Another Nigerian eCommerce Firm Is Eyeing Int’l IPO, But Not Just One

The JUMIA story has to be the best-known African eCommerce narrative. The billion-dollar company’s identity was questioned, it struggled with staying afloat and finally broke even in terms of its unicorn status, offering quite an interesting saga in the African tech ecosystem. Now, Konga.

Konga may be the next e-tailer to walk a similar path. Also based in Nigeria, the online retailer has made public its intentions to list its shares on global stock markets. The catch is to raise just about enough money to champion its African expansion that will land the company a multibillion-dollar status.

Konga mulls going public on the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE), bourses from which the company has already received enquiries for the process. It is somewhat unclear whether the firm will list on both exchanges and when the initial public offering(s) are going to happen.

Also important to mention is that the Nigerian Stock Exchange (NSE) is not left out of the mix. The West African country represents Konga’s largest market, from where it intends to take the technology business to other parts of the continent.

In 2019, word got out that Konga was laying the groundwork to IPO on the NYSE by 2020, a listing which at the time was purported to give the company a valuation of USD 3.5 Bn.

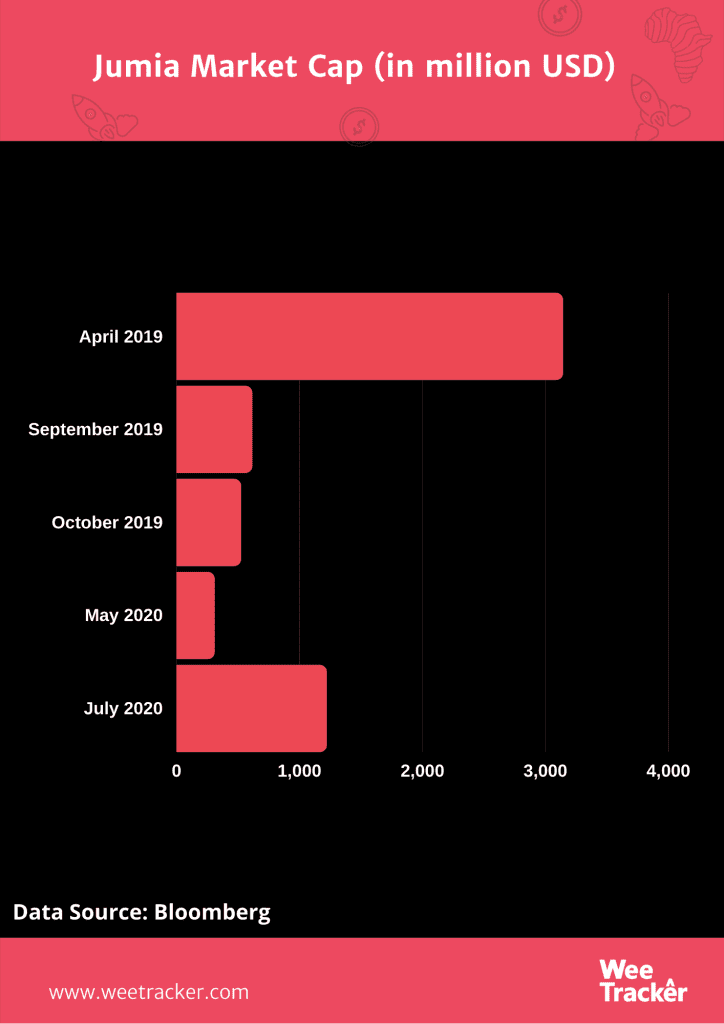

It was in early 2019 that JUMIA, one of Rocket Internet’s former tech offsprings, IPO’d on the New York Stock Exchange. A little while after the listing provided the company with USD 196 Mn, things appeared to start going south. From being called a fraud to suffering from losses, the eCommerce giant’s once-was glory went into the rough.

Nevertheless, a recent turnaround on the stock markets has seen JUMIA reclaim the unicorn status, spurring series of conversations that African eCommerce is not a dead end after all. To support claims, some of Nigeria’s biggest companies, especially fintechs, are branching into eCommerce.

On its part, Konga has invested more than USD 120 Mn since its Nigerian acquisition by Zinox 2 years ago. Per its claim, it cut its monthly losses from NGN 400 Mn to NGN 100 Mn within the same timeframe. To achieve this, the business relied on new systems and refined operation structures.

Listing on more than one stock exchange is nothing new for African firms. Take MTN into consideration, whose shares are being traded on about 3 different African bourses. But listing on foreign stock markets have been a rollercoaster ride for Africa-focused firms, and there is an abundance of vivid case studies.

‘‘We partner to create a trusted and sustainable digitally-driven ecosystem and working hard to scale this to about 250,000 before the end of 2020. We see ourselves as more than just an e-commerce company. Konga is a technology company and as a technology company, we are positioned to leverage that status in deploying new solutions and innovations,” said Nnamdi Ekeh, Konga’s co-Chief Executive Officer

Well, Nigerian eCommerce, as well as Africa’s at large, is no cakewalk. Companies operating in the space have struggled to make profits, the online retail sector has a high barrier to entry, and the cost of sales can be overbearing. All of these are in cahoots to make the profitability of eCommerce in the region Herculean.

But even in a tough environment, Konga is not keen on raising funds from investors, unlike JUMIA. This August, the firm revealed that it turned down a USD 300 Mn investment offer from a consortium of global investors. One one part, is says it current investors have assured the company of sufficient capital to best the worst of the next 5 years.

Apparently, profitability is the priority. As such, it would be interesting to see how Konga fares in a world perhaps more complex than that of JUMIA.

Featured Image: Quartz Africa