A Top-Rated Nigerian Bank Went Dark For 96+ Hours & No One Really Knows Why

It was the evening of Thursday, July 16, and Nonso* (not real name) had reached for his battered but functional Infinix Note 5 smartphone to answer a phone call.

It was the third time his younger sibling had called him that week to remind him that the GOtv subscription back home had expired and it was time for him (Nonso) to do the monthly ritual.

Like many millennials who had moved away from their homes in South-Eastern Nigeria since landing a decent job in the cutthroat job market that is Lagos, monthly cable TV subscriptions for the folks back home is one of the ways one gets to prove their worth (just kidding, of course).

But on this particular evening, he didn’t get that chance. Nonso tried to log in to his bank’s app to make the payment as usual but all got was a disconcerting error message that read: “Login failure.”

Nonso tried again and again, but it didn’t budge. He opted for the USSD service, same issue. He tried the GOtv app but the payment just wouldn’t go through. Try as he might, this was not to be his night. Nonso eventually gave up, having resigned to “prove his worth” another time.

Throughout the next day (that’s Friday, July 17), the same issue. By now, he had become worried that his plans for Saturday which should see him finally buy a small generator to supplement the poor power supply in his area in the Lakowe area of Lagos was now in doubt. Of course, Nonso couldn’t get anything done if he couldn’t access the money in his sole bank account.

Come Saturday, nothing had changed, so he shelved all his plans. But by now, it had become clear that he and many others who make up the 5.1 million customers of First City Monument Bank (FCMB) — one of Nigeria’s oldest banks — were in a fix. They were all locked out, the bank had gone dark.

It turns out FCMB’s online banking channels had crashed for reasons that are yet unclear, leaving millions of customers stranded. Naturally, the bank got flak from irate customers.

Hey Alex, we still dey, abeg no vex. Our IT team dey work to resolve all these wahala wey dey sama our customers. Dem go soon fix am abeg.

— FCMB (@MyFCMB) July 20, 2020

Unknown to him, the bank had sent this tweet on Friday evening: “You may experience challenges using some of our self-service channels. We apologize for every inconvenience and are working to resolve the challenges in the quickest time possible.

SERVICE DISRUPTION!

You may experience challenges using some of our self-service channels. We apologize for every inconvenience and are working to resolve the challenges in the quickest time possible.#FCMB #MyBankAndI pic.twitter.com/nvTixtBeB4

— FCMB (@MyFCMB) July 17, 2020

By the time he saw the message, it was Sunday morning, about the same time he received a text message from the bank acknowledging the system downtime. It won’t be the first time a well-known Nigerian bank had been blacked out but this case was unusual because it had lingered for days, longer than any such “system failure” on record.

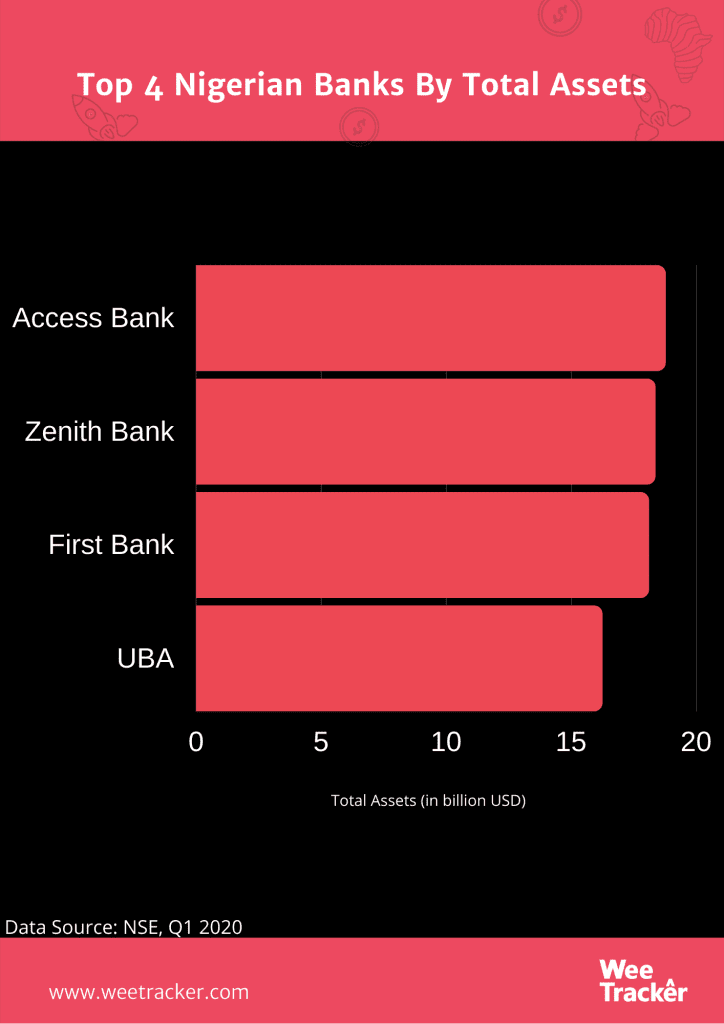

While FCMB may not exactly be up there with Nigeria’s most capitalised and most profitable banks (that title belongs to the likes of Zenith Bank, UBA, GT Bank, Access Bank, and First Bank), it does hold its own as a listed, top-rated lender that has been in existence since 1977.

FCMB also takes pride in being the first bank to be established in Nigeria without government or foreign support.

With 206 branches in Nigeria and a banking subsidiary in the United Kingdom through FCMB Bank (UK) Limited, the bank’s total assets were valued at USD 4.4 Bn (NGN 1.7 Tn) as of December 2019. FCMB has repeatedly topped the charts as Nigeria’s best bank for SMEs and customer experience.

Yet, the bank appeared to have been blindsided by a system failure that was only rectified in the later hours of Monday, July 21, more than 96 hours since the blackout was first logged.

Throughout the whole episode, the lender opted to remain tightlipped on what had caused the problem, throwing around a few “hollow” messages acknowledging the problem while claiming to be working hard at solving it, despite obviously struggling.

With the bank failing to offer any tangible explanation for the downtime, speculators got to work. First, it was rumoured that the bank had been affected by some form of outage beyond its control.

Sometime last week, it was reported that CloudFlare — one of the world’s largest companies providing web-infrastructure and website-security — suffered a service outage that affected many websites.

The timing of the FCMB collapse had somewhat coincided with this outage and it was a convenient explanation for lovers of speculation. But this explanation was rebuffed as the bank’s digital infrastructure actually has nothing to do with CloudFlare. Still, speculators had a field day in the absence of official word from the bank.

WeeTracker reached out to FCMB for some real explanation of the issues that triggered the alarmingly long outage but the bank is yet to offer any word on the matter.

Troubling scenes featuring scores of desperate and irate customers marred several Nigerian banks immediately after the COVID-19-enforced lockdown was first eased in May.

Many of the customers who besieged banks on that first post-lockdown Monday had come to fix problems related to failed online transactions attempted during the lockdown. The rush encapsulated the unreliability and lack of trust for digital channels in the Nigerian banking system.

At a time when Nigerians are being nudged towards online banking and digital channels, it really is counterproductive for any bank to be offline for up to four days.

Featured Image Courtesy: Premium Times Nigeria