Even With A Splash Of Fancy Malls, Most African Retail Markets Are Yet To Go Formal

An increasing young population in addition to growing urbanization and a fast-growing consumer expenditure makes African retail a cluster of attractive frontier markets. This creates opportunities for players from around the world, who look to have a slice of the continent’s retail pie.

Africa’s retailing contributions to Gross Domestic Product (GDP) are steadily upwards, an indication that the region is being driven by consumption.

In 2018, Euromonitor International said that retail sales in the continent amounted to more than USD 500 Bn. Though numbers for 2019 a relatively a long shot to come by, it is easy to assume they go nowhere but up.

However, the spotlight is shed on the retail markets of countries such as South Africa, Kenya and Nigeria. This points to an existence of formalized retail markets, while other markets in Sub-Saharan Africa are mostly just referred to as “promising”.

The Formalized Markets

Africa hosts a profusion of emerging markets, but the ecosystem as a whole is not only different, but also complex. The continent has 55 independent countries, all of which have diverse economies and multiple patterns of consumption.

The populace in the continent comprises a variety of income groups, religions, races customs, and even languages. All of these variables form a factor which puts different countries’ retail markets at different development stages. This is a likely reason McDonalds has not shown real commitment to the African market.

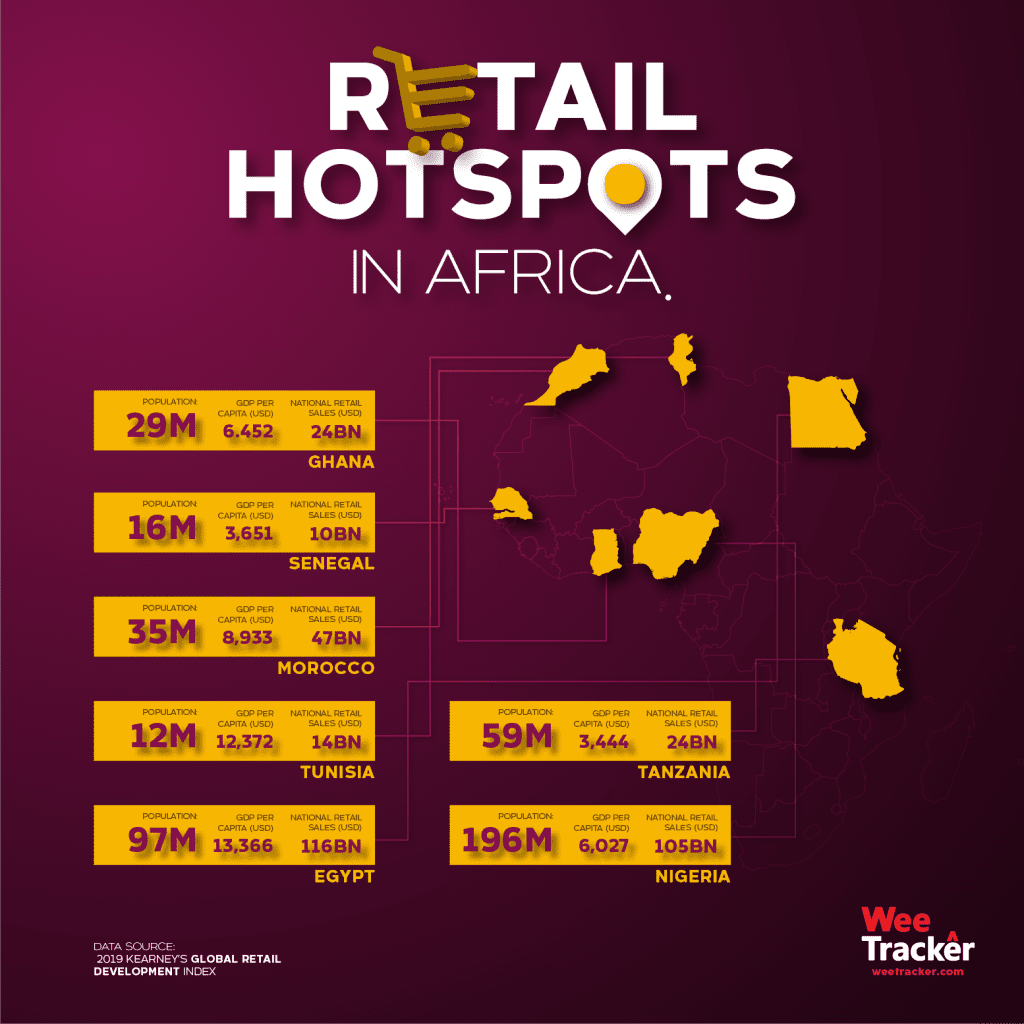

A.T Keaney’s 2019 Global Retail Development Index (GRDI) gives a vivid idea into the ranking of retail markets in Africa. To rank, the research firm considers the current state and future potential of each country’s retail environment. However, it excludes South Africa.

Based on market size, market saturation, country risk and time pressure, the report puts Ghana at the African top for the first time. The commonness of department and variety stores as well as the political stability of the West African country are strong factors.

A key theme in this report is the “Arrival of the Middle East and Africa”. Indeed, 10 of the top 30 countries fall into this bucket, indicating that emerging economies are maturing, and the next wave of retail development and growth will certainly be in the broader region.

Nevertheless, the most mature, developed and formalized retail market in Africa is South Africa. That is evidenced by the fact that most of the biggest retail players on the continent come from the country.

| Company | African Countries Of Operation | Country Of Origin |

|---|---|---|

| Shoprite | 15 | South Africa |

| Pick 'n Pay | 7 Southern African nations | South Africa |

| Massmart | 13 | South Africa |

| SPAR | 9 | Netherlands |

| Metcash Trading Africa | 5 | Australia |

| Woolworths | 11 | South Africa |

Woolworths, a South African retail chain which is one of the best-known players in the continent, agrees with the stand.

In an interview with WeeTracker, the Cape Town-based company says South Africa is followed closely by the Kenyan market.

“This relates more to formalized retail markets. Most of the markets in the main are a mix of informal retail and formalized retail across the continent. The trends are pointing towards a rise in formal retail as urbanisation increases at a rapid rate,” the spokesperson explained.

Presence Of Malls

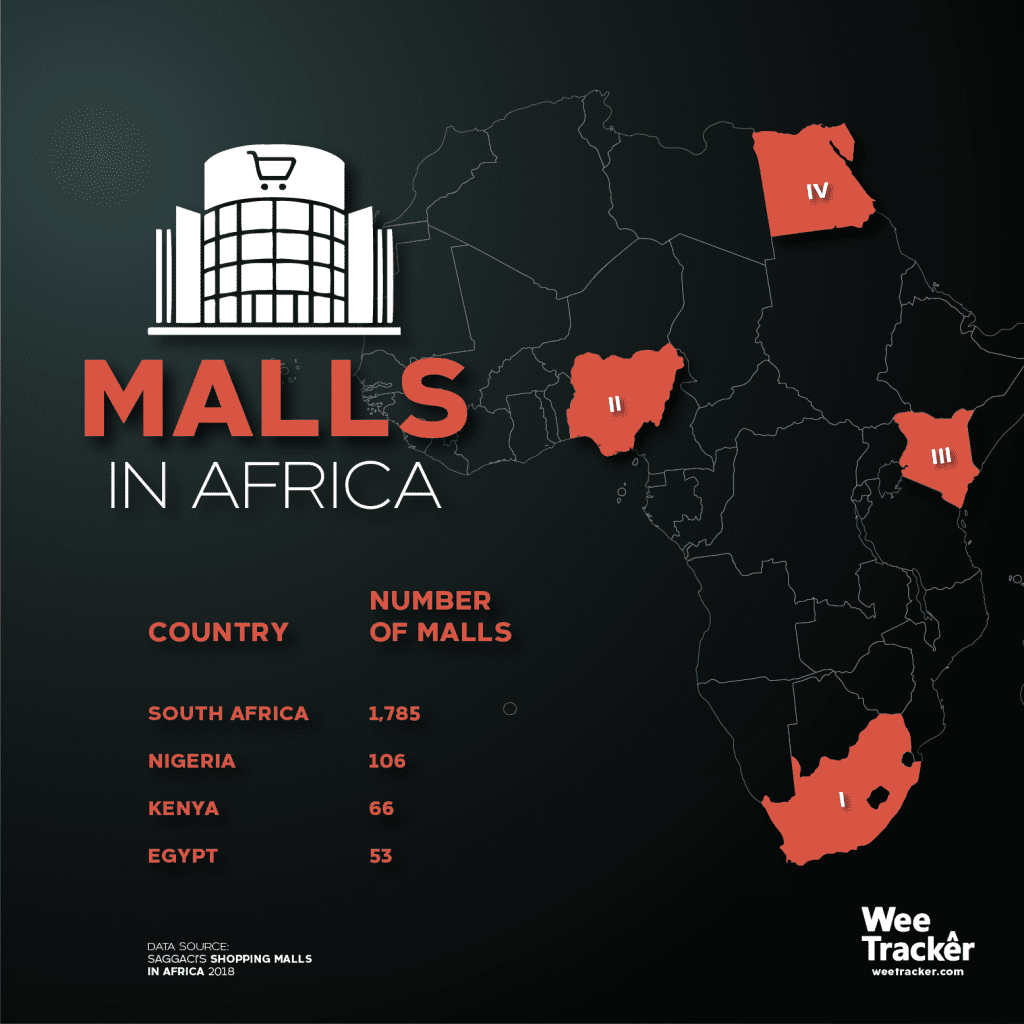

One telling sign that a country’s retail market is being set in order is the existence and numerousness of shopping malls. Per the sixth edition of the Shopping Malls in Africa report, Africa now boasts of 579 malls, up from 225 in 2010.

When the Mall of Africa—South Africa’s largest shopping center yet—was officially opened, the number of malls in the country became approximately 2,000.

About 75 percent of shopping centers in the Southern African country are located in the urbanites of Western Cape, Gauteng and KwaZulu-Natal. In total, South Africa has 23.4 million sqm of retail floor space—the largest in Africa.

MSCI who provided this data on behalf of the South African Council of Shopping Centres (SACSC), also ranks the country as the 8th in the world for its retail real estate size, just behind Australia and France.

As per the same report, the country is the only one in Africa to appear, pointing again to the state of formalization. In comparison, the rest of Sub-Saharan Africa has only about 3 million sqm of retail real estate. This is another indication of informal activities dominant in the other countries.

Data availability drops as the retail torch is shone on less formalized markets. This is why numbers are hard to come by for Kenya. But while there’s uncertainty as to the actual number of malls and/or shopping centers in the East African country, Nairobi has the highest ‘available’ retail space in malls across sub-Saharan Africa.

The Kenyan capital has 500,000 sqm, according to a Knight Frank Africa report. This puts it far ahead of other top cities like Kampala (170,000 sqm), Lagos (150,000 sqm), Addis Ababa (60,000 sqm), Dakar (170,000 sqm) and Kinshasa (170,000 sqm).

Other Parts

Away from Sub-Saharan Africa, countries like Egypt have a substantial retail market. In a similar urban trend, Cairo plays host to an estimate of 66 operating shopping malls while many others undergo construction.

In March 2017, one of the largest malls in the MENA region officially opened. The USD 708 Mn piece of retail real estate alone covers 400,000 square meters, 165,000 of which are dedicated to shopping.

Also, Egypt has hypermarkets—big-box stores that combine supermarkets and department stores. Because of this, Dubai-based retail giant Lulu is investing USD 500 Mn in the country, in a bid to leverage the already existing hypermarkets and create new ones.

According to the 2019 Bright Africa Report, the largest malls in Africa remain in Egypt’s Cairo and most of South Africa’s large cities, with mall sizes ranging from around 100, 000 m2 up to 267, 000 m2, in the case of Egypt’s Mall of Arabia.

The Nigerian narrative of retail is not left out as it is tended towards formalization. McKinsey estimates that between 2008 and 2020, there is a USD 40 Bn growth opportunity in food and consumer goods in Nigeria, the highest of any African nation. Nevertheless, Ghana dominates West Africa.

Tumbling Blocks

Africa’s retail market is characterized by an approximate of 90 percent of transactions happening via informal channels.

This points to an opportunity to the increased establishment of formal retail presence in order to chance upon the chunkier portions of the market share. Markets dominated by the informal economy can be a key to the door of the African market potential.

The big BUT is that there are hurdles. Diverse consumer mix, low levels of established distribution networks, infrastructure constraint as well as economic and political uncertainties.

These form some of the tumbling blocks which big chains like Shoprite, SPAR, Woolworths, Game and Jumbo have to jump over while setting up operations in different countries.

“Formalised retail malls are still being developed on the continent, the main dependency is infrastructure development. There is a rising trend in urban metropoles being developed across various countries.

The main advantage for African retail is that it is learning and adapting quicker to global shifts, hence you note that malls are being developed in line with demand and having the capability to ensure full tenancy,” Woolworths explained.

Africa is made up of a combination of traditional and modern retailing channels. These channels vary by market and are influenced by factors such as economy, state of development, consumer preferences and local culture.

In Nigeria, for example, more than 90 percent of the country’s retailing market is dominated by informal retailing. In terms of product availability, many products sold through modern channels are also sold by informal channels.

Entering The Formal Space?

Andrew Nevin, Chief Economist at PricewaterhouseCoopers (PWC) Nigeria, believes that the informal economy of Africa is essential.

He told WeeTracker that it forms at least 50 percent of the overall economy of the continent. However, he points out that it is hard to measure because by definition, the informal economy is not captured fully in official statistics.

“Prosperity requires that the formal economy become an increasing part of the overall economy because in the informal economy, investment and productivity are too low. Only in the formal economy will companies and individuals make significant investments to scale a company,” he said.

However, entering the formal economy is an economic decision. So the imperative is for governments to make it attractive to enter the formal economy for economic actors currently in the informal sphere. This could mean making it simple and inexpensive to hop on the nicer-looking train.

Nevin shares that joining the formal economy needs to provide clear benefits—particularly proprietary rights and provision of services (like infrastructure, security).

So governments—of the countries where retail is still informal —”need to think carefully about why economic actors are not willing to join the formal economy. In most cases, it seems it is too expensive, too complex and offers few benefits to join the formal economy”.

Inroads & Trends

First, there are variations in the logistics costs and lead times required to access different African markets. Second, the region has a multiplicity of retail channels, supply chains, networks, supply chains, marketing strategies, distribution networks and a melange of regulations.

Companies are also challenged by underdeveloped infrastructure and the complexity of Africa’s distribution channels. But Woolworths cites that Africa is leapfrogging technologies and adapting to trends.

This is in line with what each market requires or can sustain and there are seeing a lot of developments in online shopping through various platforms. It is now easier to order products globally from the comfort of your home.

“Customers have a wider choice of offers than before in bricks and mortar, and have access to retail markets in USA, Europe, China, etc. Mobile money is rising at a rapid rate, especially in East Africa.

Competition is becoming tougher and African retail is seeing a rise in the entry of players originating from Europe, Asia, and Australia. Plus, other niche boutique shops all vying for the middle to upper income classes,” the firm concluded.

Featured Image: priznajem.hr