Vodacom’s New Super App Plan For South Africa Is Haunted By M-Pesa Misery

After pulling the plug on its “failed experiment” with M-Pesa in South Africa four years ago, the telecom operator, Vodacom, is making another bold fintech bet by rolling out a super app, not unlike China’s WeChat.

And the second time might be the charm — or not, thanks to the telco’s troubled history with fintech and the state of financial services in South Africa.

In a press release dated July 20, Vodacom revealed that it is rolling out a super-app packed full with offerings, from “paying for your morning coffee, listening to a podcast on business management, sending money to your family, paying your utility bills, shopping online for everything from clothes, to groceries to electronics, checking on your business point of sales transactions and ordering new stock – all through the same, easy-to-use, super-app, from the convenience of your smartphone.”

To make this happen, the telco announced that its fintech arm, Vodacom Financial Services, had scored a technology partnership with the close-to-IPO Chinese fintech giant, Ant Financial Services, perhaps better known by the name of its popular product, Alipay, which claims over 1.2 billion users worldwide.

Vodacom says its new fintech play will not only serve individuals but also SMEs, which are being targeted with lending and insurance services. However, the company is believed to be also eyeing the approximately 11 million South Africans who make up the country’s unbanked population.

The whole thing sounds like a plan that might come together, up until it starts to register that the telco has been here before. And it didn’t go so well.

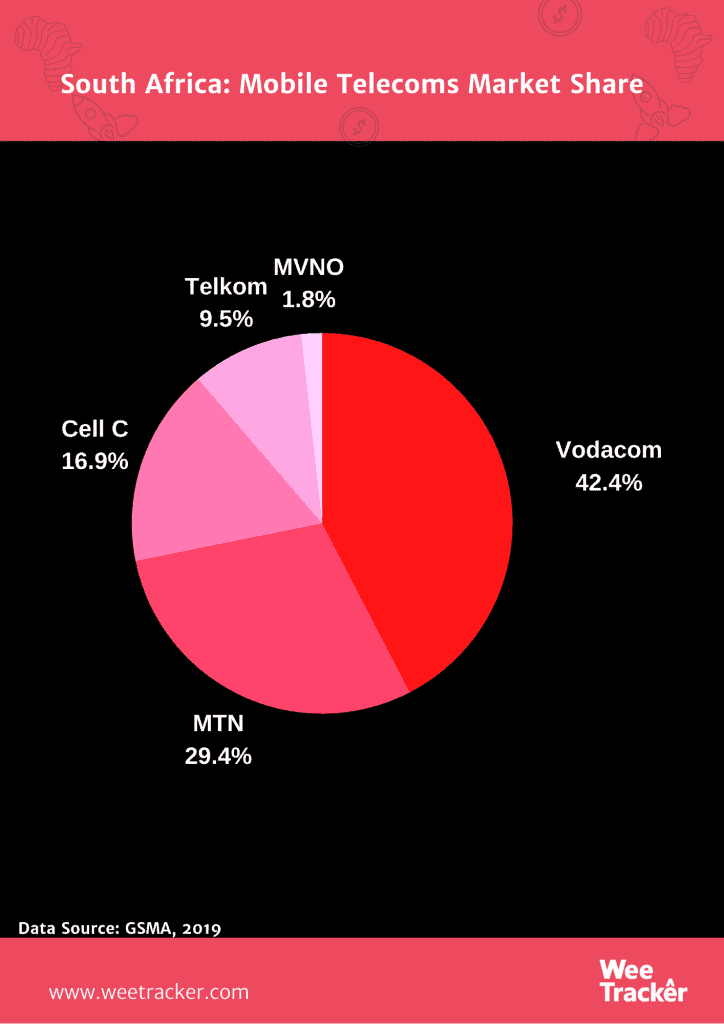

In 2016, Vodacom, which is the leading telco in South Africa accounting for 42 percent of the country’s mobile subscriptions as of 2019, was forced to euthanize the M-Pesa mobile money service which it launched in the country in 2010.

The popular mobile money service that is M-Pesa is now co-owned by Vodacom and Kenyan telco, Safaricom, ever since the UK’s Vodafone divested its stake in the service in April.

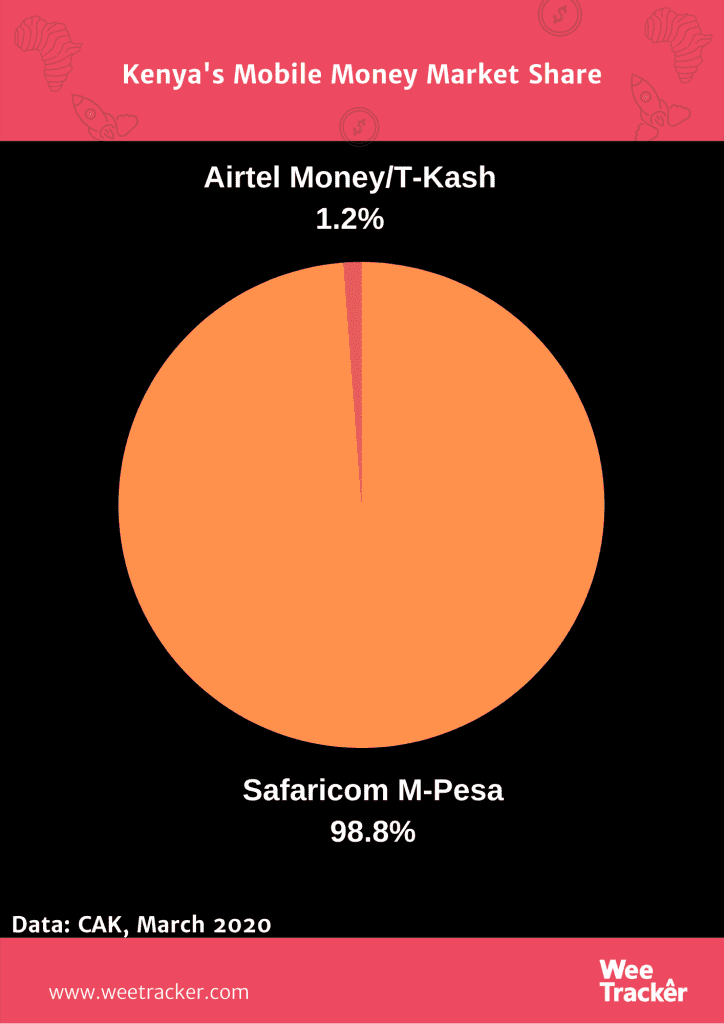

Having seen M-Pesa quickly become a hit in East Africa (especially in Kenya where the current 83 percent financial inclusion rate was largely pushed by M-Pesa), Vodacom decided to “copy-and-paste” the service in South Africa.

But it turned out a largely underwhelming undertaking. M-Pesa backfired spectacularly in South Africa, the telco fell short of plans to capture up to 10 million South African users in 3 years by some distance. In fact, by 2016, Vodacom had managed only 76,000 active users.

More than a few explanations have been put forward over the years to account for the failure of M-Pesa in South Africa. But perhaps the most frequently occurring entry in the post-mortem file is the reckoning that Vodacom attempted a one-size-fits-all instead of paying attention to the peculiarities of South Africa.

There are more than 25 million M-Pesa users in Kenya and the Safaricom-provided service currently accounts for nearly 99 percent of all mobile payments.

In countries like Kenya, Tanzania, Lesotho, Mozambique, and the Democratic Republic of Congo where a large percentage of the population has always been unbanked and thus excluded from formal financial services, M-Pesa has excelled; serving as the first link to not just technology (mobile phones) but also formal financial transactions for the previously unserved/underserved.

But M-Pesa was perhaps always going to flop in South Africa from the outset since the huge gap it filled so well in Kenya was not as wide in Jozi land. About 75 percent of adults in the country have bank accounts, according to a survey done by technology research body, FinMark.

Indeed, there are widely reported but untested claims that there is a bank, branch or ATM within a 20 kilometre (12-mile) radius in any urban or rural settlement in South Africa.

As a matter of fact, the country has the most technologically advanced, financially liquid, and accessible banking system on the continent. A 2015 KPMG report revealed that South African banks are growing at an annual rate of 7 percent and the industry has assets worth USD 361 Bn. No other African nation comes close.

Hence, Vodacom always had a mountain to climb trying to fix something that is not exactly broken, so to speak. Even as data from Pew Research Centre indicates that 9 in 10 South Africans own a mobile phone and a third of these are smartphones, Vodacom was taking on a robust financial system by trying to propagate mobile money services and there was only ever going to be one winner.

Another explanation that is commonly cited for the M-Pesa fiasco in South Africa is the decision by the Vodacom to link up with Nedbank to provide the financial service on its platform.

Nedbank is one of the largest banks in South Africa and the perception is that it caters to middle-class and high-income earners who are already enjoying financial inclusion. Hence, it was hard to sell the service from there.

There are also talks of stiff banking regulations in South Africa and the absence of a “very dominant” telecom player in South Africa (like Safaricom in Kenya) as other issues that prevented M-Pesa from taking off in South Africa.

Four years on from the failed M-Pesa experiment, Vodacom has once more set out to compete in the country’s fintech turf through a freshly-minted super app backed by a global fintech heavyweight. And it would be hoping to get it right this time, though the warning signs are still there now as they were in 2010.

Featured Image Courtesy: Khusoko