Mobile Money Has Become Very Popular In Africa – But It Is Failing As A Savings Tool

Access to formal financial services has been a challenge to low income earners in the East African region. Mobile money, a recent innovation in some parts of the developing world continues to prove its potential as alternative in providing financial inclusion to both the banked and unbanked populace.

For instance Kenya’s mobile money platform M-Pesa, introduced in 2007, has been by far the most successful experience among Sub-Saharan economies adopting this innovation. The platform is mostly known and used for sending and receiving money.

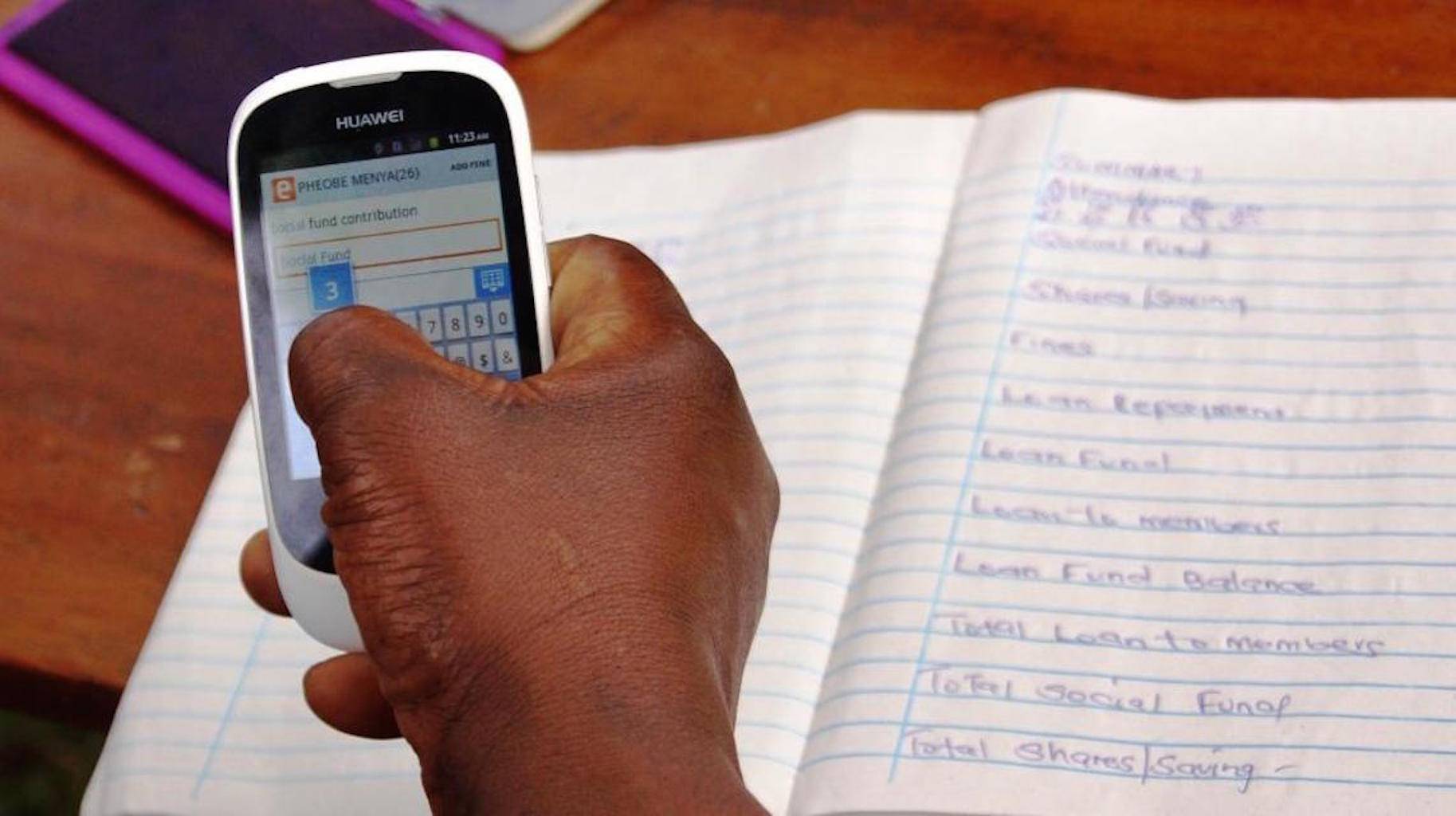

M-Pesa just like other mobile wallets offers a secure place to save as money is stored virtually. And both the mobile money facility and the mobile phone can be password-protected. Despite the security and comfort of mobile money services, some people, mostly in developing countries still opt for informal saving mechanisms such as or jewels, Saccos and saving “under a mattress”.

The World Bank Group recently carried out a study on the impact of making mobile money available to mostly subsistence farmers in a remote region of northern Uganda.

The research focused on rural Northern Uganda, where penetration of mobile phones is much lower. An earlier survey, conducted in early 2018 showed only 27.6 percent of households own a mobile phone in the region. However, it was noted that people tend to share or use someone else’s phone since a higher proportion (39.9 percent) of households reported that they have access to a mobile phone.

Even after having access to mobile money, the report found out that two‐thirds of respondents who save, report keeping the money on their person or at home, which may be less safe compared to mobile money. “We do not find an effect of the agent roll out on savings.” a part of the report read.

“In the follow‐up survey, about 97 percent of mobile money users report that they use mobile money to receive or send money, followed by 41 percent who use it to buy airtime. Only 4 percent say they use mobile money in their business and 3 percent say they use it to pay bills.”

The availability of mobile money agents were however seen to boost the percentage of households using mobile money in areas further than 25.2km from a bank branch.

It was discovered also that agent roll out increased the probability of sending and receiving P2P transfers.

“We do not find an effect of the agent roll out on savings or agricultural outcomes. However, in areas far from a bank branch, the agent roll out statistically significantly increased the fraction of survey respondents who work in non‐farm self‐employment,” the report read.

Featured Image Courtesy: FSD Kenya