Africa’s Agritech Sector Needs More Attention Than It Gets

Agriculture has been an essential aspect of human civilisation for thousands of years, profoundly influencing societies, economies, and cultures. The Neolithic Revolution, which took place around 10,000 BCE, was a monumental shift from hunting and gathering to establishing stable farming communities, marking the beginning of agricultural history.

Agricultural techniques have undergone significant advancements throughout history, owing to improvements in tools, irrigation systems, and crop rotation knowledge. Over time, agriculture has continued to evolve with the introduction of modern farming practices and technology, such as the Green Revolution of the 20th century, which aimed to increase food production. Today, the agricultural sector remains highly diverse and dynamic, adapting to changing environmental, economic, and social factors to meet the needs of our growing global population with utmost confidence.

The potential for development through agriculture in Africa is immense. It can effectively tackle various issues, including food security, poverty reduction, and economic transformation. Despite the pivotal role technology is expected to play in resolving farming and agriculture challenges, the sector is still not receiving the attention it deserves.

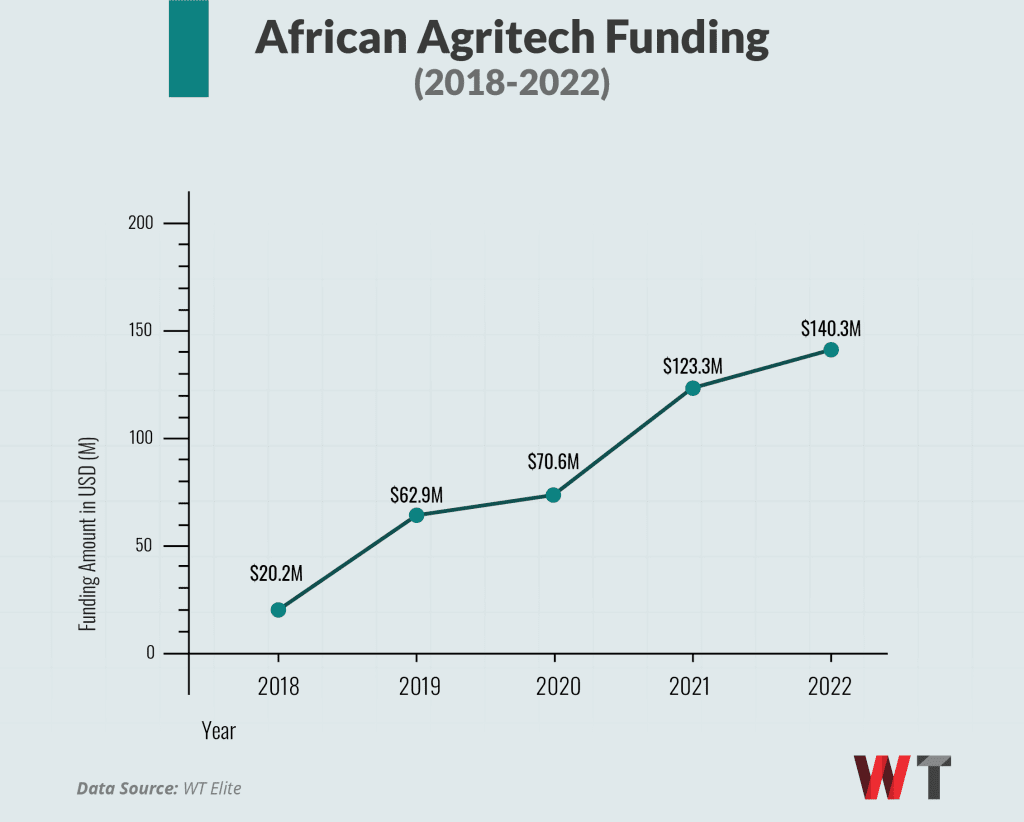

Despite the increasing amount of VC funding in the agritech industry in Africa since 2018, it is evident that the sector has not yet reached its tipping point. This industry is confronted with a myriad of challenges, such as poor-quality inputs, limited credit availability, post-harvest losses, and difficulty accessing markets. Another challenge for the venture capital space could be the unheard of ‘big exits’ in the agritech space.

AFEX, a Nigerian company that Financial Times recently recognized as the “fastest-growing” African company, is committed to tackling the challenges in the agricultural technology sector. Currently operating in Nigeria, Kenya, and Uganda, AFEX plans to expand to nine more countries within the next decade. In an email interview with WT, Mariam Tobun, VP of Corporate Services at AFEX, sheds light on why the Agritech sector requires a boost.

The Background

According to the Food and Agriculture Organisation, food security is a major problem on the continent, with as many as 258 million people facing food crises due to problems like lack of access to food, climate change and malnourishment.

A general position on agriculture in Nigeria and, by proxy, the rest of Africa is that it is the singular most important economic activity and the backbone of multiple industries in one way or another. Nigeria’s agric sector is a key driver, contributing 22.35% to the total GDP of the nation and employing about 70% of the population who are mostly involved in small-scale farming. This demographic alone contributes to 90% of food production in the country, yet they are an underserved, excluded group in terms of financing and policy coordination.

Despite its contribution to the economy, the sector faces multiple challenges that impede productivity and reduce the capacity to feed the burgeoning population. These challenges range from high post-harvest losses, limited financing, poor access to markets, unsophisticated irrigation systems, and lack of access to technology and agricultural extension services to combat climate change and global warming.

On agriculture financing alone, the World Bank estimates that the value of the financing gap is as wide as USD 65 B. Low financing in agriculture means that farmers do not have the necessary inputs, seeds and fertilisers to produce enough to match demand. The ripple effect is that people are not able to access the necessary nourishment to stay healthy, and in the case that they can access food, they do so at incredibly high, unsustainable rates.

“I would say that between 30 years ago and now, we’ve seen a major shift in stakeholder involvement in the sector,” says Mariam.

While Africa has a long way to go in terms of building and maintaining efficient systems, growing exports and reducing reliance on food imports, the sector has witnessed steady growth.

She adds, “Today, the landscape is rapidly evolving, with multiple private organisations like AFEX, working to transform the sector by building efficient infrastructure to manage our food needs.”

The Rising Challenge of Climate Change

Nigeria is racing against multiple potentially disruptive factors, from rapid population growth, declining resources and finally, climate change. The potential ripple effect of climate change affects the entire food chain, from farmers to final consumers. Just last year, Nigeria witnessed its most devastating floods since 2012, and this left many farmers with losses they are yet to recoup to this day. Beyond the loss of income faced by farmers, reduced harvest as an implication of these floods affects subsequent planting seasons, leading to food shortage crises.

For many rural farmers who typically lack access to data and technology services to build long-term resilience to environmental challenges, climate change poses a major threat to their survival as well as the capacity to manage the demand and supply of food to those that need it.

Climate change poses a huge threat to Africa’s food production and supply. According to a survey carried out by the World Economic Forum, as far back as 2007, 30% of crop harvest fluctuations have been directly caused by climate change. While global agriculture has managed to maintain crop harvest, Africa still has challenges preventing food shortage.

The Missing Link(s)

Agriculture today contributes 22.35% to the country’s GDP; however, it is also ironic that it is the least invested sector, making up only 3.26% of bank credit issued in 2019. Even when the government allocation for agriculture is viewed, it stood at 1.73% in 2021 and 1.8% in 2022, significantly lower numbers than the stipulated 10% allocation contained in the Maputo agreement. It is noticed that across private and public sectors, agriculture investments are low.

An often-repeated rhetoric is that agriculture possesses a credit, liquidity and market risk profile that investors avoid, and while there is a base to this claim, multiple platforms have been working to derisk agriculture.

In order to truly enhance investment in agriculture, it is imperative to have a deep understanding of the unique characteristics of the ecosystem. It is essential to prioritize innovative and progressive financing strategies to enable Africa to fully maximize its productivity and effectively address food security concerns. Taking proactive measures is also crucial to achieving success in this endeavour.

The potential of agritech to revolutionize agriculture in Africa is immense. However, it is clear that Africa’s adoption rates are still relatively low compared to developed nations due to certain challenges such as limited internet access and lack of knowledge. To increase adoption, stakeholders must prioritise strengthening extension services that educate farmers on best practices, address affordability concerns, and create a favourable policy environment that reduces barriers to accessing agritech solutions. Additionally, it is imperative that stakeholders focus on improving their capacity to ensure successful implementation.

Mariam says, “Identifying these key adoption factors forms the essence of our Code Cash Crop industry platform, where we harness the potential of the technology, finance and agriculture sectors to transform agriculture in Africa.”

The Code Cash Crop features an agritech hackathon, which provides a platform for young, talented minds in the space to ideate and propose ideas that dismantle barriers to sustainable food systems. “Through Code Cash Crop, we are multiplying opportunities available to relevant players in the commodities value chain to optimize efficiency and create shared prosperity for all,” adds Tobun.

In Africa, an essential element for climate adaptability is missing, which is data. By utilizing data to monitor climate patterns and enhance precision agriculture, farmers can be assisted in managing climate hazards. This can lead to more sustainable and resilient agriculture that is better equipped to withstand the impacts of climate change.

The Solution

Mariam points out, “At AFEX, we are building the necessary physical and digital infrastructure to enable Africa to solve these problems and enable Nigeria and the African continent to feed itself.”

The AFEX platform is designed to provide seamless access to infrastructure, markets, and capital for the commodities sector in Africa. They boast over 200 strategically located warehouses in Nigeria, Kenya, and Uganda, providing capacity for storing and aggregating commodities in the right quantity and quality for physical trading.

The digital commodities exchange platform also provides a marketplace for buyers and sellers to trade and invest in commodity-backed investment contracts. The solutions enable price transparency and standardisation, boost export confidence, promote quality, provide better access to markets, and reduce the exploitation of farmers while connecting them to formal markets.

Mariam adds, “We work with smallholder farmers to improve their capacity for production as well as build resilience via our innovative financing products.”

For smallholder farmers, this includes input financing and advisory services. These tools essentially enable farmers to maximize the value of inputs provided. Extension services include general research and data-driven insights to strengthen knowledge of best agricultural practices, and this knowledge is constantly updated in view of the realities of climate change. Beyond input packages, storage operations prevent post-harvest losses and food wastage while boosting resilience for the nation against global food shocks.

AFEX is building proactive measures to manage climate change effects. At the forefront of these models is focusing on innovative financing to unlock climate mitigation and adaptation projects. One such project is the food security fund that was launched in 2021, which is still a future project. The aim of this fund is to scale the “building blocks” required to profitably cultivate and process commodities on the continent, applying technology and data to improve climate-smart agriculture.

Mariam concludes by saying, “Building a resilient data ecosystem cannot exist in a vacuum; it requires collaboration between governments, research institutions, civil society, and the private sector.”