Beyond Fintech, Facebook’s WhatsApp Pay Dares e-Tailers In Frontier Markets

Fintech startups have a new, serious headache. That’s not a line from some eye-opening research. It’s the most common opinion that trailed last week’s announcement from Facebook which unveiled WhatsApp Pay.

As it is, the world’s most popular social networking site, Facebook, has transformed the world’s most popular instant messaging app, WhatsApp, into something more.

Beyond texts, images, videos, audio, documents. status updates, emojis, stickers, and GIFs, WhatsApp now also handles payments, enabling users to send and receive money through the messaging app.

Although WhatsApp Pay is currently live only in Brazil where the app has 120 million users, the new feature is already being described as the fintech’s nightmare.

However, a more robust view of the new WhatsApp feature, as well as the developments leading up to it, might suggest that Facebook, which acquired WhatsApp in 2014, is also spoiling for an e-commerce onslaught.

Indeed, as things stand, it appears Facebook Inc., is looking to pull off a move that would make its trio of hugely-popular apps; Facebook, Instagram, and WhatsApp, into a one-stop-shop for everything, from discovery to purchase.

And apart from fintechs, e-commerce platforms (especially those in emerging and frontier markets) may have a make-or-break battle in their hands.

Besides payments, Facebooks wants eCommerce

After months of talks and trials, the launching of WhatsApp Pay, which follows last year’s unveiling of Facebook Pay, all but confirmed what has been speculated for years.

It appears Facebook is forging ahead with plans to capitalise on emerging and frontier markets and bring e-commerce to its platforms, supported by payments on its platforms.

Since it rolled out Facebook Pay on its main Facebook platform and Messenger app, the company has also launched Shops to allow sellers to create digital storefronts on Facebook or Instagram.

With the Shops feature which was announced in May, users are able to browse and buy products directly from a business’ Facebook Page or Instagram profile.

Before now, both Facebook and Instagram supported businesses by functioning as makeshift e-commerce platforms to some degree. But now the company’s new tools go further, enabling businesses to create a full-fledged shop.

Then, there’s WhatsApp Business which was introduced in January 2018 and lets SMEs post catalogues and stock links within the app.

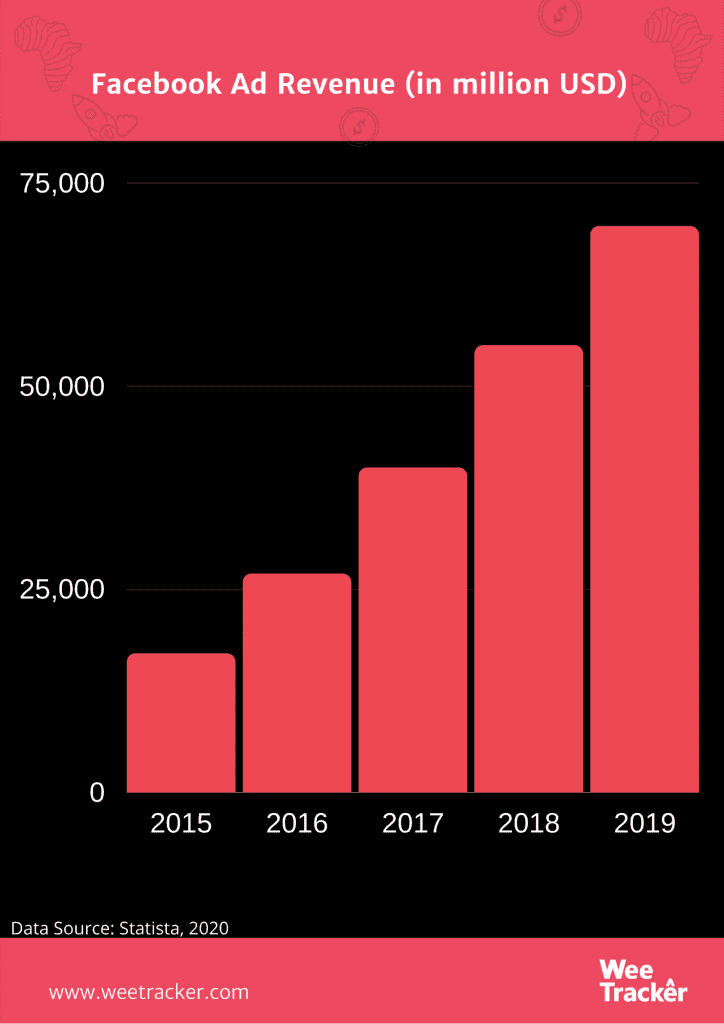

Also, advertisers on Facebook can create links through to their WhatsApp accounts. For context, in 2019 alone, Facebook generated close to USD 69.66 Bn from ad placements only, which makes up an overwhelmingly huge part of the company’s revenue.

Put it all together and it becomes obvious that Facebook Inc. has progressively built an ecosystem of popular social platforms with e-commerce capabilities; a social commerce juggernaut, potentially. And the payment feature looks like the final piece that brings it all together.

How popular are Facebook’s platforms in Africa?

As was earlier mentioned, the Brazil launch is the first nationwide rollout of payments on WhatsApp, though Facebook’s CEO, Mark Zuckerberg, has, in the past, spoken of rolling out the feature to high-priority markets like India, Mexico, and Indonesia.

In any case, there is reason to believe that the WhatsApp Pay feature will eventually reach Africa where WhatsApp is especially so popular that even knock-off versions are among the most-used apps in the continent’s biggest markets.

A youthful population, as well rising internet and smartphone penetration, have created quite the horde of trendy, social media-savvy Africans, many of whom conveniently approximate the concept of “internet” or “online” to social media access.

As of December 2019, there are 526,710,313 internet users in Africa, with a 39.3 percent penetration rate. Of those internet users, 211,611,701 are Facebook subscribers.

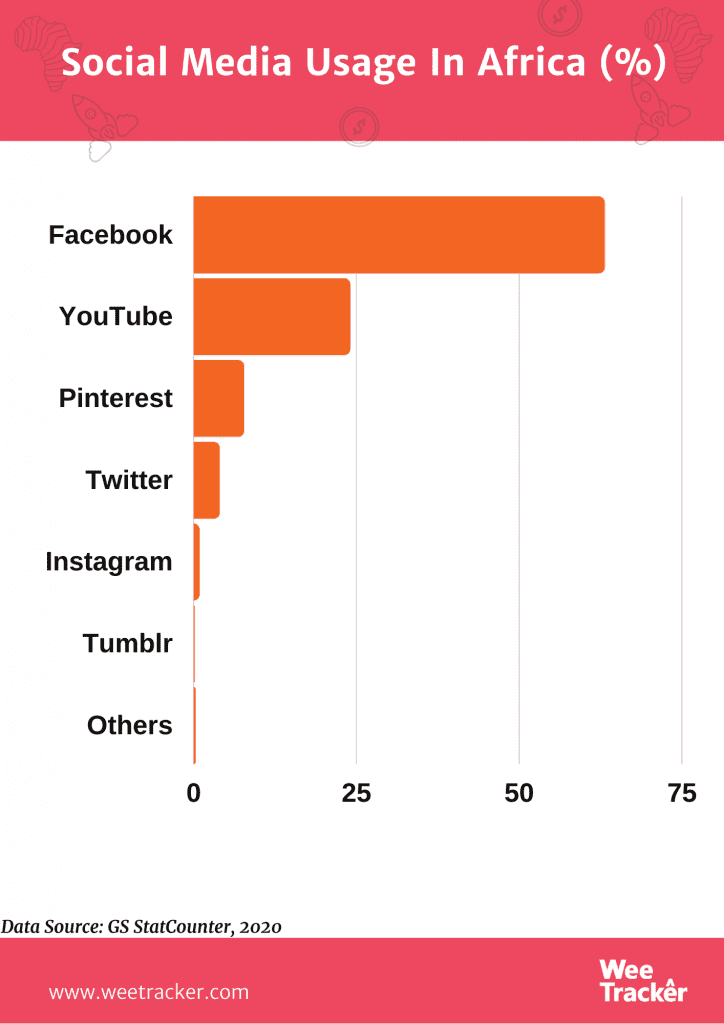

According to data from GS StatCounter, Facebook currently accounts for 63.12 percent of social media usage in Africa. YouTube (24.02 percent), Pinterest (7.7 percent), Twitter (3.95 percent), Instagram (0.86 percent), and Tumblr (0.12 percent) make up the rest.

WhatsApp, on its part, is the leading messaging app across African countries and offers huge business potential. For reasons bordering on accessibility and convenience, WhatsApp is often the platform of choice for many small businesses in these parts.

In 2018, about 192 million social media users were identified in Africa and WhatsApp was the most popular and most-used social app among users, followed by Facebook.

These point to the popularity and dominance of the Facebook-owned platforms in Africa where Facebook’s e-commerce play, especially, might threaten established e-commerce companies.

How so?

Jumia and Takealot are among the biggest e-commerce companies in Africa. Countries like Nigeria, South Africa, and Kenya are the hottest e-commerce markets in Sub-Saharan Africa.

But for many years, e-tailers have found themselves struggling to cut it in a segment where cultural, fundamental, and infrastructural gaps continue to hamstring online shopping.

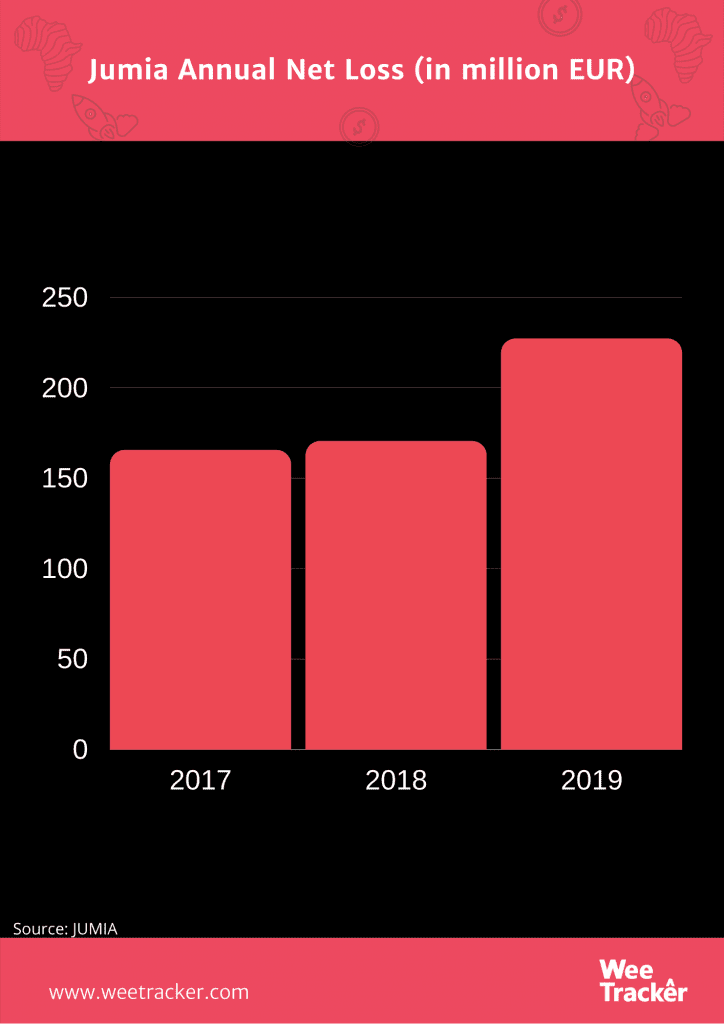

Jumia, for instance, which many consider the “Amazon of Africa,” has had a torrid time scaling e-commerce in Africa, such that, among its other well-documented problems, losses have piled up and the company has increasingly embraced other new verticals.

Although the concept of online shopping has picked up over the years with several e-commerce platforms getting in on the act across the continent, there is still a huge gap with respect to making e-commerce go mainstream in Africa.

Facebook’s fintech cum e-commerce play could potentially change the game when it takes root in Africa, and Jumia and others that have huffed and puffed so far should probably be worried.

The Facebook Inc. trifecta of apps is well-positioned to work perfectly with payments, bringing customers and merchants much closer to each other. It started with the unification of ad accounts where merchants needed an account at the Command Centre, Facebook, to run ads.

Then, it added the Facebook and Instagram Shop feature, plus the WhatsApp Business catalog feature. Now it looks like the perfect e-commerce setup, right within the apps billions of people already use. For many of these people, these apps make up the “internet”.

Payments was the missing link, but now it’s here too. Add it all up and it’s the merchant’s dream — the freedom to offer products/services on a WhatsApp Business account connected to the Facebook or Instagram account of the business.

Customers can connect from any of these platforms, discover products/services, and make payments without ever leaving the app. No barriers between customers and merchants.

This is something that some of the biggest e-commerce companies in Africa have failed to offer, instead they adopt a heavy-handed, centralised e-commerce model that makes the process cumbersome for both merchants and buyers.

Typically, when an order is placed, Jumia Market, for example, requires merchants to check email, log into the website, print 7 pages of delivery documents, take the product to Jumia (not the client), and wait for Jumia to deliver it to the client.

The entire process can sometimes take 3-5 days, assuming the email didn’t end up in the spam folder. This is partly why customer orders take so much time to deliver sometimes. In the end, merchants typically receive their payment after 2-4 weeks.

When Facebook’s e-commerce game really kicks off in these parts, it might upend the entire industry for the very fact that it would be a lot less unwieldy and more distributed.

By design, it would eliminate the barriers between customers and merchants and facilitate payments inside the same apps that have become part of daily life.

Featured Image Courtesy: ghnewsnow.com