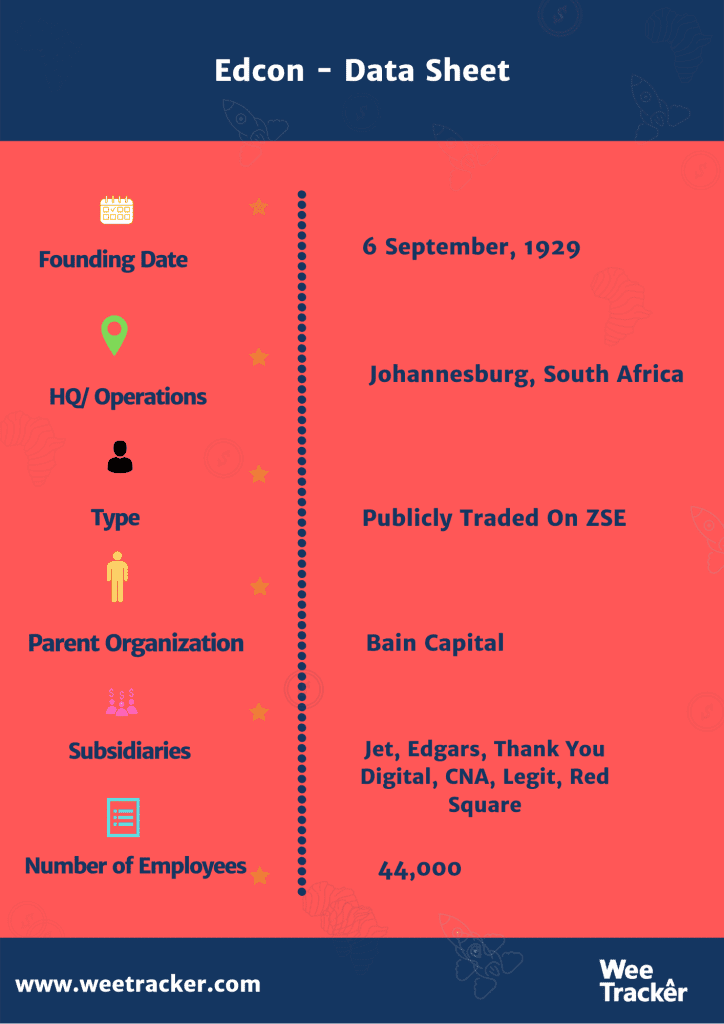

Another day, another loss-making South African company. This time, its Edcon, the country’s former biggest non-food retailer who is now hungry to sell off its assets and subsidiaries, even to retail rivals.

Business Rescue

Edcon, the parent company of iconic local brand such as Edgars, Jet Stores and CNA went into business rescue proceedings at the end of June 2019. Back in 2018, its management pushed the hardest for a ZAR 2.7 Bn (over USD 160 Mn) bailout from the Public Investment Corporation of South Africa (PIC) on grounds that about 14,000 jobs would be affected if the business was not saved from drowning. The financial support involved creditor and landlord concessions as well as ZAR 1.2 Bn (more than USD 72 Mn) from the Unemployment Insurance Fund (UIF).

Prima facie, one thing led to another and Edcon’s creditors agreed for a business rescue plan that involves the sales of its assets. After entering bankruptcy at the end of April 2020, more than 75 percent of its shareholders approved that the retailer should be sold in parts or whole. This paved the way for the business administrators to finalize the sale process by the end of June to create time for supplier negotiations and for its summer stock to be acquired.

The business rescue plan proposed a kind of accelerated sale of the divisions of Edcon, a company that once sat on ZAR 28.7 Bn (USD 1.7 Bn) in annual revenue and hored 17,292 permanent employees and 5,000 seasonal casual workers. Apart from the sales of its budget retailer subsidiary, Jet, and department store chain operators, Edgars, Edcon looks to closing its store and freezing the brands that emerge unsold. Retrenchment notices have already been served to 22,000 of its workers.

Acquisitions In Order

The latest update from the shelves of the retailer is that the Foschini Group, commonly known as TGF—a Cape Town-based retail clothing firm with over 3,000 stores—has submitted a conditional offer to Edcon to buy selected Jet stores and related assets. TGF aims to acquire these assets at a ZAR 480 Mn (USD 28,596,792) consideration. Edcon’s business rescue practitioners have accepted the offer’s terms, granting it exclusivity for negotiation and finalization to conclude the proposed transaction.

Meanwhile, Edgars, South Africa’s second-largest clothing retailer is in the middle of another acquisition plan. According to a Bloomberg report, the retailer has agreed to sell part of Edgars to a private equity-backed regional rival in an attempt to hurl the 91-year-old brand out of a doom-shaped hole and save thousands of jobs. The buyer is Retailability, a holding company for Legit, Beaver Canoe and Style, brand which have up to 460 stores across the Southern African region.

South African retailers have been in the rough as of late. Most of them have decided to sever ties with markets that are outside the country and focus more in growing as well as sustaining their businesses back home. From ShopRite to Woolworths, Mr Price to TGF, retailers in different sub-sectors are betting on the South African market and a few in the Southern African region. Edcon’s potential acquisitions, however, falls more in the lines of debt and coronavirus-exacerbated revenue holes.

Dollar Crunch

Covid-19 took a toll on nearly every retailer in South Africa, and Edcon’s businesses was not left out of the threshold. The company posted a turnover decline of 43 percent for the three months which ended June 27th, thanks to coronavirus-controlled severe lockdown in South Africa. Nevertheless, the retailer’s problems were manifold long before the pandemic, as Edcon had been struggling with debt and trying to keep its business afloat. At some point, it was saved by a ZAR 25 Bn (USD 1.4 Bn) buyout by US private equity firm Bain Capital. But that 2007 deal loaded Edcon with debt.

The retailer was forced to service its interest burden rather than investing in its brands and making some changes to its retail environment. Coronavirus was, however, the nail on the coffin. In May, Edcon admitted it was no longer capable of paying salaries through the pandemic, until the group is stabilized. For instance, TFG said retail turnover for its Africa operation declined 38.4 percent for the three months ended June 27th, when compared to the same period in the previous financial year.

Edcon’s struggles was also brought on by the nature of its target economy. Middle income consumers are barely growing as a result of financial hamstrings. Retail shopping trends are on a rapid change across the globe, as online sales are gobbling up most of the retail market pie. With its debt burden, truncated revenue, Covid-hit sales and shaky niche, Edcon’s chances of surviving without the intervention of more agile competitors does appear slim.

Featured Image: Artificial Photography Via Unsplash.