Africa’s Super-Rich Class Holds Old Money With Small Appetite For Local Startups

Despite the influx of capital and the explosion of capacity that has swamped the African tech startup ecosystem in the last decade, the continent’s richest individuals are still largely ignoring the local ecosystem.

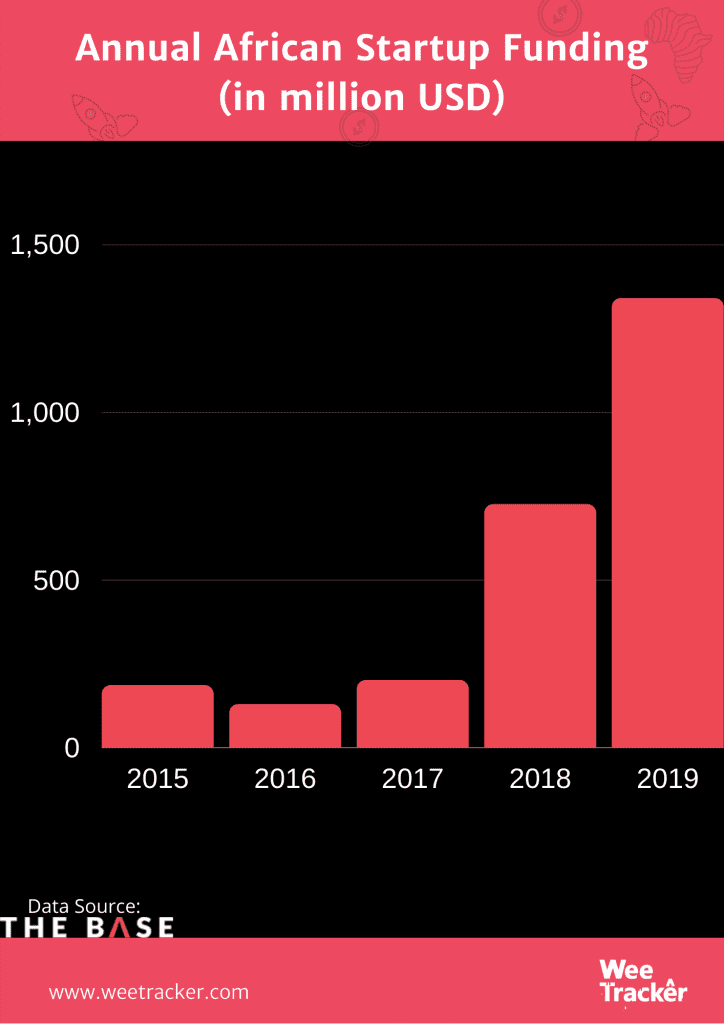

Mostly buoyed by foreign capital, startup funding in Africa has skyrocketed to levels previously uncharted, catalysing the building of a startup scene that is among the fastest-growing in the world.

Yet, the African tech ecosystem continues to rely heavily on bets by foreign entities (fomenting expat bias and local founder apathy in some cases), while high net worth individuals (HNIs) with the capital and capacity to invest continue to either keep their distance or have a lukewarm affair with the continent’s tech scene.

Elsewhere in the world, some of the world’s wealthiest individuals and families are making huge bets on tech startups as they position for the future.

In 2017, the world’s richest man and CEO of Amazon, Jeff Bezos, teamed up with fellow billionaires — Eric Schmidt, Howard Schultz, members of three of the world’s wealthiest families: the Waltons, the Kochs and the Pritzkers, along with many others — to join Steve Case’s Rise of the Rest fund, which invests in startups.

And that’s just one out of many examples of how some of the world’s wealthiest people are leaning or have leaned towards venture capital (VC) investments in tech startups.

On the African continent, it’s kind of a different story. In these parts, the wealthiest individuals continue to display a very small appetite for local tech startups’ equity.

In fact, huge investments in the local scene from global tech titans like Facebook CEO, Mark Zuckerberg, has done little to get “old money” flowing into the ecosystem.

Time and again, this sort of foreign investment has given a ringing endorsement to the African tech scene. But it has done little to loosen the purse strings of African billionaires who command a rich but yet-untapped funding source.

Unlike in the west where six out of the world’s ten richest people amassed their fortunes through tech — and also have significant equities in several tech businesses — Africa’s wealthiest individuals are holders of the so-called old money.

The continent’s richest are mostly industrialists and tycoons who built their fortune from traditional asset classes like the oil industry, banking, real estate, and commodities.

Indeed, only one out of the ten richest people on the continent grew rich from a tech-related business. That would be Egypt’s Naguib Sawiris’ who excelled in the telecommunications industry.

As such, the unfamiliarity and uncertainty of African billionaires with the asset class that is tech might be keeping them away from tech, unlike their peers in the west.

Africa’s richest man, Aliko Dangote, currently has a net worth of USD 7.7 Bn, according to Forbes. The Nigerian is an industrialist who has interests in cement, flour, sugar, salt, and tomato paste.

To date, he is not known to have invested in tech, nor is he known to have publicly expressed interest in any local tech startup venture. This is true for half the top ten richest people in Africa. The other half has mostly exhibited tepid interest.

South African, Nicky Oppenheimer, is Africa’s second richest individual with a net worth of USD 7.6 Bn. In 2012, it was revealed that the Oppenheimer family had become an investor in South African VC firm, 4Di Capital, supporting the funding of a number of local startups. Most recently, the family helped raise USD 1 Mn to assist African tech startups amid the COVID-19 pandemic.

Johann Rupert and family, as well as Patrice Motsepe (all South African billionaires), as well as Egyptian billionaire, Naguib Sawiris, are among the top ten richest Africans known to have also invested in a few local startups in the past through their respective funds.

Other billionaires in the Africa top ten like the Egyptians, Naseef Sawiris (brother to Naguib) and Mohamed Mansour, are big on private equity investments and not venture capital investments.

The Mansour Group, for instance, has notable private equity investments in marine logistics firm Vanguard Logistics Services and Nigerian telecoms infrastructure provider, IHS Towers. However, the billionaire is also an early investor in foreign tech companies like Airbnb, Grab, Facebook, Twitter, Spotify, and Uber. Local startups are conspicuously absent in the portfolio.

Together with Dangote, other top billionaires on the continent like Nigeria’s Mike Adenuga, Algeria’s Issad Rebrab, and Angola’s Isabel dos Santos, are not known to have invested in local tech startups, even though it’s a possibility that they keep any such involvement under wraps.

According to Forbes, of Africa’s 54 nations, only 8 countries have billionaires: Egypt and South Africa are tied with five billionaires each, followed by Nigeria with four, Morocco with two, and one billionaire each from Algeria, Angola, Tanzania, and Zimbabwe.

As Africa’s tech ecosystem continues to be almost exclusively built with foreign capital — leading to a lack of diversity and inclusion in some circles — it is hoped that some of the continent’s super-rich people would, in the near future, find merit in actively betting on what is shaping up to be a very promising field.

Featured Image Courtesy: CNBC