MTN Joins African Telecom’s Pursuit Of OpenRAN

As Africa’s largest carrier network, MTN tries to make sure it stays on top of the major telecom-related trends in the continent. From fifth-generation networks to mobile money and from digitizing sales channels to SIM-less phone tech.

The South African telecom operator has announced that it will jump on a new trend and accomplish it by the end of the year: deploying the OpenRAN technology.

According to the company, it will join forces with vendor partners Voyage, Altiostar, Parallel Wireless, Mavenir, and Tech Mahindra to roll out OpenRAN before year’s end. However, making it commercially available might be a launch for another year.

When OpenRAN first made rounds in African telecoms, it was France’s Orange calling the shots.

As of July 2020, the Paris-headquartered carrier had quietly switched on the technology in the faraway Central African Republic (CAR). With that launch, Orange pledged to roll out the alternative radio access network across Africa—particularly in the markets where it operates.

MTN is present in no less than 20 markets in Africa and the Middle East. The telco will take advantage of its expansive footprint across the continent to test and effectively deploy the OpenRAN tech.

The company claims to be an early adopter—having had hands-on experience with open-source technologies two years ago to improve rural network coverage. MTN has reportedly rolled out 1,100 commercial sites in 11 countries at the time.

“While OpenRAN brings a new architecture to mobile networks and more suppliers to deal with, it gives telcos much-needed flexibility. This means that MTN can now look at building a network that can meet cost and capacity requirements of specific markets, or even rapidly deploy 5G and/or 4G seamlessly with existing legacy services. This is a real game-changer for mobile advancement in emerging markets,” said Amith Maharaj, MTN Group Executive: Network Planning and Design.

5G? MTN is also one of the early adopters of fifth-generation connections in the continent. After South Africa’s Rain rolled out the country’s first standalone 5G network, MTN joined the race with a commercial launch about a year after.

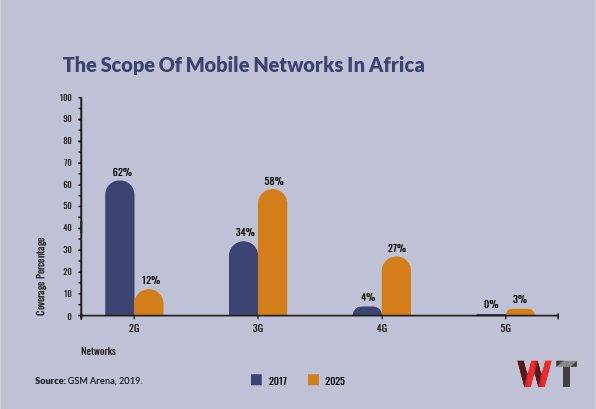

Even as the continent’s 4G landscape is yet to be smooth, no less than 18 African countries are testing—or have already tested—commercial 5G. Looking at this growth, the use case for OpenRAN becomes more glaring.

The OpenRAN tech is designed to allow service providers to accelerate 5G network development by way of open architecture.

This enables the engineering teams of telcos to build energy-efficient base stations to aid the deployment of 5G. This process isn’t only more cost-effective, but also reduces the amount of research and developments they have to do with such networks.

For example, MTN already has multi-technology software-defined GPP-based stations that allow it to deploy 2G systems with fully virtual 2G technology. It can run 2G, 2G, and 4G simultaneously on the same base station, providing commercial data and voice services to African customers, in urban and rural parts of the continent.

Etisalat—the Middle Eastern telecoms provider better known as 9mobile in these parts—is also making room for OpenRAN to support its African operations.

February last year, the operator announced that it would begin testing the technology across its 16 markets (comprising 148 million customers) across Africa, Asia, and the Middle East. Etisalat’s extensive operations in Africa cut across 11 nations where the company has full or part ownership of operators.

The world’s telecom industry is going through a dramatic change, one that can be compared to what data centers experienced in the 2000s. This drives the need to move from costly, proprietary solutions to COTS and open-based ones.