Africa’s PE Funding Landscape Sets Duly Expected Record High

Venture capital-backed African tech has more or less proven itself a multibillion-dollar industry quite capable of outperforming itself, but private equity investments into this emerging but fast-growing ecosystem are also witnessing a similar liftoff.

Per WeeTracker’s venture investment report for 2021, African early-stage tech companies raised a record-setting >USD 4.08 B in venture capital; less than USD 1 B was accumulated in 2020, the prime year of the global pandemic.

In Q1 2022, these local startups are on the verge of smashing set records that took years to achieve, having already piled up about a quarter of the VC raised last year, now over USD 1.6 B and counting.

Be as it may, African tech’s apparently growing funding landscape is obviously not dependent on venture capital alone. Not relegating the very essence of angel investments, corporate venture capital, syndicating and crowdfunding efforts, private equity (PE) is the continent’s second-busiest funding market. PE is, after all, a major funding source for the venture capitalists vested in backing promising startups.

According to the newly released 2021 Annual African Private Capital Activity Report by the Africa Private Equity And Venture Capital Association (AVCA), the sum of private equity deals that took place in the continent [last year] smashed its own records just as much.

The report shows that USD 7.4 B was circulated in the space, marking a 118 percent growth in the amount invested in 2020, which is USD 3.4 B.

At USD 7.4 B, PE deals have effectively eclipsed [by about 85 percent] the once-was average annual inflow of USD 4 B in the years between 2016 and 2020. Weighing in the newest figures, Africa’s private equity environment is fast-maturing having risen by a not-so-paltry CAGR of 13 percent in the last half a decade [2016 to 2021].

What’s more, the count of PE deals recorded last year stood at 429, which is 66 percent more than the 258 which took place in 2020. With the new volume, deals have [thus] trumped the yearly average of 215. Also, for the years between 2016 and 2021, the number of PE deals has increased by over 19 percent.

Based on a compendium of these metrics, it is evident that Africa’sAfrica’s PE drive has shifted gears.

“Not only was 2021 an exceptional year from an investment activity perspective, but also from a fundraising point of view. African private capital fund managers closed funds totalling USD 4.4 B in final closes, which is the highest fundraising value since 2016; and USD 2.3 B in interim closes,” the report reads.

This new normal somewhat corroborates with the findings of a WeeTracker exclusive from last October, one which foreshadowed a not-so-distant watershed moment for PE fundraising in these parts.

In the interview, Adefolarin Ogunsanya, Principal at Development Partners International (DPI)—a United Kingdom-based PE firm which recently raised USD 1.15 B to invest in Africa—pointed to continual growth in response to the ongoing “tech building” for the continent’s middle-class citizens.

Meanwhile, a previous analysis of the PE funding outlook of the continent shed some light on the exit realities of the space. That potential continues to manifest; 32 exits were recorded in 2020, but in 2021, it increased to 36.

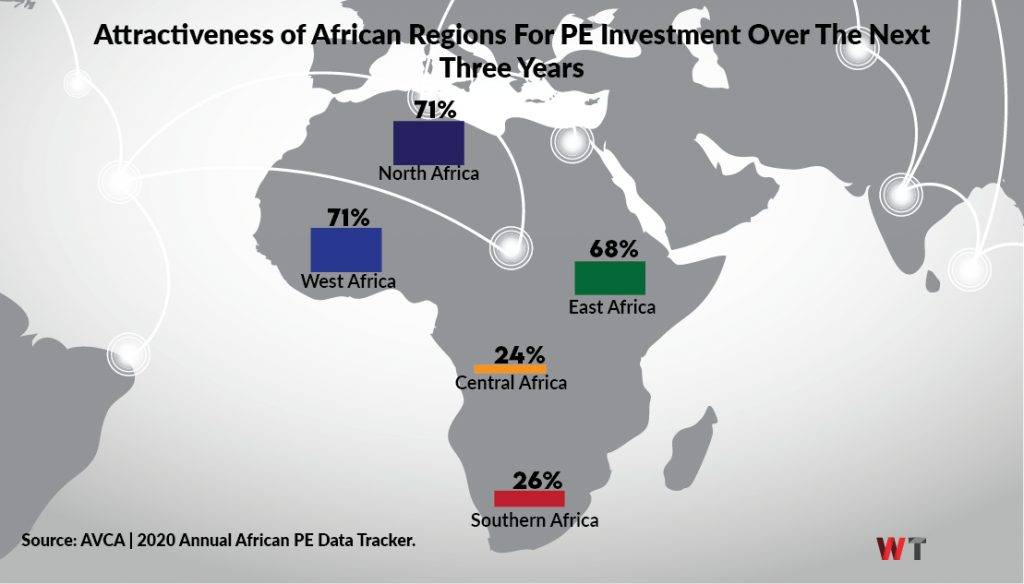

The report finds that in 2021, West Africa attracted the largest share of PE deals, at 33 percent; Nigeria, quite expectedly, accounts for 69 percent of this region’s deal value. Southern Africa was allocated 20 percent, East Africa 16 percent and North Africa 17 percent. Multi-regional deals attracted 13 percent, while Central Africa [finally] took 1 percent.

Sector-wise, financials [aka fintech] leads the pack—as expected—sitting on 30 percent of the capital pool and attracting the largest share of deal value, at 39 percent. Consumer directionaries absorbed 16 percent of volume and 21 percent of value. Information technology (IT) claimed 14 percent of both proportion and value.

“The report highlights how Africa’sAfrica’s economy continues to be fertile ground with attractive investment opportunities for investors in search of yields. As innovation across Financials, Technology, Energy, Healthcare enables the pace and scale of pioneering companies, new alliances with local and international investors continue to progress our industry and Africa’sAfrica’s growth story,” Abi Mustapha-Maduakor, CEO at AVCA, said.

From its looks, Africa’s economic resilience in the face of a raging pandemic has brought about increased friction in its yet-nascent capital markets. With more investor attention garnered and more unique businesses emerging, newer highs are on the cards for a perhaps more historic funding year.