From Woolworths To Shoprite – The Fall And Fall Of SA Retail Chains In Nigeria

By now, it’s hardly news that Africa’s largest supermarket chain, Shoprite Holdings Ltd., is quitting the Nigerian market where it has 25 stores and has operated for 15 years.

In its just-released “Operational and Voluntary Trading Update (for the 52 weeks ended 28 June 2020), the South African grocer revealed that the Board had sanctioned the disposal of Retail Supermarkets Nigeria Ltd; a subsidiary of Shoprite International Limited.

It is understood that Shoprite is severing ties with Nigeria due to protracted poor performance, caused by declining sales amid soaring business costs.

While that is largely the case in most of its African markets besides South Africa, Shoprite’s decision to exit the Nigerian market is the latest addition to a growing list of South African retail businesses that have had to cut ties with Africa’s most populous country — after running into a reality that is nothing like the attractive visage that lured them in.

According to the Nigerian Investment Promotion Commission (NIPC), wholesale and retail sales (trade) is the second-largest sectoral contributor to Nigeria’s GDP.

“Trade accounted for 16.4 percent of Nigeria’s GDP in 2018 with estimated market size of USD 109 Bn,” the Commission claims.

“The informal market is the primary outlet for most products and is geared towards the lower-income segment of the population.

“Formal retail, an emerging sub-sector in Nigeria, accounts for roughly 5 percent of the entire market. Nigeria ranks as the eighth most attractive investment market for retailers in Sub-Saharan Africa and twenty-seventh globally, largely based on its volume of consumers and its growing middle class,” reads a statement from the NIPC.

That’s the kind of data multinational retail chains have in mind when they launch in Nigeria and, over the years, South African brands have been doing the most on that front. But as most of them eventually found out, doing business in Nigeria is quite the struggle.

A tale of woe for SA retailers in Nigeria

After Nigeria lifted an eight-year ban on the import of garments in 2011, the door was open for South African brands like Mr. Price, Pep, Truworths, Woolworths, and Foschini to enter the market.

And they did. The South African clothing retailer, Woolworths, which has been operating for decades – since 1931 in fact – and has operations in various African countries and elsewhere, launched in Nigeria in 2011. However, Woolworths had to close shop in Nigeria barely two years in.

The reason? The then-Chief Executive, Ian Moir, expressed disappointment that the Woolworths clothing and general merchandise business in Nigeria had not been successful, despite several attempts to improve performance.

The closure was put down to the notion that “high rental costs, duties, and complex supply chain processes, made trading in Nigeria highly challenging.”

Interestingly, even after closing its three stores in Nigeria, Woolworths stated that “the remaining 59 stores in 11 African countries will continue operating normally.”

While this is not exactly an indictment of the Nigerian business environment, it is hardly a ringing endorsement. And the events that would occur in the following years align with the latter.

In 2016, another South African retailer, Truworths, was forced to pack and leave. According to Africa News, the listed clothing company closed its two remaining stores in Nigeria citing stringent import regulations and rising costs in Africa’s biggest economy.

According to the CEO, Michael Mark, the clothing company struggled to get stock into Nigeria and cash out of the country.

“The regulations were making it extraordinarily difficult to get stock into the stores, we can’t get money out, so there was no point any longer,” said Michael Mark, the CEO.

Consequently, Truworths was unable to fill its shelves, struggled to pay rent, and faced great difficulty in accessing foreign exchange which had dried up due to the oil price slump at the time.

Quite recently, it was the turn of Mr. Price, one of South Africa’s biggest retailers. The company walked away from the so-called economic powerhouse of Africa in June 2020, citing weak economic growth, volatility, and inflation as major reasons for the exit.

Mr. Price’s CEO, Mark Blair, regarding the Nigerian exit said: “Quite frankly I’m not prepared to invest any further whether it’s an investment in time or in money into a country that is volatile as it is. In the early days, we were making money but now we just came up against too many roadblocks, whether it’s getting the money out, etc”.

Now Shoprite is going down the same path having struggled to transform its efforts in Nigeria into meaningful endeavour.

Reading the handwriting on the wall

Generally, South African retailers seem to now be reading the handwriting on the wall by giving up the lustre of multi-country presence to focus on their only really performing market, South Africa.

Last November, Shoprite had stated that it was reviewing its supermarket operations outside South Africa and would consider exiting certain countries if that would help stem a worrying decline. And true to that, it has since closed two of its three stores in Kenya where formal retail is facing a torrid time.

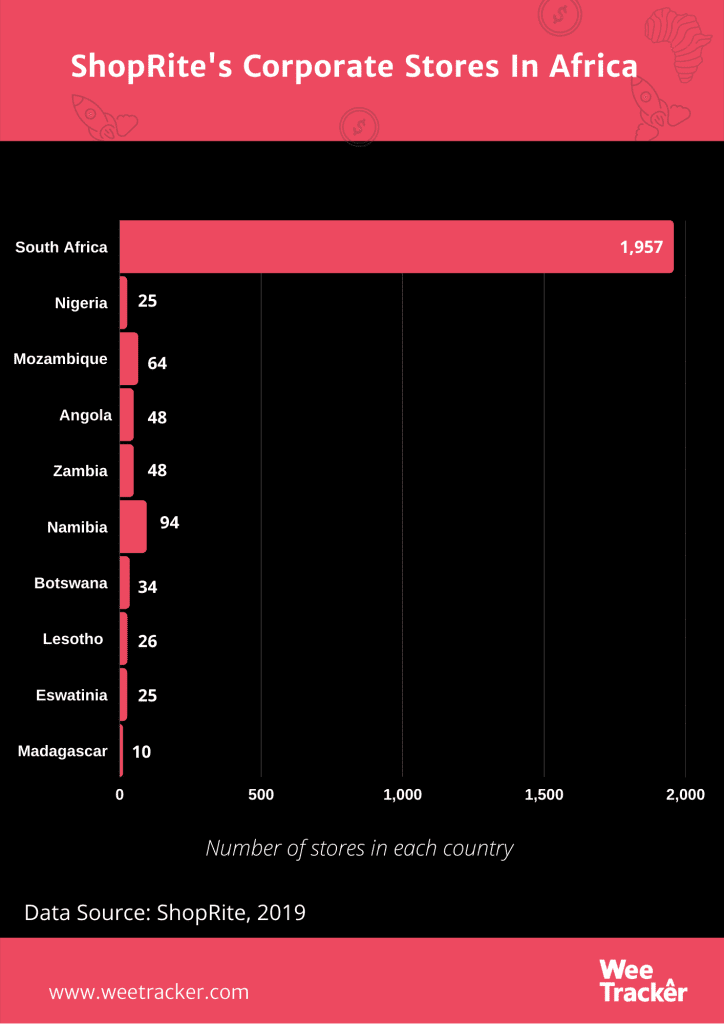

Although Shoprite has 2319 corporate and 275 franchise outlets in 17 countries across Africa, its South African business by itself accounts for up to 80 percent of its profits. More so, in Shoprite’s latest update, its international supermarkets contributed only 11.6 percent to group sales, while the South African division accounted for 78 percent of overall sales.

Further, while international supermarkets experienced a 1.4 percent decline in sales from 2018, Shoprite’s operations in South Africa saw a rise of 8.7 percent. Also, sales in its core South African business increased by 9.4 percent in the last 3 months of the fiscal year through June.

Evidently, Shoprite is better off intensifying its efforts in South Africa where it is gaining market share and earning the overwhelming majority of its revenue rather than hamstringing itself by exploring markets that flatter to deceive at best.

Similarly, the case of Mr. Price was such that 92.5 percent of its sales in the year to March 2020 came from South Africa. Nigeria contributed 4 percent of the group’s sales outside of South Africa and those sales shrank 26.6 percent in the past year. Thus, there was little merit in keeping the lights on in Nigeria, hence, the decision to pull the plug.

Bad market or bad method?

The big debate over the major factors forcing South African retailers out of Nigeria seems like a never-ending one. On one hand, there’s talk of the tough and challenging market and on the other, there are claims that some of those businesses could have done some things better.

For less popular outlets like Woolworths, Truworths, and Mr. Price, a case could be made that those brands didn’t adopt proper marketing strategies and theirs was a futile attempt at selling pricey products to a small and mostly unstable middle-class segment that would rather “overspend” on more recognized foreign brands.

In addition, those brands have often cited the fact that their stock in trade, clothing, is subject to excessive duties, as one of the major issues. There are also problems that come with delayed goods at the ports, local currency devaluation, and foreign exchange roadblocks which have all made carrying on in Nigeria untenable.

On its part, Shoprite has been in Nigeria for far longer than any of the other South African retailers and it is known to be very popular — up to the point of being some kind of synonym for major malls in Nigeria. Shoprite, which has up to 25 stores in Nigeria, undoubtedly has more reach than any other retail chain in the country, including Dutch-owned, SPAR.

So, what’s pushing Shoprite out of Nigeria? The signal from people familiar with the matter is that Shoprite’s unquestionable popularity in Nigeria hasn’t produced the goods at the business end of things.

With staggering poverty levels and low disposable income — coupled with the fact that retail in Nigeria remains largely fragmented/informal and the addressable market is still very small relative to the population — Shoprite seems to be incurring expense that is many times more than the sales it is making in the country, as margins continue to be eroded due to local currency woes.

Hence, the retailer is poised to cut its losses and walk instead of unavoidably sinking into a deeper hole.

Featured Image Courtesy: NigerianFacts