Surviving The Crunch: A Growth Expert’s Take On African Tech’s New Reality

In the wake of the global tech funding drought, the repercussions have been profound, resulting in valuation cuts, down rounds, and a chain reaction of closures and layoffs across Africa’s tech landscape. Approximately 15 African startups shuttered operations in 2023, underscoring the volatile nature of the endeavour.

Facing shrinking prospects, startups reached a critical juncture: adapt or fade away. Many pivoted toward sustainability and profitability, prompting a reevaluation of strategies. At the moment, emphasis is being placed on prioritizing customer value, revenue, and sustainability, emphasizing the need to fix unit economics for lasting competitive advantages.

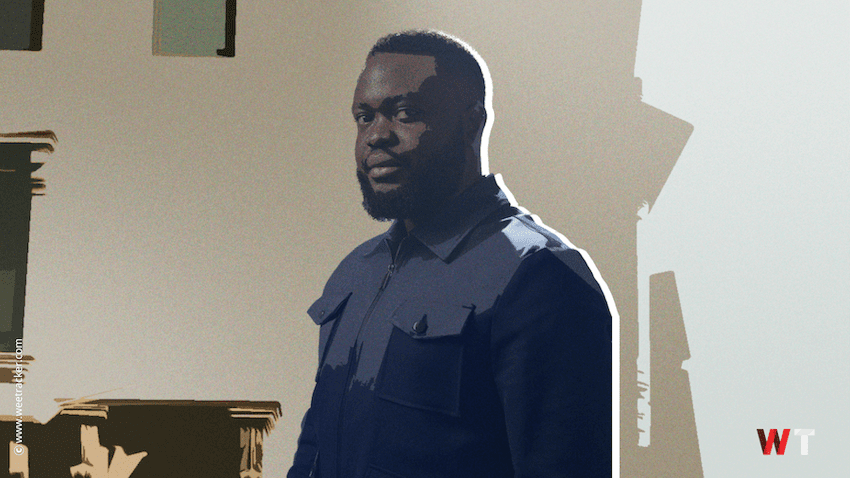

In an exclusive interview, we sit down with Segun Adeyemo, the Founder and CEO of SAVA Global, a growth partner for African startups and enterprise companies that has helped drive growth for LG, Zenith Bank, Payday, Kuda Bank, Foodcourt, OPay, Honda Nigeria, Chowdeck, and many others.

We delve into the nuanced challenges facing African startups. From economic uncertainties to the role of venture capitalists, Segun provides candid insights and strategic advice on navigating the ever-evolving landscape.

This interview been edited for brevity.

The Startup Landscape in Africa: A Reality Check

Q: Segun, let’s start with a reality check. How would you describe the current state of the startup ecosystem in Africa, especially considering the economic challenges and global shifts?

Segun: It’s essential to be pragmatic. The era of hype and FOMO has faded, and startups are facing real challenges. Many are struggling, and it’s crucial to reassess expectations.

Surviving the Storm: Sales, Cost Cutting, and Customer Retention

Q: Amidst these challenges, what survival strategies do you recommend for startups? How can they balance the need for sales with the imperative to cut costs?

Segun: Sales should be the primary focus. Startups must reassess operational costs, consider collaborations, and prioritize customer retention over aggressive user acquisition. It’s about finding that balance.

Economic Instability and the Currency Conundrum

Q: Economic instability, especially in Nigeria, has been a concern. How should startups navigate the devaluation of local currency, and are there alternative solutions worth exploring?

Segun: Economic instability poses a significant challenge. Exploring alternative currencies, considering crypto, and using platforms with multi-currency solutions can be strategic moves to mitigate risks.

VC Expectations and the Need for Realignment

Q: Shifting our focus to venture capitalists, what role have they played in the ska, and do you believe their expectations need realignment, particularly in the context of African markets?

Segun: VCs should take a significant share of the blame. Unrealistic expectations have been set. It’s time for a realignment, focusing on thriving industries like fintech, agritech, and climate tech.

Traits VCs Seek and the Future Outlook

Q: Considering the VC perspective, what traits are they seeking in startups? How do you see the future outlook for startups aligning with these expectations?

Segun: VCs seek ambition, profitability, and impact. Startups must align themselves with these expectations to attract investment. Despite challenges, there’s hope if they adapt and find their niche.

A Call for Realism and Strategic Thinking

In this insightful Q&A with Segun Adeyemo, we’ve gained an understanding of African startups’ challenges and opportunities. The interview serves as a call for realism, urging founders to adapt, strategise, and align with the expectations of both the market and venture capitalists. As the landscape evolves, the key to success lies in creativity, adaptability, and a strategic approach to growth.