This Is Why It Will Cost You More To Borrow From This Mobile Lending Platform

Kenyans relying on mobile loans have a variety of options to choose from owing to the many mobile loan apps in the country, In a bid to have a share of this market, KCB partnered with Safaricom’s M- Pesa to launch a mobile loan service dubbed KCB M-PESA.

The service was deemed attractive to most KCB Bank clients and has been offering their loans at an interest rate of 4.08 percent per month, this means that if someone borrows Kshs 40,000, he/she will repay the loan with an interest of Sh1, 632

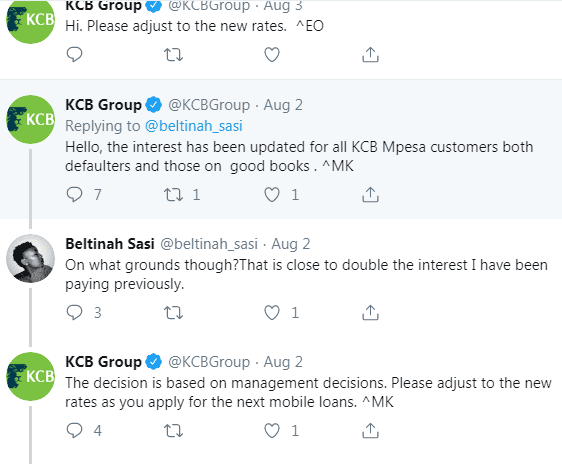

The situation has now changed for KCB M-Pesa users, for the worse, The bank has increased the M-Pesa rate to 7.5 percent on credit regardless of its duration within a month, a borrower will now pay back Sh40,000 with Sh3,001.60.

Without mentioning the specific reason for the changed rates, the lender noted that the rates will apply to all KCB MPesa customers, both defaulters and those on good books.

The new rate will now match Mshwari’s 7.5 percent, the two products are some of the most expensive lenders alongside Barclays’ Timiza which stands at 6.17 percent.

Other commercial banks-backed mobile apps include; Equity’s Equitel, Co-operative’s M-Co-op Cash, Barclays’ Timiza and HF’s Whizz which are issuing millions of loans daily.

These mobile loan apps are tackling competition with other independent apps such as Tala Kenya, Branch International, and OKash which are also advancing cheap loans to millions of Kenyans daily.

Central Bank of Kenya Governor Patrick Njoroge, has, over time expressed his dissatisfaction with the mobile loan apps which offer loans at a huge component of fees, outside their regulatory control.

Lawmakers have also backed the CBK boss calling for the regulation of mobile phone-based lenders, which they term as ‘shylocks’ saddling Kenyans with expensive debt.

The interest rate cap, which was introduced in 2016, only regulates the traditional banks and this has clearly opened up the market for the mobile app lenders.

Featured Image Courtesy: FSD Kenya