The Victor & Victim As Mobile Wallets & Cards Fight For Africa’s Payments Future

The rise of mobile wallets

The mobile phone is easily the most convenient and most available communication tool. However, over the course of the last decade, the mobile phone has become more.

First, it went beyond its initial purpose as a tool for communication and became a multidimensional portal for information and convenience. And then it became a gaming device, a camera, and a wallet.

While the metamorphosis of the mobile phone has been nothing short of awe-inspiring across the board, it is the advent of the mobile wallet that has transformed financial services and changed the rules of the game within the sector.

Previously, access to financial services compulsorily entailed having a bank account and probably being the holder of a debit or credit card. But as of today, people are plugged into the financial system just by having a mobile phone with a functional SIM connection. Phones have become digital wallets.

Africa is the global capital for mobile wallets

In mobile wallets, people are provided with a means to transfer funds, pay for utilities, shop online, and access a host of other financial products on the go. Mobile wallets also leverage a widespread network of agents which are like “mini-banks” for cash handling.

The mobile wallet revolution is changing the way people deal with money, and Africa — the birthplace of this revolution — is the quintessential case in point.

The proliferation of mobile/digital wallets has been rapid in Africa. Thanks to the growing penetration of mobile devices on the continent, mobile wallets have expanded at such a pace that it has outstripped cards in terms of digital payments.

And there are quite a number of stakeholders and enthusiasts who already believe wallets, not cards, are the future of payments in these parts, and even beyond.

“Payments have traditionally gone through banks, the outdated SWIFT system, and payment networks like Visa and Mastercard. The problem with that system is that it is designed to pay way too many people,” said Stone Atwine, CEO of Ugandan digital payment startup, Eversend.

“It is therefore terribly expensive for the consumer and merchants that end up paying these fees. This system persists because it is deeply ingrained especially in Western countries. Card payments are deeply ingrained in the payments DNA of western countries especially the US. But in Africa, we are building from scratch, and cards will never make a serious dent,” he added.

Just how big is Africa on mobile wallets?

Twelve years ago, the concept of mobile wallets took root in Kenya, birthed by Safaricom, which is now the country’s biggest telco.

Through the now widely-popular M-Pesa service, Kenya revolutionized the world of digital payments and financial services, changing the country’s (and eventually the continent’s) view of how money can be managed. Thanks to M-Pesa, financial inclusion in Kenya is 82.9 percent; the highest in Africa.

Since the Kenyan boom, mobile wallets — both digital mobile wallets and telco-led mobile money wallets — have gone on to become a hit on the continent.

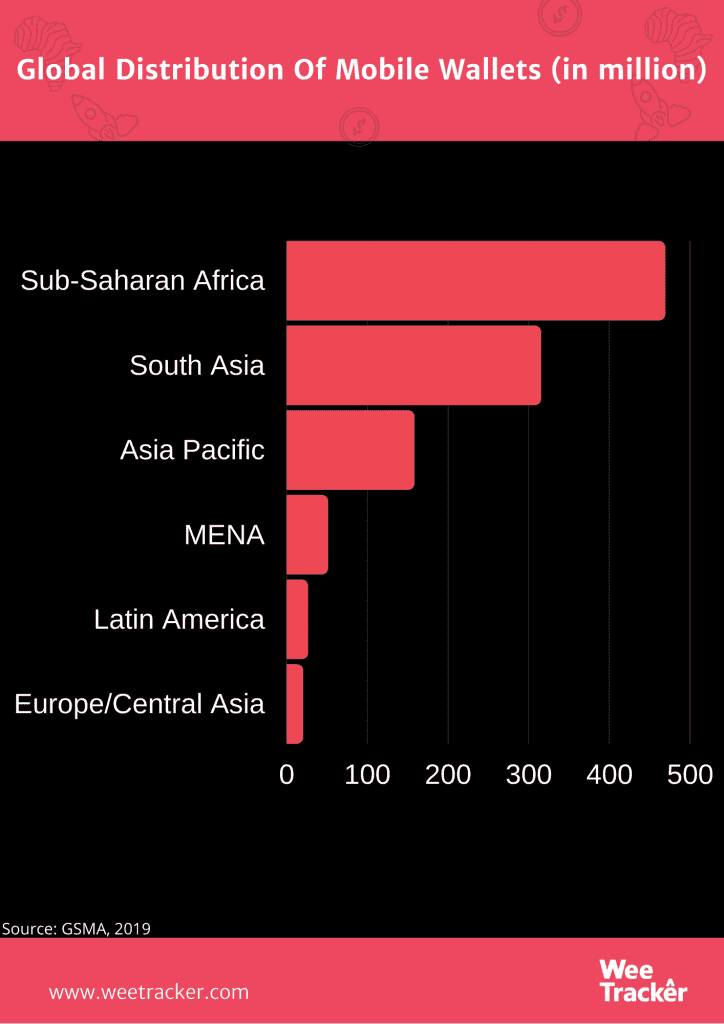

With 469 million registered mobile money accounts, Sub-Saharan Africa accounts for nearly half of the 1.04 billion mobile money accounts registered globally, per GSMA’s State of the Industry Report on Mobile Money 2019.

That is to say, the larger part of the African continent accounts for approximately 45.1 percent of all mobile money accounts in operation throughout the world.

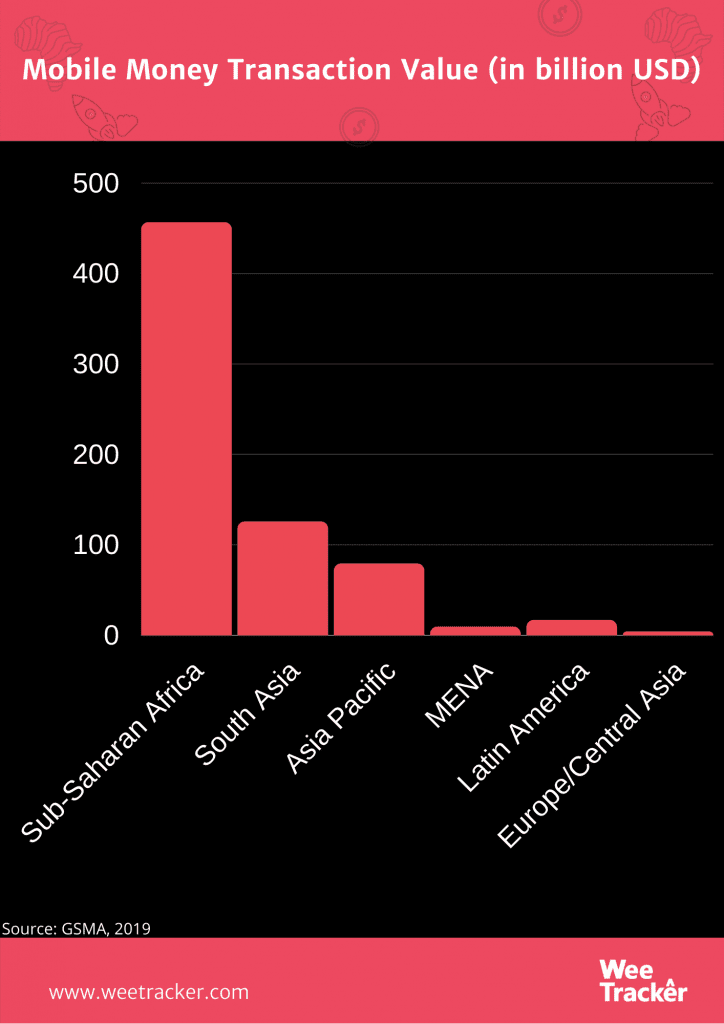

Sub-Saharan Africa also trumps all other global regions studied by the GSMA on all fronts with 181 million active mobile money accounts and a total of 23.8 billion transactions valued at USD 456.3 Bn in 2019.

The value of transactions has grown over 890 percent since 2011 and shows no signs of slowing down. Plus there’s still a lot of room for growth as the battle to capture the remaining 57 percent of adults in Africa who still aren’t included in the formal financial system rages on.

There are several mobile money operators and wallets in Africa. Startups like OPay, Paga, ChipperCash, Eversend, Wallets Africa, and a boatload of others have built a business around the service.

Telcos like MTN, Safaricom, Airtel, and several others are also in on it. Although Safaricom’s M-Pesa is the most-widely cited, MTN Group’s mobile money service has the widest coverage in Africa.

What’s behind the uptake?

According to the World Bank, over 66 percent of adults in Sub-Saharan Africa do not have a traditional bank account.

The impact and role of mobile money in bridging this gap continues to grow as more governments ease the stiff regulation against mobile money operators and payment gateway providers that have set out to provide financial services to this unbanked population.

Furthermore, by the end of 2018, there were 456 million unique mobile subscribers in Sub-Saharan Africa, representing a penetration rate of 44 percent. According to GSMA’s 2019 report, the region will have 600 million subscribers by 2025, representing around half the population.

A combination of factors, including the need for greater financial inclusion, growth in mobile phone penetration, as well as convenience and transparency, is spurring the proliferation of mobile wallets in Africa — overshadowing card usage and penetration.

Africa and cards

Reliable and up-to-date data on debit/card penetration in Africa is hard to come by. Some sources have hit that credit card penetration, specifically, is somewhere around 10 percent. Others claim the EMV (Europay, MasterCard, and Visa) penetration rate in Africa is upwards of 77 percent and rising.

However, a recent study claims that 32 percent of African banks agree that debit cards are the payment product most in demand by consumers, followed by credit cards (23 percent) and prepaid cards (11 percent).

The study, titled “2020 Digital Payments in Africa survey,” was put together by OpenWay and Ovum, and it claims that 163 respondents were surveyed across seven markets (Ethiopia, Ghana, Kenya, Nigeria, Rwanda, South Africa, and Tanzania).

According to another report which studied credit card usage in Africa, it was stated that credit card penetration remains extremely low across most of the continent with the one exception being South Africa, where there were 31 credit cards per 100 adults in 2015.

In Nigeria, Africa’s largest economy, there are fewer 2 two million credit cards in circulation, although growth in card numbers has averaged over 30 percent per annum since 2009.

Egypt and Angola have penetration levels of five and four percent respectively while, in all the other markets considered in the study, penetration is one percent or lower.

In addition, the report claims there were an estimated 17 million cards in issue at the end of 2015, up from ten million in 2009.

But will wallets replace cards totally?

Atwine of Eversend believes the card payment system that is popular the world over is inherently flawed and fundamentally rigged against the end-user. Thus, he said wallets will take over.

He tethers his argument to not only the ubiquity and accessibility of mobile devices, but also the fact that there are so many “middlemen” between the cardholder, the issuing bank, and the merchant who all have to be paid in the process of completing a simple transaction.

“When you use your card to pay at a restaurant, there’s a chain of connections happening in the background that adds about 3-4% to your dinner and lines the pockets of multiple corporations,” he said.

“Wallets do not have to pay multiple banks, payment networks (Mastercard/VISA), or even payments processors. Even if banks are too slow to allow direct debits from their user’s accounts, wallets are already storing value and I believe this is the way of payments in Africa in the long term,” he emphasized.

However, Akeem Lawal, Divisional Chief Executive Officer for Transaction Processing and Enablement at Interswitch (the Nigerian fintech unicorn that claims to have 30 million of its Verve cards issued by 40 banks across Africa in circulation), told WeeTracker that wallets and cards can thrive and there’s merit in paying attention to both.

“Our view is that digital wallets and cards need not be divergent from one another; in fact, we see them as complementary. Indeed, many wallet issuers are offering companion cards to their customers so that wallet holders can have access to payment card infrastructure. That’s one of the ways cards and wallets are converging to give better value to consumers,” he said.

“The benefits of using an e-Wallet include greater transaction success, faster payments, and the ability to comprehensively manage one’s expenses. Interswitch offers consumers a digital wallet service, via our Verve eCash solution.”

Lawal added, “The continued opportunity lies in the transition from cash to cashless payments, which of course includes physical cards and other payment types such as mobile money, online transactions, and digital wallets.

He also maintained that the physical card market has continued to grow significantly. “We are still seeing high levels of uptake for both our Verve Classic and Verve Global offerings.”

Featured Image Courtesy: Mastercard