Africa-Focused Digital Lender Branch International Raises Massive Round With Fresh USD 170 Mn

In one of the most significant and most enormous Series C funding round ever seen in the league of Africa-focused startups, mobile lending app Branch International has secured USD 170 Mn in investments.

The fundraise is led by Foundation Capital and Visa with efforts from B Capital, Andreessen Horowitz, Formation 8 and Trinity Ventures, in a development which comprises USD 100 Mn debt financing and USD 70 Mn in equity.

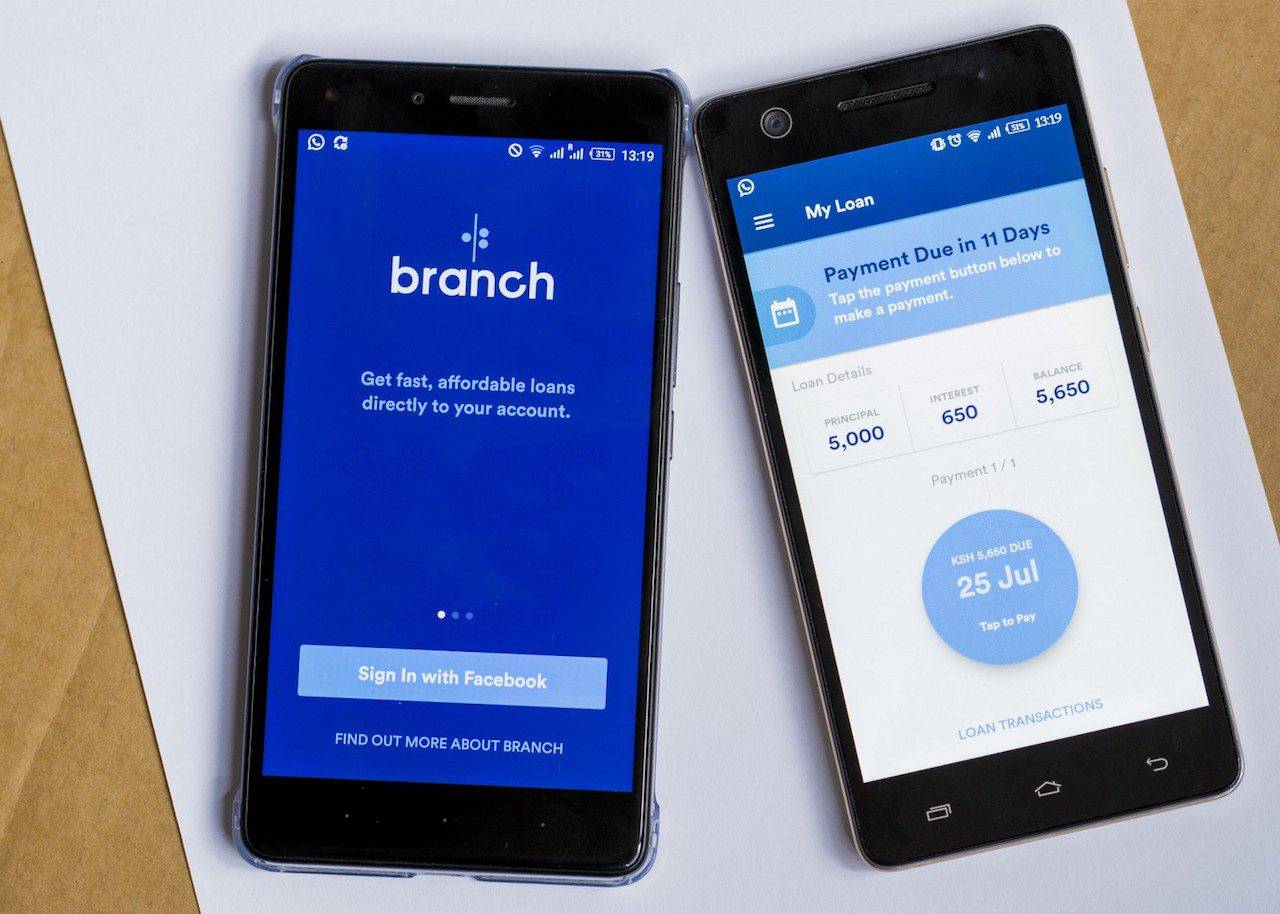

The San Francisco-based startup which makes small personal loans in emerging markets in Africa has also agreed on a partnership with Visa to offer virtual, prepaid debit cards to Branch client networks in Africa, South Asia, and Latin America. The company who uses an algorithmic model to determine creditworthiness, build credit profiles and offer liquidity via mobile phones, will use the investment to deepen its existing business in Africa.

While serving Nigeria, Kenya and Tanzania where it has more than 3 million users, the startup who also has footing in India and Mexico, uses smartphone data such as GPS, call logs, contact lists and texts such as balance messages and bill payment receipts to decide to make loans which range from $2 to $700 for up to 68 weeks. It also charges interest rates of up to 12 percent in Nigeria and Tanzania, while settling for 14 percent in Kenya.

The funding round will help Branch plan and execute its international expansion, which a report says could include Brazil and Indonesia. The collaboration with Visa will allow borrowers to obtain virtual Visa accounts with which they will create accounts on Branch’s mobile app. This reality gives the firm a more extensive reach in countries such as Nigeria, the most populated nation in Africa with up to 190 million people. The West African country is the one place in the continent where cards have factored more significantly than mobile money in connecting unbanked and underbanked populations to finance.

The funding round emerges at the top of the table for the investments that have been concluded since January 2018 by Africa-focused fintech startups, beating Jumo’ s 52 Mn raise last year. The financial development further cements the position and reputation of fintechs as the most investor-attractive sector in Africa, as the space has been taking the lion share of African venture fundings since about 2017.

The 2015-founded company which started operating in Kenya has processed no less than 13 million digital loans and disbursed USD 350 Mn, according to Branch’s stats. It’s ready-set-go in Kenya came at a time when mobile money payment product like Safaricom’s M-Pesa – which now has 25 million users – already existed. Despite, Branch has found a way to scale significantly and expand to the other African countries. Today, Branch is one of the most downloaded fintech apps in Africa according to numbers presented by Google Play.

“We started Branch in Kenya, where M-Pesa gives anyone with a phone — including the unbanked — access to digital credit,” Branch co-founder and CEO Matthew Flannery said in the announcement. “Unfortunately mobile money isn’t available in most countries. With the help of Visa, now we can send money to any ATM and reach the underserved around the planet.”

Featured image courtesy: exchange.co.tz