Zambia May Not Get A Covid-19 Loan From The IMF

Coronavirus has thrown the finances of Zambia into disarray. Paying pension, civil salaries and funding medicine has become hard because of the uncertainty of financial sources.

At worst, there is a possibility the International Monetary Fund (IMF) will not loan the Southern African country funds to fight Covid-19, thanks to its already “unsustainable” debt.

Only Option

Zambia’s eurobonds have been among the world’s worst-performing in 2020, while the country’s currency has depreciated by 23 percent against the USD. The global pandemic, having brought supply chains to a halt, has forced down the price of copper, which accounts for most (about 75 percent) of Zambia’s exports.

Zambia is Africa’s second-biggest copper producer, but the IMF has projected its economy falling by 3.5 percent in 2020, thanks in part to the coronavirus cataclysm. Also, the government’s debt will reach 110 percent of the country’s GDP this same year if adequate measures are not taken.

The price of copper has fallen by 16 percent this year. In 2019, Zambia produced more than 800,000 tonnes. It would be a miracle if the country can produce more than 700,000 in this Covid-19-ridden 2020.

In January, Zambia’s foreign exchange reserves were at a record low, already at levels lower than what is required to cover the year’s external debt servicing.

At press time, the country has 441 coronavirus cases, but a more pressing problem is its prevalent impoverishment. About 60 percent of people live under the poverty line, while 42 percent are classified as extremely poor.

As of now, Zambia is arguably one of the developing countries facing the biggest debt problems in the era of Covid-19. This coupled with the economic manifestations of the virus outbreak has left it with the only option of seeking a bailout from the IMF.

Another Problem There

Last year, the IMF itself cautioned and counselled Zambia regarding its borrowing habits, pointing out that the country is heading down a path of unsustainability.

Presently, even as the Washington-based lender tailored as much as USD 100 Bn for member countries, it said that it will not be lending to countries whose repayment odds are very slim.

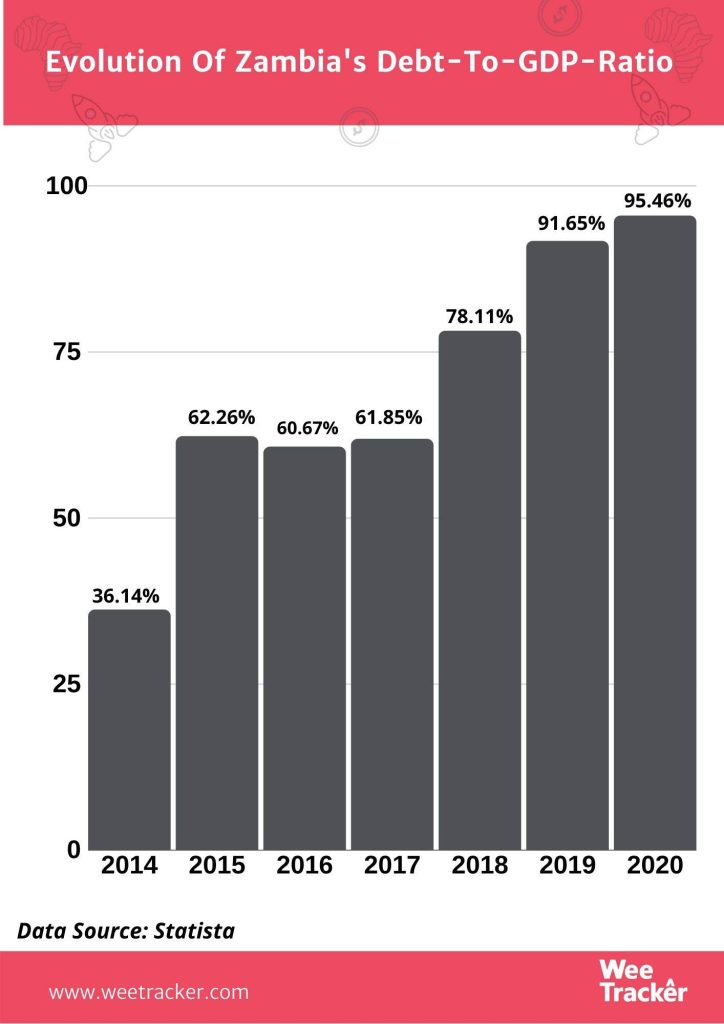

The pandemic did not cause Zambia’s debt problems, but it did worsen them. Almost all of its tax revenues go into debt servicing, leaving only a little left when public wage bill is added. In the last five years, the country’s debt has climbed as it boosted infrastructure spend.

Credit rating agencies like Fitch have warned that Zambia is at a high risk of default. The government’s external debt shock jumped to 45 percent of its GDP in 2019. In 2018, it was only 37 percent. Meanwhile, Zambia’s total debt stock, according to the World Bank, is estimated at 89 percent.

If not restructured extensively, debt could exceed 100 percent of its GDP this year (2020). Even though it can access up to USD 1.3 Bn in relief to mitigate the economic effects of the Covid-19 outbreak, Zambia may run into a thick brick wall trying to get financial assistance from the IMF.

Battered Friendship

Since 2018 when Alfredo Baldini—the IMF’s resident representative in Zambia—was recalled for deployment elsewhere, the lender has not sent a replacement. There were reports that the government unceremoniously asked Baldini to leave the IMF’s office in Zambia.

“In cases where the debt is unsustainable, the member must take steps to restore debt sustainability in order to access fund financing. This could require the government to strike a balance of fiscal adjustment that protects critical social spending and debt relief,” the IMF has now said.

The lender has also said that Zambia does not qualify for the Revamped Catastrophe Relief Fund, which it recently released to 25 poor countries. This is because the country faces difficulties in its policy choices even while its fiscal revenues are under pressure.

Only countries with per capita income under the IDA cutoff of USD 1,175 are eligible for the catastrophe containment window. Zambia’s is USD 1,430, making it ineligible for the relief.

Though Germany gave the country ZK 370 Mn (more than USD 20 Mn) to fight Covid-19, the European country’s government demanded for the donation’s accountability and an active solution to the mounting debt pile.

Restoring Sustainability

Zambia is not alone in the boat with the “unsustainable debt” caption. Its fellow Southern African nation, Mozambique, has a higher debt-to-GDP ratio of 99.84 percent. But the country was able to land emergency funding from the IMF, even after suffering two powerful tropical cyclone strikes in 2019.

Mozambique got on the IMF’s good books by having advanced restructuring talks with Eurobond holders. It also had to prove to the lender that its future natural gas revenues would be massive, enough to repay its debt.

So, if Zambia can make good on similar negotiations, it may be able to convince the IMF to allow it access emergency funding. Angola, Nigeria, Ghana, Gabon and Cameroon all have eurobonds that traded at spreads of more than 1,000 basis points over US treasuries, the point above which the securities are considered to be distressed debt.

“If a country’s debt is unsustainable, the fund can only lend if it has adequate assurances that the member is on track to restore sustainability,” the IMF said. “If such steps involve a debt restructuring operation, we take into account its prospects for success in restoring sustainability.”

Featured Image: Atlas Green via Unsplash