Deal-Street Africa [June 7-11]: Egypt Hogs The Funding Limelight

![Deal-Street Africa [June 7-11]: Egypt Hogs The Funding Limelight](https://weetracker.com/wp-content/uploads/2021/06/April-12-16-2021.png)

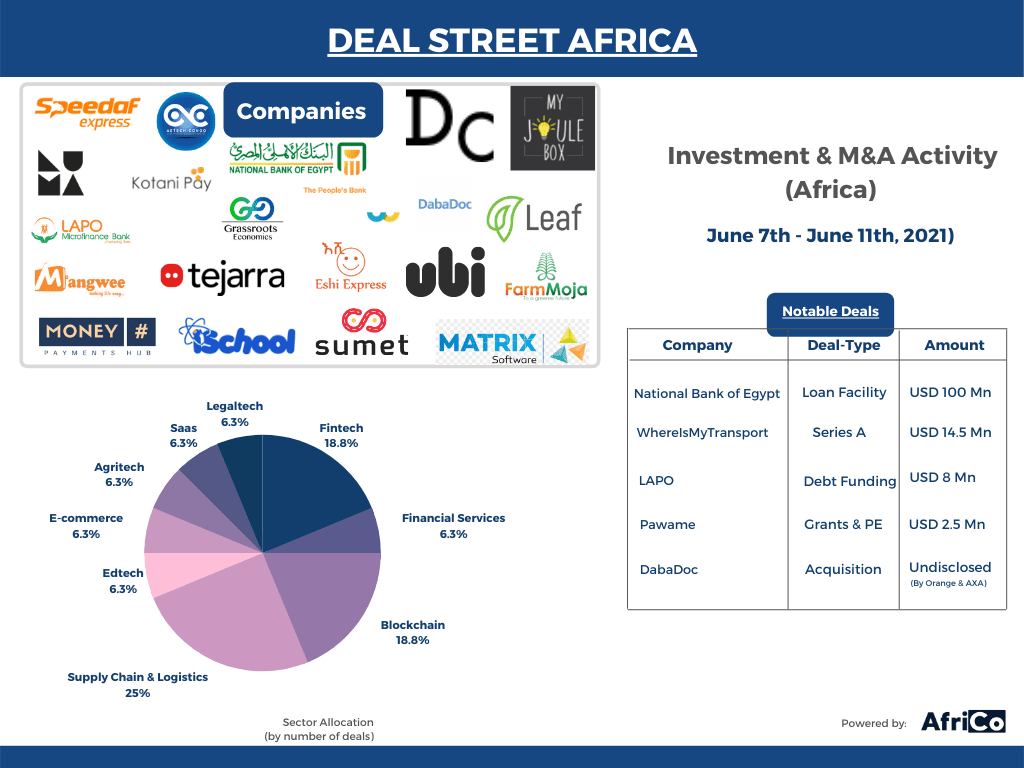

Here is a recap of last week’s notable deals on the African continent;

Pawame Raises USD 2.5 Mn Funding For Africa Expansion

Pawame, a solar energy startup that aims to serve off-grid communities in Sub-Saharan African countries, secured USD 1.7 Mn in grants to speed product development. This is in addition to USD 750 K in equity funding, including USD 250 K from the Launch Africa Fund.

SPE Capital Exits Morocco’s Dislog In First Liquidity Event

SPE Capital, an African and Middle Eastern private equity fund, exited Morocco’s Dislog in its maiden liquidity event, just two years after investing in the logistics company. The PE firm sold its investment in H&S Invest Holding, Dislog’s holding company, to the Belkhayat family and its management in a buyback deal. The financial details of the deal were not disclosed.

Egyptian Fintech Startup MoneyHash Raises Pre-seed Funding Round

MoneyHash, an Egyptian fintech startup that uses a unified checkout experience and a universal API to help businesses consolidate and grow their payments and financial tech stack, raised a six-figure US dollar pre-seed funding round to expand its services in the Middle East and Africa (MEA) region. The six-figure round was led by UAE-based venture capital firm COTU Ventures, with participation from Ventures Platform, Kepple Africa Ventures, and various angel investors.

WhereIsMyTransport Raises Additional USD 14.5 Mn In Series A Extension

South African mobility startup WhereIsMyTransport announced that it had raised an additional USD 14.5 Mn in its Series A extension to cement its position as one of the market-leading mobility data and solutions providers for emerging-market megacities. The funding round included investors such as Naspers Foundry, Cathay AfricInvest Innovation Fund, and SBI Investment.

Egyptian Edtech Startup iSchool Raises USD 160 K Funding

iSchool, an Egyptian edtech platform that provides the newest educational technology for young pupils, raised USD 160 K in investment from EdVentures, the venture capital (VC) arm of Egypt’s Nahdet Misr Publishing Group. The startup intends to use the funds to build an online platform to grow its edtech services in Egypt and beyond the Middle East and North Africa (MENA).

Five African Startups Secure USD 5 K Grant Funding Each From SAIS, Seedstars

Five African startups received USD 5 K each in grant funding from the Southern Africa Innovation Support program and Seedstars after completing the Investment Readiness Program. The five startups awarded include; Mangwee, a Zambian fintech startup; SUMET, a Tanzanian FMCG distribution platform; UBI, a Mozambican city planner app; Luma Law, a South African legal information service, and Astech-Congo, a DRC-based startup that allows users to stay connected to their school or university.

Egypt’s E-Commerce Platform Tejarra.com Secures Six-figure Seed Round

Tejarra.com, an Egyptian electronics e-commerce website, announced that it had received a six-figure USD seed investment from venture capital firm Openner. Openner will provide finance and in-depth, hands-on technical support, scientific experience, and additional resources to the platform’s marketing and sales operations and its market success and positioning as part of the agreement.

National Bank Of Egypt Secures USD 100 Mn Loan From EBRD To Support SMEs

The National Bank of Egypt (NBE) received a USD 100 Mn loan from the European Bank for Reconstruction and Development (EBRD) to help the country’s small and medium-sized businesses (SMEs). According to the EBRD, the loan will aid Egypt’s SMEs in terms of energy efficiency, climate change mitigation, and the use of adaption technology.

Benin’s Solar Startup MyJouleBox Secures USD 1.8 Mn Funding

MyJouleBox, a French solar energy firm, inked a USD 1.8 Mn finance agreement with ElectriFi to deliver Solar Home Systems (SHS) in Benin and hire 200 new employees. The startup also hopes to extend its market share in Burkina Faso and Togo, and Benin. MyJouleBox offers a solution for solar professionals in Africa to offer leased solar installations to their customers.

Orange, AXA Assurance Acquire Controlling Stake In Health-tech DabaDoc

Orange Middle East and Africa and AXA Assurance Maroc acquired a majority stake in DabaDoc, a Moroccan health-tech startup that is digitizing access to healthcare in Africa. The financial details of the deal were not disclosed. The transaction is expected to close in the third quarter of 2021.

Ethiopian Logistics Startup Eshi Express Secures Angel Funding

Eshi Express, an Ethiopian last-mile delivery services startup, received an undisclosed amount of funding from the Addis Ababa Angles Network. The Addis Ababa Angels Network is a group of individual investors whose aim is to promote economic development and sustainability in Ethiopia to create a strong startup ecosystem in Ethiopia that fills the funding gap and focuses on early-stage innovative firms.

Nigerian Microlender LAPO Secures USD 8 Mn Debt Funding

Nigerian microfinance company, LAPO, secured a three-year senior secured loan of USD 8 Mn from the International Finance Corporation (IFC), the private-sector investment arm of the World Bank. The financing will go into helping micro, small, and medium-sized businesses (MSMEs) affected by the coronavirus pandemic.

Logistics Company Speedaf Secures Investment To Scale Operations

Speedaf Express, a China-Africa integrated logistics service provider, has announced the completion of a funding round led by Trustbridge. The round also included participation from Northern Light Venture Capital and Vision Plus Capital. The funding will go into expanding the logistics network in emerging countries, build an IT system, and structure the talent team.

Egypt’s E-commerce Startup DressCode Secures USD 250 K Funding

DressCode, a Cairo-based fashion and leisure e-commerce firm, received a USD 250 K investment from Egypt Ventures. The startup plans to use the funds to expand beyond fashion and cosmetics, focusing on rejuvenating the online store’s home décor items.

FarmMoja Secures Investment From Impact Fund ADAP Fund 2

ADAP Capital LLC announced an investment of an undisclosed amount in Kenya’s FarmMoja that helps smallholder farmers gain better market access by providing training and inputs through its ADAP Fund 2 to expand its operations.

UNICEF Awards Grants To Three African Blockchain Startups.

The UNICEF Venture Fund has awarded grants to three African blockchain businesses intending to assist early-stage companies in addressing local and global issues. Two companies are from Kenya and one from Rwanda. The Kenyan startups include; Grassroots Economics, which runs programs to empower marginalized communities to control their own livelihoods and economic future, and Kotani Pay, a technology stack that allows blockchain protocols, dapps, and blockchain fintech companies to seamlessly integrate with local payment channels. In addition, Rwanda’s Leaf provides virtual banking services to underprivileged populations crossing borders, allowing them to access their own savings quickly and affordably.

South Africa’s Matrix Software Secures Investment From AgVentures

AgVentures, an agritech-focused venture capital firm, has invested in Matrix Software, a specialized software provider to the meat sector in southern Africa, in its second deal of the year. The VC firm didn’t disclose the financial terms of the deal. Matrix intends to use the funds to grow into adjacent market verticals such as poultry, fisheries, and dairy and deliver additional functionalities to existing clients.