U.K’s Multiple Billion-Dollar Investments In Egypt Fore-runs Its North African Ambitions

British Minister of Trade, Liam Fox, said in Cairo, this week, that the United Kingdom aims to become the largest investor of the Group of Seven (G7) in North Africa and Egypt by 2022.

The intention was revealed along the sidelines of a meet with Egypt’s Trade Minister and Minister and Investment, Amr Nassar and Sahar Nasr, respectively, to discuss fresh investment opportunities between the countries, in the wake of repeated collaborations.

Arguably, the United Kingdom is already one of the largest investors in the North African country.

Sahr, in an April discussion with the U.K. Department for International Development Permanent Secretary, Matthew Rycroft, did mention that the 1,816 U.K. companies operating in Egypt have a total investment of USD 46 Bn in the country – no investor else comes that close. Notwithstanding these impressive figures, Sahr pushed for more strategic collaboration between both countries.

Per a May 18 released statement from Egypt’s Chamber of Commerce, British investments in the country had reached USD 5.6 Bn via implementing projects.

Revealed by the Minister of Industry and Foreign Trade, Tarek Kabil, the information was hotted on by an emphasis on the essence of enhancing strategic partnerships between Egypt and Britain.

February 2018, the U.K. trade envoy to Egypt, Jeffrey Donaldson arrived in Cairo, marking the largest British trade delegation to the North African country in almost two decades.

The five-day visit, according to the British Embassy in Cairo, was aimed at improving the sectors of oil, gas, education, infrastructure, and health in the “cradle of civilization.”

All looking for investment opportunities in Egypt, the delegation comprised 33 companies from the Scottish Development International, six companies from the Energy Industries Council, 14 companies from the transport and healthcare sectors and four firms hugely focusing on the education sector. The 50-plus companies included repeat investors such as Bombardier, Mott MacDonald, and GlaxoSmithKline, as well as first-time investors.

Since 2011, British firms such as the CDC Group, Unilever Group, and B.P., have pumped funds to the tune of USD 30 Bn in a range of essential projects across the Arab Republic of Egypt. The investments have spanned drug manufacturing, solar energy, financial services, and telecommunications, among others.

The strategic partnership between the two countries, is in part, in the light of studying their future relationship regarding Brexit. The amalgam of the words “British” and “exit,” Brexit describes the withdrawal of the U.K. from the European Union, introduced by a vote by the British electorate to leave the body with a percentage of 51.9.

Given the nature of investments already on ground in Egypt, and also in its neighboring countries, the U.K’s vision to become the largest investor in North Africa by 2022 is achievable. Case in point, Egypt is the most populated Arab country in the Middle East and the third most populous in North Africa.

However, Prime Minister Theresa May is to step down next month as per unyielding efforts to deliver Brexit. Regardless, Brexit or not, Egypt remains Britain’s strongest ally in Africa.

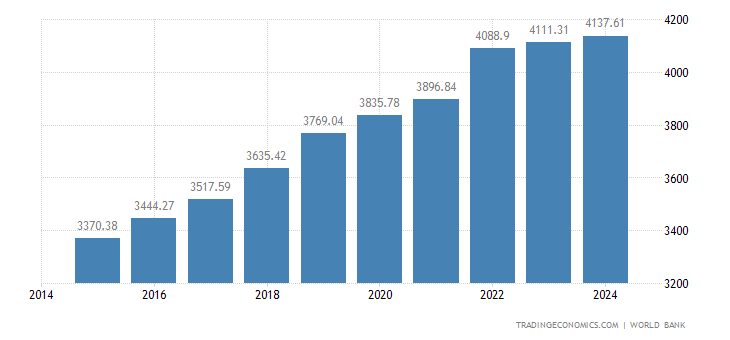

The investments so far have contributed to the development of the North African country’s economy, currently expected to be at USD 270 Bn this quarter.

Featured Image Via Webjet Exclusives