Deal-Street Africa [May 31- June 4]: Fintech Startup Chipper Cash Closes USD 100 Mn Series C

![Deal-Street Africa [May 31- June 4]: Fintech Startup Chipper Cash Closes USD 100 Mn Series C](https://weetracker.com/wp-content/uploads/2021/06/4thhhh.png)

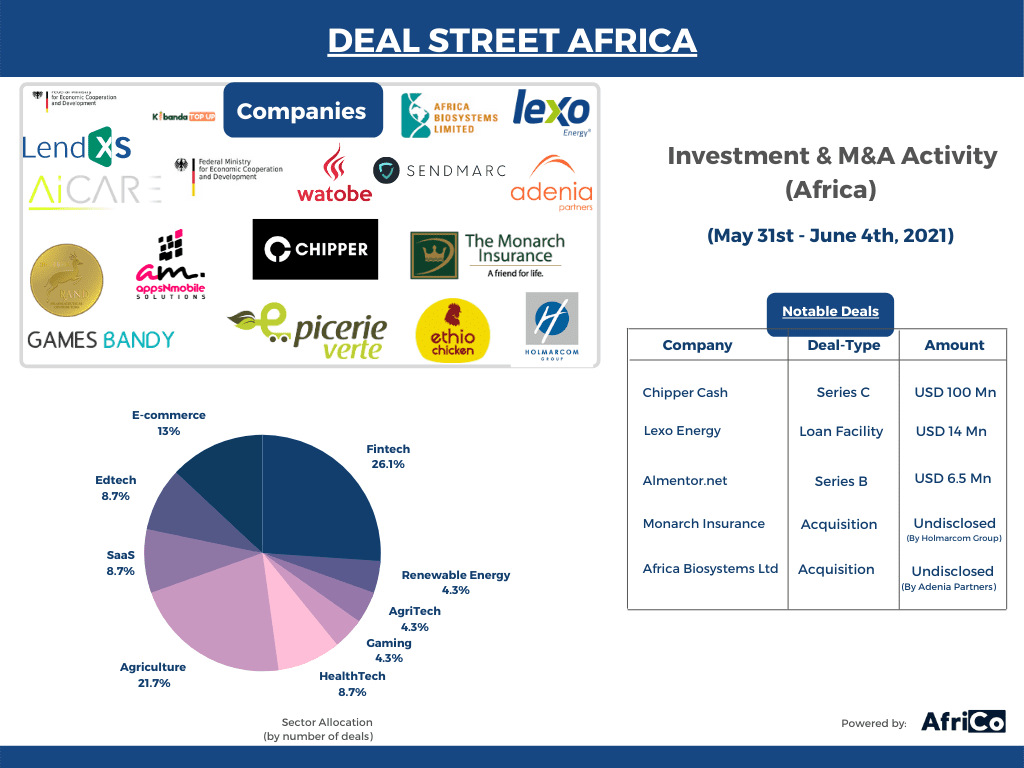

Fintech Startup Chipper Cash Closes USD 100 Mn Series C

Chipper Cash, an African fintech startup, raised USD 100 Mn in a Series C round led by SVB Capital, the investment arm of Silicon Valley Bank. Deciens Capital, One Way Ventures, Ribbit Capital, 500 Startups, Bezos Expeditions, Tribe Capital, and Brue2 Ventures are among the other participating investors. The startup intends to use the additional Series C capital to launch new products and increase its workforce by up to 100 people.

South African Edtech Watobe Raises USD 636 K Seed Funding

Watobe, a South African Edtech firm supporting math learners, recently announced that it had raised USD 636 K in a seed funding round from educational publisher Twinkl. The Cape Town-based EdTech startup has joined the Twinkl business accelerator with this investment.

Video E-learning Platform Almentor Raises USD 6.5 Mn Series B Funding

Almentor.net, one of the leading video e-learning platforms in the MENA region, raised USD 6.5 Mn in series B funding in a round led by Partech. The round also included Sawari Ventures, Egypt Ventures, and Sango Capital. This new investment brings the total funding raised by the company to USD 14.5 Mn since its establishment.

Egyptian Gaming Startup Gamesbandy Closes Seed Round

Egypt-based gaming startup Gamesbandy raised an undisclosed seed round led by Flat6labs Bahrain and Tamkeen. The investment will help to expand Gamesbandy’s platform to support additional games, invest in marketing, and expand regionally to become Mena’s one-stop shop for game trade.

Kenya’s Lexo Energy Secures USD 14 Mn Loan From IFC

Lexo Energy, one of the leading fuel retailers in East Africa, secured a USD 14 Mn loan from the International Finance Corporation (IFC) to help it gradually install electric vehicle charging stations in Kenya and Tanzania. In addition to financial assistance, IFC plans to provide Lexo energy with technical assistance for greening projects and environmental, health, and social best practices.

Eleven Benin Startups Awarded Funding By The Digital Entrepreneurship Support Fund

The Digital Entrepreneurship Support Fund, a project of Benin’s ministry of Digital and Digitalization effort to revitalize the country’s digital ecosystem through direct financial assistance, training, and technical assistance, granted 11 Benin startups a total of FCFA 200 million (USD 372 K) in funding. The winning startups included; Fedapay (fintech), GoMedical (fintech), Ylomi (Concierge), BFT (fintech), Gounod (Agribusiness), Ola Medical services (health), (health), Africa Puzzle (entertainment), Jinukun (Agribusiness), Tech in All Engineering (Agribusiness), Tico (Agribusiness), and Medom Benin (health).

Morocco’s Digital Marketer Epicerie Verte Raises USD 748 K Funding

Epicerie Verte, a digital marketplace located in Casablanca that allows local organic farmers to sell their products online, raised USD 748 K from Azur Innovation Fund to accelerate its growth in Morocco and internationally. The young company also plans to recruit and target the European market with its new investment to promote organic “Made in Morocco.”

Egypt’s E-commerce Enabler zVendo Raises Pre-Series A Investment

zVendo, an Egyptian eCommerce SaaS solution provider, successfully closed a Pre-Series A funding round of an undisclosed amount from Mobica and Gratus Holding. The startup intends to use the new cash to improve its platform capabilities and grow its geographical footprint.

Morocco’s Holmarcom Group Acquires Kenya’s Monarch Insurance

Holmarcom Group, a Moroccan conglomerate, acquired a majority stake in Kenya’s Monarch Insurance Company for an unknown sum through its holding company, Holmarcom Insurance Activities. The arrangement, subject to certain closing conditions, including regulatory approvals in Kenya, is expected to see Holmarcom Insurance Activities along with Kamu Group, and Maisha Microfinance Bank becomes the company’s primary stakeholder, a 51 percent stake.

South Africa’s Rand Pharm Secures Investment From Vumela Fund

Rand Pharmaceutical Distributors (Rand Pharm), a South African pharmaceutical distributor, received funding from The Vumela Fund, founded by FNB Business and Edge Growth. The investment is targeted at supporting an acquisition that will boost capacity and create new partnerships that will sustain long-term growth.

Toyota Announces Investment In Kenyan Telematics Insurance Provider AiCare

Toyota Tsusho Corporation announced an investment in Kenyan telematics insurance provider AiCare Group. The investment will be made through Mobility Investment SAS, Toyota Tsusho’s corporate venture capital subsidiary. Toyota Tsusho will also partner with AiCare to deploy its technology across Africa, leveraging Toyota’s extensive automotive network.

Adenia Partners Acquires Africa Biosystems Limited

Adenia Partners, a private equity firm investing in Africa, announced it has completed the acquisition of Africa Biosystems Limited (ABL), a leading distributor of life sciences and clinical diagnostics equipment in East Africa. The deal’s financial specifics were not disclosed.

German Ministry To Launch DeveloPPP Program For Kenyan Entrepreneurs

The German Federal Development Ministry (BMZ) is launching the DeveloPPP Ventures Program, which will offer local Kenyan entrepreneurs an entrepreneurial support program with a grant of up to EUR 100,000 (USD 122 K). The project is intended for young entrepreneurs who are making unique contributions to sustainable development in their developing nations while also enhancing the population’s living conditions.

OP Finnfund Global Impact Fund I Invests USD 5 Mn In EthioChicken

EthioChicken, an Ethiopian chicken company, received a USD 5 Mn investment from OP Finnfund Global Impact Fund I, Finland’s first global emerging markets impact fund. The goal of the investment is to create good jobs, increase food security, and eliminate poverty.

Ugandan Fintech Emata Wins CATAPULT: Inclusion Africa 2021

Emata, a Ugandan Fintech that provides farmers with digital and cheap financial solutions, was named the Best Catapulter Award winner at the conclusion of the CATAPULT: Inclusion Africa 2021 digital boot camp. Emata received EUR 5,000 (USD 6 K) in LHoFT prize money as the overall winner of the boot camp and free registration and lodging to the upcoming African Microfinance Week in October 2021.

Ghanaian Fintech Startup appsNmobile Secures USD 1 Mn Investment

Ghana-based fintech firm appsNmobile secured a USD 1 Mn investment from Oasis Africa VC Fund to help it establish itself as a major player in Ghana’s and the sub-payments region’s markets. In addition, a portion of the funds will be utilized to meet the Bank of Ghana’s statutory capital requirement and other business requirements.

Kenya’s Kibanda TopUp Raises USD 460 K Pre-seed Round

Kibanda TopUp, a Kenyan startup that intends to digitize the supply chain for Africa’s micro, small, and medium restaurants, acquired USD 460 K in pre-seed capital to expand its customer base. JAM Fund led the round, which included mPharma founder and CEO Gregory Rockson, Flutterwave founder and CEO Olugbenga GB Agboola, Alarko Ventures’ Cem Garih, and several angel investors.

IDH Farmfit Fund Acquires Stake in LendXS To Accelerate Smallholder Finance

The IDH Farmfit Fund signed an agreement to acquire a 21% ownership stake in fintech scale-up company LendXS BV. The investment begins off a unique collaboration between the IDH Farmfit Fund, IDH’s catalyzing smallholder finance facility, the Sustainable Trade Initiative, and LendXS, the Financial Access Group’s fin-tech start-up.

Nigerian Agritech Startup Thrive Agric Launches USD 10 Mn Project For Smallholder Farmers

Abuja-based agritech startup Thrive Agric launched a one-year project to empower 50,000 smallholder farmers. The project will be supported and carried out in partnership with the USAID-funded West Africa Trade & Investment Hub (Trade Hub). Thrive Agric has committed to raising at least USD 10 Mn as part of its cooperation with the Trade Hub, while the Trade Hub will invest a USD 1.75 Mn grant.

Endeavor South Africa’s Harvest Fund Announces Second Investment In Sendmarc

Endeavor South Africa has announced the second investment of its fund, Harvest venture Capital II, into South African startup, Sendmarc. Kalon Venture Partners, a South African-based venture capital firm, led this latest funding round to build Sendmarc’s cybersecurity business in South Africa and beyond. It is a follow-on injection from their initial investment in January last year.