Fresh Entrants: 12 Startups Penetrating Egypt’s Fast-rising Digital Commerce Landscape

As one of the deepest and largest tech pockets in the African continent, Egypt wears digital apparel most of its North African neighbors are yet to afford. In the record-smashing 2021, the Arabic-speaking country unseated Kenya as the third most VC-funded startup market in the region, albeit marginally.

Unarguably, Nigeria is the fintech fortress, South Africa diversely builds for the wider, more developed world, and Kenya blazes the trail in agritech. For Egypt, eCommerce [or digital commerce] is the numero uno; this sector booms despite struggles observed in the counterpart markets across the continent.

A young, urban and tech-savvy populace, in combination with a well-connected middle class and rising internet—and mobile—penetration rate, constantly drive eCommerce adoption in Egyptian eCommerce. The space inspired considerable confidence since the COVID-19 era, ever since when VC funding into early-stage ventures on the landscape has been growing steadily.

On the revenue front, the sector witnessed an increase of 30 percent between 2018 and 2019, escalated to 70 percent in 2020, and moderated to 40 percent in 2021—thanks to consumers becoming more accustomed to ordering goods online and the government’s efforts to bolster e-retailing.

According to eCommerceDB, Egypt has the world’s 39th largest eCommerce market, with a 2021 revenue of USD 5.2 B. The sector, which has vastly contributed to the worldwide growth of 15 percent in the same year, is expected to perform even better than the global average of 6 percent by growing by 22 percent between 2021 and 2025.

Set to become more competitive, 20 percent [or one-fifth] of Egyptian tech startups are active in the eCommerce and retail segments, the highest for any sector and twice as many as ventures in the fintech space. In 2021, these companies raised a combined USD 131 M, nearly 1.5 times the amount similar businesses recorded in Nigeria, Kenya, and South Africa in the same period.

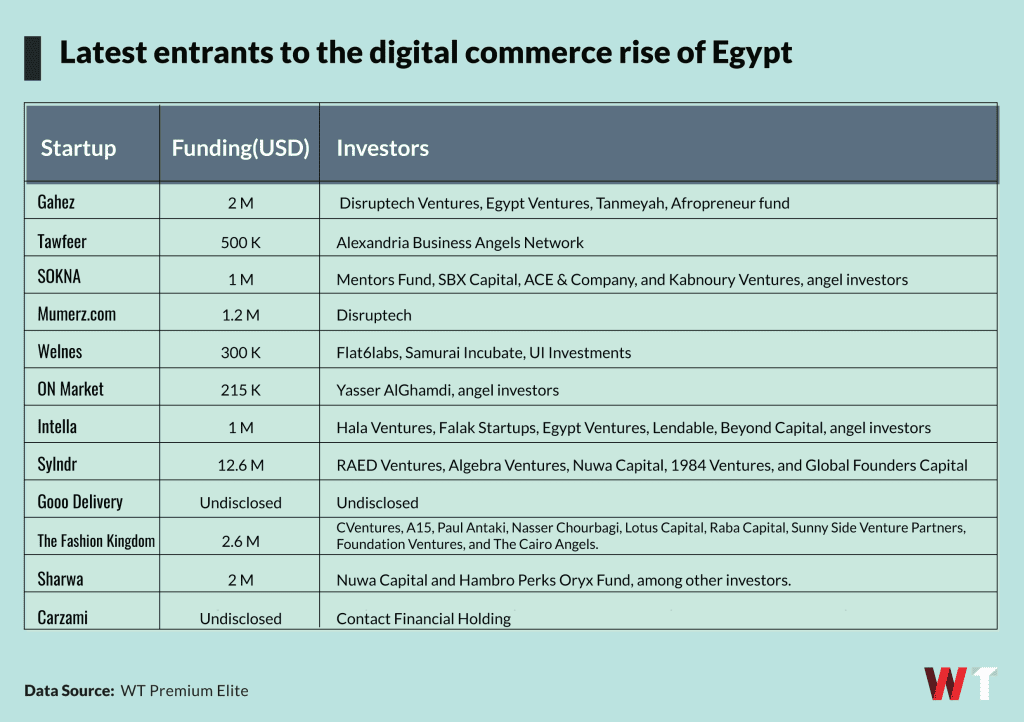

As the industry is ripe for further development, more players, platforms, and business models make their way in, looking to upend the disruption. With an intent to spotlight the shakeup, WeeTracker has created a thoroughgoing list of these startups, most of which are at the seed level of their funding journeys.

Gahez

Launched in late 2021, Gahez was founded to address the inefficiencies that exist between the manufacturing, trade, and retail industries of Egypt’s fashion industry, as well as that of the MENA region, by connecting retailers with suppliers.

The startup offers credit to retailers and facilitates settlements with suppliers while handling logistics, supply, and the provision of insights—and analytics.

Gahez has created an online platform where thousands of manufacturers can display their fashion items to retailers, who can access said merchandise click-by-click, rather than relying only on physical shops and exhibitions. This way, the retailers, as well as suppliers, can operate similarly to global fast fashion players, and small to mid-sized textile factories can access foreign markets.

The brand operates in 16 Egyptian governorates, has onboarded more than 15,000 retailers and 142 manufacturers, and recorded more than 4,000 SKUs. In the future, Gahez plans to export to select African countries and replicate its model in other emerging markets.

Tawfeer

Founded around 2019’s end by Wael Olama and Mohamed El-Zahaby, Tawfeer exists to allow consumers to easily find and buy groceries with an application.

Utilizing its quick eCommerce fulfillment arm, the startup delivers groceries to the doorsteps of its customers. Its app has been downloaded over 100,000 times, and the tens of thousands of orders placed on its platform are growing at a two-digit rate monthly.

Tawfeer, which launched order placement operations in the pandemic year of 2020, has a product range of 4,000 SKUs, including frozen and fresh food, all of which it claims to deliver within an hour. According to the company’s co-founder and CEO, Ahmad Fasseh, the Egyptian grocery retail market is currently worth USD 50 B and is expected to grow exponentially.

In January this year, the company, which operates from Alexandria—the country’s second most populous metropolis—raised a seed round of USD 500 K to build on its growth.

SOKNA

On a mission to destigmatize death and ease the process of laying the deceased to rest, SOKNA specializes in providing tech-enabled end-to-end funeral services. The startup is reimagining Egypt’s funerary culture by handling an array of burial rites by supporting everything from releasing burial permits to providing post-loss assistance.

SOKNA, which was founded by Ahmed Gaballah and launched in 2020, handles body preparations, hall bookings, cemetery setups, custom-made sadaqa giveaways, condolence services, and obituary arrangements. Succinctly, the startup handles every aspect of funeral processes, to make “honoring the dead” more worthwhile and less hassling.

Since its kickoff, SOKNA, which has 50 full-time employees, has entered into partnerships with about 20 hospitals and corporates in Greater Cairo, brought over 70 partner vendors on board, and handled no less than 3,000 funerary occasions. In July, it signed a partnership with the Ashraf Zaki-led Egyptian Syndicate of Actors to become the exclusive funeral service provider for all its members.

Mummerz

Mumerz is a one-stop-shop shop and parent-and-child bilingual community platform offering every mother and child service that cater to their needs. Founded by Nadia Gamal El Din, it focuses on supporting these people from pregnancy up until when the child turns 12 years of age.

Said to be a first of its kind in the market as per its promises for growth in the female-focused tech scene, Mumerz offers an extensive array of services, from information to advisory support and physical items such as baby gear, diapers, apparel, toys, vitamins, skin care products, gift wrapping, gift registries, and customized cards.

The startup also operates a blog that provides article-based education on various topics related to pregnancy, childbirth, childcare, and mothercare, all of which are directly linked to its primary eCommerce platform.

As a result of the huge gap in the market and the time it takes to deliver merchandise in the country, Mumerz can only promise next-day deliveries for its competitively-priced products.

Welnes

This community-centric platform connects people with expert nutrition and fitness instructors to enable its customers to make good on their lifestyle choices and weight loss objectives.

Founded in 2020 by Amr Saleh and Amr Diab, the startup creates individualized nutrition and training routines for various categories such as keto, low carb, and paleo, among others.

Using a gamified approach to get users motivated and committed, Welnes delivers its programs group by group, creating an avenue for users, dietitians, and physical trainers to participate at the same time.

Through this method, the app has helped more than 15,000 people with their lifestyle choices; this number has uploaded over 500,000 pictures of food choices and received more than 5 million likes.

ON Market

Incorporated in 2020 by Moatasem Marzouk, Seif Yasser, Ahmed Najjar, and Moataz Marzouk, ON Market’s mission is to empower grocery retailers in Egypt with digital solutions that will help them build sustainable online commerce.

The startup, which graduated from the 2021 AUC Venture Lab acceleration program, connects customers to nearby grocery vendors, enabling them to buy from a multiplicity of sources with a single order, for what is the first time such a process is gracing the local market.

Leveraging the marketplace business model, ON Market has no warehouses or stockpiles, which affords the startup some flexibility and agility compared to its competitors. The approach allows the company to partner with retailers in every neighborhood or residential block, and deliver large-sized grocery baskets worth up to EGP 1,500 in under an hour.

Intella

Intella, founded in 2021 by Nour Altaher and Omar Mansour, is referred to as the first real-time intelligence provider in the Middle East and North Africa. Using artificial intelligence and machine learning, and big data, the platform provides on-demand business insights and market research to a diversity of clients.

The said clients include tech startups, financial institutions, small businesses, and government entities in the fintech, banking, marketing, healthcare, education, logistics, and transport sectors in the MENA region, including Egypt and Saudi Arabia.

The platform-as-a-service (Paas) company has an objective to make data and market research a lot more accessible and reliable, chiefly by enabling customers to conduct what it calls “direct to consumer” market research.

Intella, which has worked with Saudi Arabia’s Ministry of HRSD and Ministry of ICT, has partnered with Impact Partners and Itmam to write the first Tech and Entrepreneurship Perception Report for the country, profiling hundreds of well-meaning individuals from the country’s business and government scenes.

Sylndr

Africa’s automobile marketplace carries one of the world’s highest growth prospects, with a present USD 35 B cap and an expected increase of USD 45 B by 2027. In this market, use car dealerships sit on the larger share.

Founded by Omar El Defrawy and Amr Mazen, Sylndr is focused on the automotive industry, where it brings about innovation to the way people buy and sell used cars, simply by making the process easier, more transparent, and more effective.

To inspire confidence in the used auto industry, the startup intends to become the go-to online platform for people looking to transact automobiles, having a comprehensive selection of high-quality cars and numerous options for flexible financing.

Sylndr is designing its business model after that of India’s Cars24 by obtaining vehicles from persons willing to sell them, buying them for an agreed cost, reconditioning, and then reselling them to a set of new owners. In the future, it looks to provide a 7-day money-back guarantee and set-time warranty.

Gooo Delivery

Gooo Delivery was founded in 2020 by Yasser Hassan to deliver meals, fresh groceries, cosmetics, medication, and toys to customers via a mobile app. The platform has a network through which it partners with stores across Cairo, Giza, and Tanta to ensure its users get their ordered items delivered.

Meanwhile, it plans to improve its platform, increase its offering size and expand operations throughout the country and even into the Middle East region, thanks to its recent round of financing.

Pre-funding, Gooo successfully built a user experience that enabled the platform to attract 100,000 users in the first 6 months of operation. The startup also increased the number of customers using the service at a 20 percent rate month-on-month and grew its store, restaurant, and supermarket arsenal by 15 percent.

The Fashion Kingdom

This player operates a digital marketplace for fashion, beauty, and home accessories items. It is a one-stop-shop solution that sees to the operations, co-marketing, omnichannel, and content creation services that help local fashion brands with their digital transformation, grow their online sales, and become a lot more sustainable.

The Fashion Kingdom (TFK), founded by Fadi Antaki, Marianne Simaika, and Karim Abd El Kader and launched in 2020, claims to have more than 150,000 customers visiting its sites monthly, with some 40 percent of its sales derived from repeat customers. It offers a range of beauty, personal care, and home fashion products, among others.

Apart from listing products on its eCom platform, The Fashion Kingdom provides support for the brands it works with, including a virtual fitting room which helps such businesses better evaluate the size of customers as well as recommend outfits.

Sharwa

Globally, inflation is straining numerous households. Due to this, consumers are on the lookout for more affordable household items. Founded in 2022 by Alaa Shalaby, Hassan El Shourbagi, and Mohamed Hanafy, Sharwa is a social commerce startup that looks to make this not only possible but also easier.

The startup has built a platform that enables customers to get some of the best prices for their day-to-day purchases on essential goods such as groceries, appliances, and home care products. Customers can fill these items into a single basket and order them on its app or via WhatsApp, accessing wholesale prices from producers, as well as next-day delivery.

To ensure its services are available to remote locations in Egypt, the brand partners with local community leaders who frequent the platform to collect orders in their neighborhoods or regions. Customers can purchase items at two price points, either singularly or in group—which offers a 40 percent discount in comparison to regular retail prices.

Carzami

Hussein Hosny and Adham Hosny founded Carzami in 2022 as an online platform allowing users to buy and sell used automobiles from the comfort of their homes. The startup offers customers a wide range of certified vehicles, 360-degree virtual tours, and inspection reports.

Billing as a mobility fintech, Carzami has created a platform where people can order any vehicle, get them delivered to their doorsteps for test driving, and then make purchases with financing and insurance options provided by the company.

Hussein Hosny and Adham Hosny have experience in the automotive sector; they, in collaboration with Synapse Analytics, co-founded Sa3ar, the first data pricing engine for used cars in all of Egypt. Also, in 2022, they launched ContactCars.com as the first automobile marketplace and community for both new and second-hand vehicles.