African Agritech’s New Look Is Wooing Investors Over

The land is green, but the harvest isn’t yet ready.

Not an attempt to hijack a decade-old lyrical but only lay the blanket that best covers the current nature of African agriculture.

According to FOA data, Africa is the continent with the most arable land. 22.8 percent of the region’s over 30 million km sq can be cultivated to provide the said harvest for its peoples. Yet, food shortage in this continent isn’t only the current reality but also a persistent challenge.

More than 100 million Africans faced emergencies, crises or extreme levels of food insecurity in 2020—a 60 percent leap from the previous year. Even this 2021, the challenge is expected to be more persistent, no thanks to the effects of last year’s pandemic scare.

Well, conflict appears to be the major reason for food security in Africa. But while the peace gets better, tech startups have risen to build systems that would support the continent’s agricultural efforts.

That’s where companies like ThriveAgric and Farmcrowdy come into play, mostly to enable the success of mechanization with smallholder farmers-targeted offerings.

Long story short, African agritech startups are now making financial strides.

In a more recent sense, agritech in the continent has a different look. Though not quite the one-size-fits-all facelift, the change isn’t far-reaching. Investors are seemingly cultivating a taste for Artificial Intelligence (AI)-enabled agritechs.

Last week, an Israeli agritech startup secured USD 10 Mn to expand its operations to South Africa. Afula-based SupPlant raised the private equity-led round to finally enter the country where it has been helping farmers.

The startup claims to have assisted South African farmers to reduce their water usage by 37 percent in apple crops, increase the lemon crop yield by 60 percent, and an increase in macadamia nuts by 21 percent.

SupPlant—which was founded in 2012 and officially launched in 2015—uses a hardware-software solution to increase crop yield and reduce water consumption in farming. More importantly, to offer smart solutions, the Israeli company blends Artificial Intelligence, agronomic algorithms, cloud-based tech and sensors.

Founded by Zohar Ben Ner, SupPlant has been working with South African farmers since 2017. Now that it wants to officially expand to one of Africa’s most agricultural countries, there’s an abundance of investors to provide it with the requisite capital, one which brings the company’s total raise investment to USD 19 Mn.

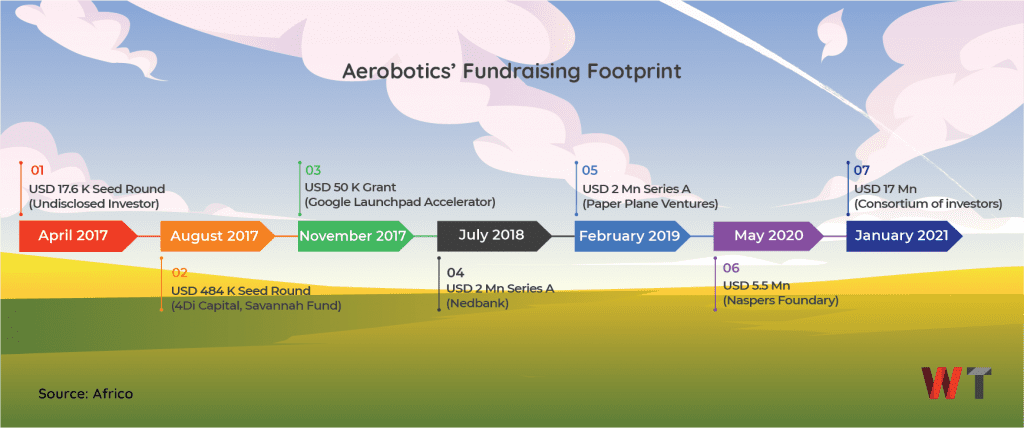

Enter Aerobotics, another agritech startup that is leveraging new tech to innovate on the African homefront. One of the few South African tech startups to get a slice of Naspers Foundry’s ¬USD 100 Mn warchest, raised USD 17 Mn in an oversubbed Series B round early this year.

Like SupPlant, it has it footprints in soils outside the continent. Though it is based in Cape Town, South Africa, it has offices in the United States, Australia and Portugal. And for its markets, the agritech operates in 18 countries across Africa, the Americas, Europe and Australia.

What does Aerobotics do? Basically, it uses Artificial Intelligence to help farmers manage their farms. Using this tech, drones and other robotics, its technology helps farmers track and assess the health of these crops, including identifying when trees are sick, tracking pests and diseases, and analytics for better yield management.

Aerobotics has developed a model that analyses data relevant for tree and fruit farmers. Other sectors could also benefit from the usage of AI, albeit that it will need to be tailored to that sector’s needs and requirements.

Another AI-driven startup is Apollo, which just raised USD 1 Mn in debt funding. Last year May, the Kenyan agritech scored USD 6 Mn in its Series A round to fund its growth. Apollo Agriculture ombines machine learning and automated operations technology to help Kenyan small-scale farmers access the tools needed to maximize profitability.

The potential of AI-supported agriculture is considered significant not just in South Africa or Kenya, but on the whole African continent.

According to the Disrupt Africa report, Kenya and South Africa lead the agritech market in Africa. One-quarter of funded agritech startups in the continent in 2020 were based in Kenya, eating 59.5 percent of the cumulative amount invested.

Agriculture is the least-digitized industry in the world. Some of the key consequences are a lack of access to good quality inputs resulting in sub-optimal yields, in-efficient supply chains resulting in high wastage levels, and low visibility on markets/prices resulting in low farmer incomes.

AI is one of the instruments of a larger toolkit that encompasses digitization and automation solutions which can be used to tackle the before mentioned challenges that farmers face. As such, it can be beneficial to farmers across the African continent.

Artificial Intelligence a means to an end. The aim is to provide farmers with actionable insights. If this can be achieved by using AI, this is considered useful, regardless of the farmer’s location.