Successes & Shortcomings Of Music Streaming In Africa – Mapping 25+ Platforms.

African music streaming platforms are probably a long way off from hitting the heights of Spotify; once valued at USD 36 Bn with an estimated 236 million active users or Apple Music; home to over 50 million songs and currently available in 167 countries.

But in any case, Africa’s music streaming space has been growing steadily, and startups have since been fueling consumer interests in music subscription and consumption.

The growth and investment landscape

The concept of music streaming was introduced to Africa in 2013 when Spinlet – a Finnish music streaming platform that started in 2006 was acquired by two Nigerian investors in 2011 and later launched in Nigeria.

Since then, the music streaming industry has grown and is still growing as the last 5 years have witnessed the most activity when it comes to the establishment of music streaming platforms in Africa. More than 50% of these platforms were launched during that five-year period.

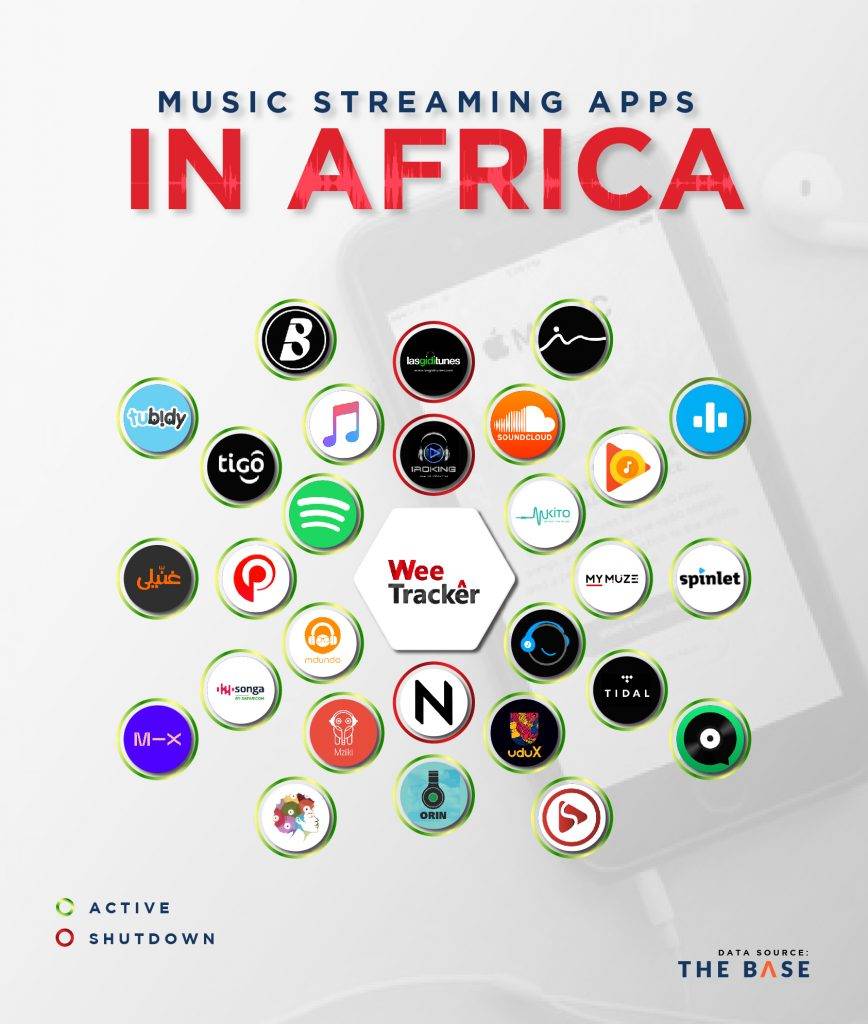

Our team identified 25+ music streaming platforms (web and mobile) that operate in Africa. Of those 25+ music streaming startups, 72% were found to be homegrown while the remaining 28% are international startups that ventured into Africa.

These startups were further divided into 2 depending on their activity status.

- Active – Startups operating in Africa and engaging on their social media accounts.

- Shutdown – Platforms assumed inoperative based on their web/social media activity in the one last year or have announced ceasing of operations.

The last two years saw telecommunication companies venturing into this space. In 2018, Safaricom PLC launched Songa App in Kenya and South Africa’s MTN Group launched MusicTime which is currently available in other African countries besides South Africa, including Nigeria, Ghana, and Zambia, among others.

Given the well-documented numbers which suggest that Africans pay more for internet service than any other region even though a huge proportion of the continent’s 1.2 billion inhabitants live below the poverty line, music streaming is yet to be embraced by the mass market.

To get around this and boost user-ship, the telcos mentioned above are known to offer a no-data burn, thus making music accessible. The incentive serves as a way of retaining and acquiring new customers.

Even as bigger corporates in Africa venture into the music streaming industry, they have not been wholly successful in piloting music streaming platforms in Africa.

Based on our analysis, Africa’s music streaming sector hasn’t quite proved attractive to investors. In the last 3 years, music streaming startups have seen a total number of 4 investment deals with 3 disclosed deals amounting to USD 20 Mn.

This raises concern as to whether the lukewarm investor activity could be attributed to the notion that the industry is still quite young.

However, private equity (PE) investors such as Maison Capital and venture capitalists (VCs) like Seas Capital have shown significant interest in the African music streaming industry.

Also, in March this year, MePlaylist – an African music streaming platform founded by a Nigerian raised an undisclosed amount from Mathew Knowles, the father of global music icon, Beyoncé.

How they rake in revenues

By 2024, Africa’s music streaming revenues are expected to have hit a 12% annual growth that will see the market reach a volume of USD 822 Mn. Nigeria, the “home of Afro-beats“, is expected to record music streaming revenues of around USD 65 Mn by end of 2020, according to a report by PwC.

On the other hand, South Africa, the “home to technologies” – as it currently hosts some of the biggest players in music streaming including the likes of Spotify – revenues are expected to be at USD 35 Mn in 2020, as predicted by Statista.

The music streaming industry is known to be capital intensive. For startups to get extensive music catalogues, they are required to pay substantial annual licensing fees. Thus, streaming companies have to recoup their investment from subscription fees and, to some extent, third-party ads.

With global leading music streaming startups offering their services on the basis of subscriptions charged to users, there are legitimate concerns over how many Africans can spare a sum to pay for music, especially as the artists themselves are known to upload their music online for free. This has seen music streaming platforms opt for either the freemium or premium route — or even both.

According to a survey done by Geopoll in 2019, Nigeria was leading with 46.67 % in terms of the music streaming users being premium subscribers and Kenya followed at 27.2 % while South Africa was at 25%.

Based on our internal research, 50% of Africa’s homegrown music streaming platforms require users to pay a subscription fee. Furthermore, 37.5 % of these platforms have adopted the freemium business model and 12.5% of them have incorporated both the freemium package and the premium package.

For instance, Ghaneely, a music streaming platform in Egypt, has adopted both the freemium and premium business model. Its freemium package has limited features and is supported by third-party advertising placements. But users can pay for the premium subscription that contains no ads and offers unlimited music downloads.

The average premium subscription fee in Africa typically costs between USD 1.00 to USD 10.00 per month.

Majority of the music streaming platforms in Africa will prefer not to disclose their total paying users, although little is known about their users. Our team found the following;

| Date | Startup Name | Number of users |

|---|---|---|

| As of Dec 2019 | Boomplay | 44 Million active users |

| As of Sep 2019 | Spinlet | 3.6 Million active users |

| As of July 2019 | Smubu | 200,000 active users |

| As of Feb 2020 | Mdundo | 2.5 Million active users |

| As of Aug 2019 | Playfre | over 3,000 active users |

The less-melodious side of music streaming

The music streaming industry has also experienced a fair share of shutdowns in the last 5 years.

For instance, Iroking, a music streaming platform based in Nigeria was officially shut down in 2018 after losing USD 2 Mn in 5 years. A statement made by Jason Njoku, founder of iROKOtv under which Iroking was created, revealed that negotiations around earnings and payments to Nigerian artists were the greatest challenge.

While Spotify, one of the biggest players in the music streaming game, took 13 years to gain 96 million paying users by 2018, Africa may take longer to grow its music streaming industry as not much is known about the number of paying users at the moment. Music streaming startups in Africa typically disclose only their total number of users.

Across Africa, the biggest challenge for music streaming startups seems to be piracy. While these platforms provide consumers access to a rich catalogue of good music, they also inadvertently become the prime targets of piracy and currently, Africa lacks a concrete framework to combat the menace.

That notwithstanding, with an estimated population of 420 million youths, as well as music streaming penetration that is expected to grow to up to 14.9% by 2024, Africa might yet become a promising market for music streaming startups.

| Startup | Logo | Country | Year Established | Status |

|---|---|---|---|---|

| Boomplay Music | Nigeria | 2015 | Active | |

| Ghaneely | Egypt | 2016 | Active | |

| LasGidi Tunes | Nigeria | 2011 | Shutdown | |

| Mdundo | Kenya | 2012 | Active | |

| Meplaylist | Nigeria | 2017 | Active | |

| Mkito | Tanzania | 2014 | Active | |

| MusicTime | South Africa | 2018 | Active | |

| My Muze | South Africa | 2019 | Active | |

| Mziiki | South Africa | 2014 | Active | |

| Nichestreem | South Africa | 2014 | Shutdown | |

| Orin | Nigeria | 2015 | Active | |

| Playfre | Nigeria | 2019 | Active | |

| Simfy Africa | South Africa | 2010 | Active | |

| Smubu | Kenya | 2017 | Active | |

| Songa | Kenya | 2018 | Active | |

| Spinlet | Nigeria | 2011 | Active | |

| UduX | Nigeria | 2018 | Active | |

| iRoking | Nigeria | 2010 | Shutdown | |

| MTN Tidal | Uganda | 2018 | Active | |

| Tigo Music | Tanzania | 2015 | Active |

The data in this research piece comes from THE BASE, Africa’s leading market intelligence platform focused on private companies, VC, and PE space. Sign up for FREE today.