Google’s Reluctance To Wield The Axe Makes Its Rules For Lending Apps Seem Hollow & Cosmetic

The Backstory

When Google updated its Financial Services policy last summer, one of the adjustments that caught the eye was the bit that suggested it would no longer be business as usual for shylock lending apps that prey on unsuspecting people. But the enforcement of the new policy has been anything but great.

To help protect people from deceptive and exploitative personal loan terms — which is quite common with the fundamentally predatory lending apps that are largely used in markets that are dominated by Google’s Android — the company introduced some new rules that must be adhered to by all lending platforms if they are to feature their offering via Play Store.

Essentially, the new rules outlawed lending apps that promote personal loans that require repayment in full in 60 days or less from the date the loan is issued.

Google also mandated such platforms to have certain details like minimum and maximum period for repayment, maximum Annual Percentage Rate (APR), and a representative example of the total cost of the loan (including all applicable fees), clearly disclosed in the app metadata.

The new rule also banned apps for personal loans where the Annual Percentage Rate (APR) is 36 percent or higher, at least in the United States, though it’s baffling that nothing was said of other countries.

At face value, it appears Google really does care about protecting its users from wanton exploitation by predatory lending apps. At least, that’s the message in the new policy. However, recent developments might suggest that Google hardly cares as much as its policies say it does, or perhaps not.

But the fact remains that many lending apps have been running afoul of the new rules for lending apps since the policy took effect and getting away with it. And the only reason those apps are still available on Play Store is either because Google has been too busy to notice or those new rules are just cosmetic.

Between Google And Lending Apps

Due to the bottlenecks associated with accessing credit from formal financial institutions, lending apps have become a popular option for retail loans in Africa — which is coincidentally one of Google’s key markets.

Google’s Android is the leader in the mobile operating system market in Africa. As of December 2019, it accounted for almost 84 percent of the mobile Operating System (OS) market.

In Kenya, where four out of the top ten free apps are fintech apps offering free loans and digital loans are becoming a debt trap, Google/Android has over 84% market share.

In Nigeria, where digital loans platforms are sort of metastasizing at the moment, its market share is nearly 80 percent.

Little wonder why most microlenders choose to distribute their product by building apps for Android and taking advantage of the growing smartphone/internet penetration in places like Africa and Asia.

Is Google Really Protecting Lending App Users?

The issue is that Google may not be doing enough to keep the lending apps in check and protect users. It is one thing to formulate a policy and quite another to implement it.

Expanding on a proverbial statement, birds have no need to learn to fly without perching if the hunter only threatens to take a shot without ever pulling the trigger.

Recently, it came to light that OKash, OPesa, and CashBean — the three lending platforms owned by Opera — may have been involved in predatory lending practices and underhanded schemes that ultimately rip off users.

The report by Hindenburg Research, which is reminiscent of last year’s short-sell attack on e-commerce giant, Jumia, by Andrew Left’s Citron Research, highlighted wrongdoings in retail loan disbursements on OKash, OPesa, and CashBean, from interest rate ambiguities to misleading offers, bogus meta descriptions, and short-term loans with a repayment plan of as little as 7 days; a clear violation of Google Play Store rules for lending apps.

But somehow, OKash and OPesa are still available on Play Store, though Opera immediately erased the lending option from its popular Nigerian super app, OPay, even as it denies any wrongdoing in its official statement addressing the matter despite the curious timing of the disappearance of OPay’s lending service.

Asked about the claims in the Hindenburg report, Opera’s Communications Manager, Alejandro Viquez, told WeeTracker that OKash and OPesa are fully compliant with the policies for the Google Play Store and partner networks they rely on. He also added that the platforms continue to provide more than 60 days repayment options for users, as required.

Discrediting the report as full of errors, unsubstantiated statements, misleading conclusions, and interpretations, he maintained that the interest rates on those platforms are in line with best practices.

“The claims about interest rates are misleading. The OKash interest rate varies from 18 percent to 36 percent. If the borrower does not pay on time, late fees apply. In order to ensure the users economy, OKash has adopted a principle called in duplum rule, which establishes a limitation that prevents the total amount a user will ever need to pay back at two times the principal amount,” said Viquez.

“As an example, a KES 1500 loan will never exceed KES 3000. Even if it is paid back much later than its due date, as we stop adding overdue interest after this effective cap has been reached. Such interests quoted in the short report are highly inaccurate and misleading.”

When questioned about the strings of evidence in the report and the curious timing of the disappearance of the lending option on the OPay app, Viquez responded thus;

“We don’t label this as evidence, to use your wording. Secondly, we have already provided a statement on the matter. OPay is a different company and therefore, I suggest that you reach out to them for matters concerning their app.”

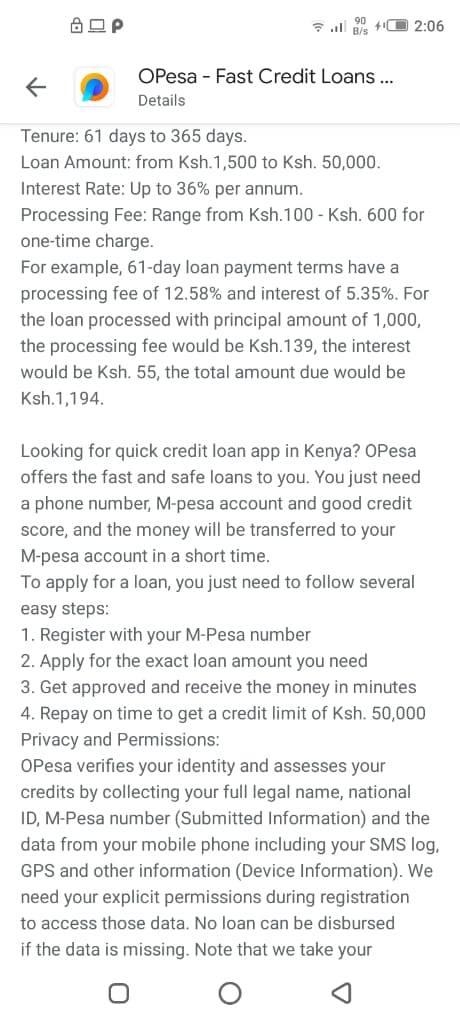

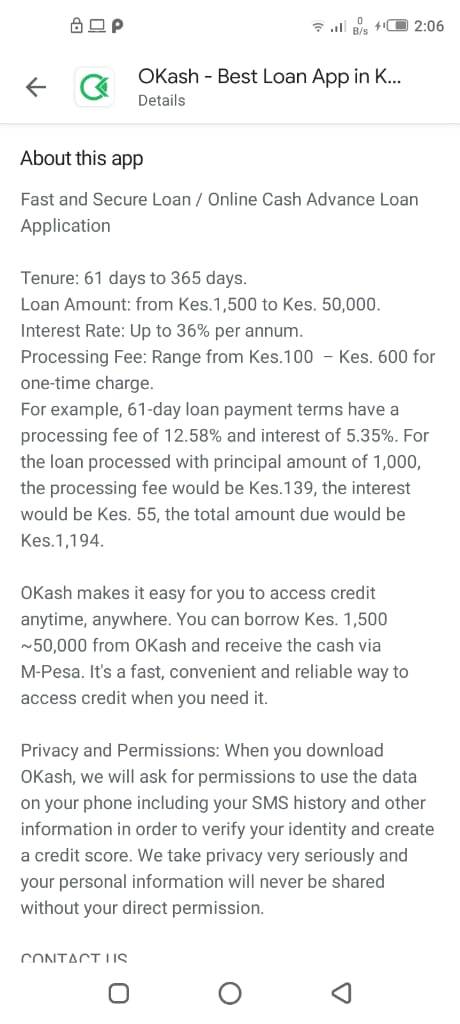

WeeTracker reached out to folks in Kenya who confirmed, as of the time of publishing, that OPesa and OKash are, in fact, still available on Play Store with the app descriptions below;

But a recent story on TechCabal confirmed with tests that those apps actually zag when they promise to zig. In other words, what the metadata for those apps says is quite different from what the apps actually do when users get in.

Now, if a bogus description is all it takes to make Google look the other way, then there really is trouble.

Opera’s Lending Apps Aren’t The Only Guilty Ones

While the Hindenburg report may have put Opera’s lending platforms under the microscope, the same shortcomings can be found with many other lending apps.

Lenders like Fairmoney, QuickCheck, Carbon, PalmCredit, RenMoney, Branch, Tala, Aella Credit, and many others are almost as guilty of flouting Google’s new rules for lending apps, and perhaps it’s only a matter of time before Google finally wakes up and wields the axe, unless of course, they are in on it and the policies are mostly hollow.

In a story which TechCrunch ran yesterday, Founder of Hindenburg Research, Nate Anderson (who confirmed that his company continues to hold short positions in Opera’s stock), took a swipe at Google.

“Google has become the primary facilitator of these predatory lending apps by virtue of Android’s dominance in these markets. Ultimately, our hope is that Google steps up and addresses the bigger issue here,” Anderson is quoted as saying.

In a statement to TechCrunch, a Google spokesperson said: “Our Google Play Developer Policies are designed to protect users and keep them safe, and we recently expanded our Financial Services policy to help protect people from deceptive and exploitative personal loan terms. When violations are found, we take action.”

However, Google did not confirm if any specific action would be taken regarding Opera’s fintech products in Africa.

It’s not clear how Google ascertains whether apps are in line with its Play Store guidelines or if they are running afoul of its rules, but a cursory test of many of these lending apps should force action, except, of course, the guidelines are being grossly misinterpreted.

Featured Image Courtesy: KuwaitiTimes