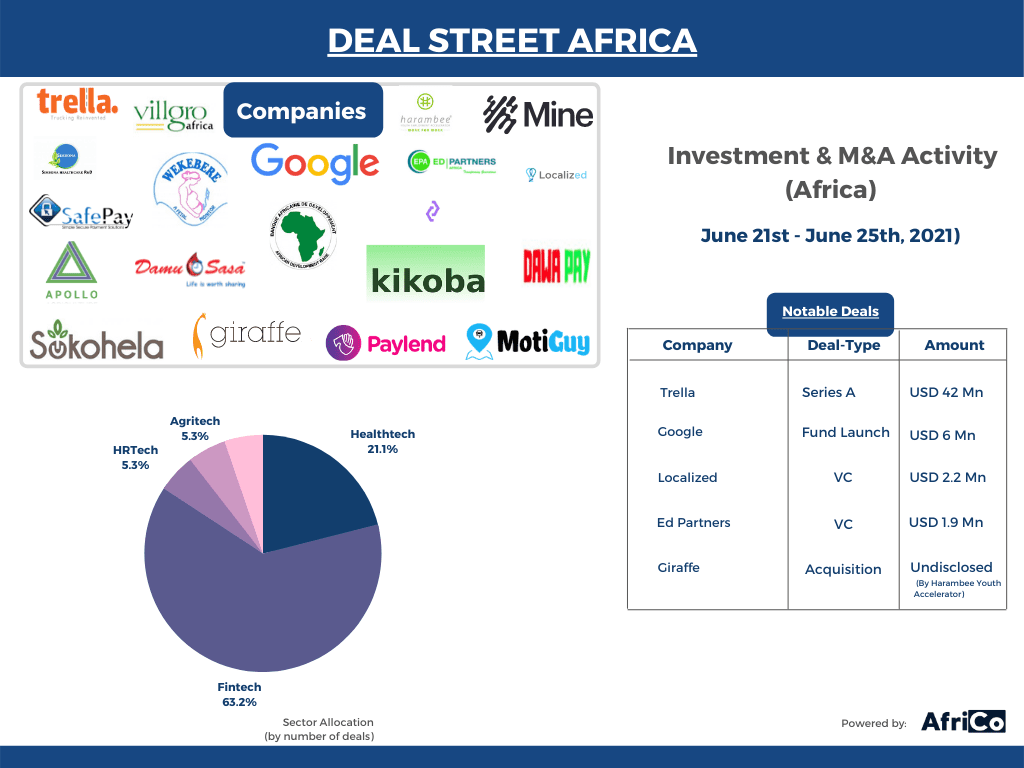

Deal-Street Africa [June 21-25]: Google Launches USD 3 Mn Black Founders Fund For Africa

![Deal-Street Africa [June 21-25]: Google Launches USD 3 Mn Black Founders Fund For Africa](https://weetracker.com/wp-content/uploads/2021/06/April-19th-23rd.png)

Localized Raises USD 2.2 Mn Seed Funding To Scale Operations

Localized, a platform that connects job seekers in the Middle East and North Africa (MENA) region with local and international career opportunities and resources, raised USD 2.2 Mn in a seed round led by Trend Forward Capital, One Planet VC, Mexican angel investors, Next Wave Impact, Bisk Ventures, Joshua Mailman, US News Digital Ventures, and Esther Dyson. The round, which was completed in April 2021, brings the company’s total funding to USD 3.6 Mn.

Kenya’s Apollo Agriculture Secures USD 1 Mn Debt Funding

Apollo Agriculture, a Kenyan agri-tech firm that combines machine learning and automated operations technology to help small-scale farmers access the tools they need to maximize their profitability, received a USD 1 Mn loan from the Agri-Business Capital Fund (ABC Fund). The startup plans to use the funds to expand its service to additional smallholder farmers who cannot obtain microfinance or commercial bank credit.

Egyptian Startup Trella Closes USD 42 Mn Funding Round For Expansion

Trella, a Cairo-based digital trucking marketplace, raised USD 42 Mn in Series A funding, with USD 30 Mn in equity and USD 12 Mn in lending facilities, to support considerable expansion in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP). The equity element was led by Maersk Growth – the corporate venture arm of global multinational A.P. Moller – Maersk – and Raed Ventures, a Saudi Arabian venture capital firm. Other participating investors include Algebra Ventures, Vision Ventures, Next Billion Ventures, Venture Souq, Foundation Ventures, and Flexport. The debt facilities are being provided by Lendable – the next-generation lending and other local financial institutions.

Twelve Startups Selected For Startup Réseau’s East Africa Fintech Bootcamp

Startup Réseau, an India-based accelerator, selected 12 startups for its first East African thematic startup boot camp, focusing on fintech and providing access to technology loans and other sorts of support. All participating startups get USD 150 K worth of technology credits and support from partners. Kenya has five, including MotiGuy, an insurtech platform, SokoHela, a provider of MSME digital tools, PayLend, a credit management service, SafePay, and Chumz, a savings channel. Micro-credit platform Yassako, digital asset exchange gateway CoinPesa, and group contribution mobile app Mine App are Uganda’s three representatives. Tanzania has two, Dundiza, a wealth management platform, and Kikoba, a savings app. Zambian blockchain-powered SME and unbanked financial services platform Krypia and Rwandan micro-lending, payments, and money management platform Pay24 complete the list.

Kenya’s Ed Partners Africa Raises USD 1.9 Mn Funding

Ed Partners Africa, a financing company for affordable private schools, has raised KSH 205 million (USD 1.9 Mn) to extend its footprint and provide loans to the underserved affordable private school sector. The funds were raised from Acumen, I&P, and Zephyr with participation from existing investors.

Google Launches USD 6 Mn Funding Program To Support African Startups

Google unveiled three new programs totaling USD 6 Mn that would support women, young entrepreneurs, and innovators in at least 13 African countries. In the first program, Google will give the Tony Elumelu Foundation USD 3 Mn to help women-owned start-ups on the continent scale up their ideas. In addition, Google has launched the Black Founders Fund for Africa (BFF Africa), a USD 3 Mn fund that will assist 50 promising start-ups in Kenya, Botswana, Cameroon, Côte d’Ivoire, Ghana, Ethiopia, Nigeria, Rwanda, Senegal, South Africa, Tanzania, Uganda, and Zimbabwe. In its third project, Google for Start-ups Accelerator Africa class 6, the tech giant has invited applications for a three-month online program that will begin in June 2021 and include virtual training boot camps, mentorship, and Google product support.

South African Startup Giraffe Acquired By Harambee Youth Employment Accelerator

Giraffe, a South African mobile employment platform, was acquired by the Harambee Youth Employment Accelerator. As a result, the startup’s present network of job seekers and employers will be asked to join the SA Youth Initiative. The Harambee Youth Employment Accelerator aims to scale up youth employment efforts in South Africa and enable job seekers and employers to engage and interact in a low-cost, self-service manner.

AfDB & Italian Technical Cooperation Fund Extend 1.8 Mn Grant To Boost Agriculture In Mozambique

The African Development Bank (AfDB) provided a EUR 990,000 (USD 1.18 Mn) grant to help smaller agro-processing firms in Mozambique enhance output and quality control, thanks to funding from the Italian Technical Cooperation Fund. The project will help businesses better access national and regional markets and take advantage of the African Continental Free Trade Area opportunities. The Confederation of Business Associations of Mozambique is the implementing agency.

Villgro Africa Provides USD 170 K Funding To Four Healthtechs Startups

Villgro Africa, an impact investor incubating and supporting early-stage social entrepreneurs in Africa, issued USD 170 K in funding to four health-related startups. The India-based early-stage business incubator and impact investor offers mentoring, funding, and access to networks to startups. Two of the funded startups are Kenyan, DawaPay, and Damu-Sasa. They both received USD 50 K in support. DawaPay is the only one of the four companies to get capital in exchange for an equity stake; the others are all grants. Ethiopian startup Simbona also received a USD 50 K grant, while Villgro has allocated USD 20 K to Ugandan company Wekebere.