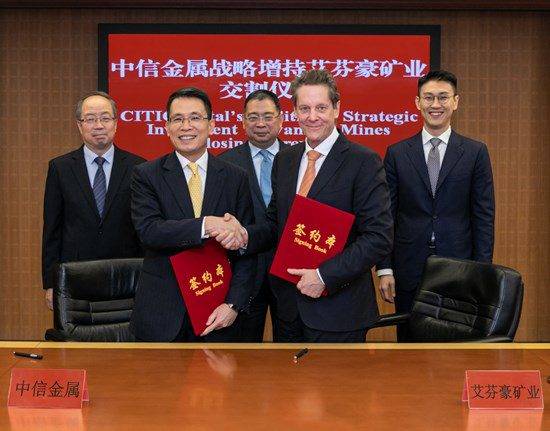

CITIC Metal Africa Closes USD 459 Mn Second Equity Investment In Canadian Mining Company Ivanhoe Mines

CITIC Metal Africa Investments Limited (CITIC Metal Africa), a direct subsidiary of CITIC Metal Co. Ltd – one of China’s leading international resource firms, has completed its second major strategic investment of USD 459 Mn in Canadian mining firm Ivanhoe Mines.

The funding comes in the trail of both companies’ long-term cooperation, bringing the South Africa-based company’s investment in Ivanhoe to over USD 1 Bn in less than 1 year.

Via a private placement at a price of USD 3 per share, the Toronto Stock Exchange-listed mining company issues 153,821,507 common shares to Metal Africa. Zijin Mining, a Chinese mining group, exercised its anti-dilution rights through a concurrent private placement of USD 3 per share. This resulted in Ivanhoe Mines issuing 16.754,296 common shares to the mining group, getting USD 50 Mn in proceeds.

CITIC Metal Africa, per the closing of the deal, now lays claim over an approximation of 29.4 percent of issued and outstanding common shares in Ivanhoe Mines. Zijin who has signed standstill agreements with Ivanhoe alongside CITIC Metal, now owns approximately 9.8 percent in the OTCQX-listed firm.

The entire shareholder base of Ivanhoe will benefit from the economic growth, and significant cash flows from the completion of three -in-the-pipeline mines – Kamoa-Kakula, Kipushi, and Platreef projects.

“The investments completed today comfortably provide Ivanhoe with the equity cushion required to rapidly advance Kamoa-Kakula’s 6 Mtpa Phase 1 mine to production,” said Mr. Friedland.

“CITIC and Zijin’s vote of confidence positions us to continue the rapid development of the Kipushi and Platreef projects. We also are aggressively exploring our 100%-owned Western Foreland licenses, with the confidence that our talented and dedicated geological scientists will make additional tier-one copper discoveries on our tenements in the DRC.”

Ivanhoe’s Co-Chairman Mr. Sun said: “Since the initial investment in Ivanhoe Mines made by CITIC Metal last year, we have been delighted to witness the profound progress being made at Ivanhoe’s three world-class projects. All of us are excited by the rapid development at the Kamoa-Kakula copper mine as it moves toward its targeted commercial production date of 2021.

The exploration breakthroughs such as the Kamoa North Bonanza Discovery and the Kamoa Far North Discovery are nothing short of spectacular. Today’s landmark and second strategic investment by CITIC Metal is not only an investment in Ivanhoe Mines and its people but also an investment in the people of Democratic Republic of Congo and South Africa.

We have been encouraged by the social and political stability that has followed the peaceful elections in the DRC late last year/early this year with the election of President Félix Tshisekedi. CITIC Metal and Ivanhoe Mines will support a prosperous investment environment with the full strength of our combined groups.”

Pursuant to the terms of the private-placement agreement with CITIC Metal Africa, Ivanhoe Mines has accepted CITIC Metal’s nomination of Manfu Ma, Vice President of CITIC Metal Group Limited, CITIC Metal’s parent company, to the Ivanhoe Mines Board of Directors. The new appointment expands the Board to 11 members.

While Ivanhoe Mines has three principal projects in South Africa, it is developing new mines at the Kamoa-Kakula copper discovery and upgrading of the historic Kipushi zinc-copper-germanium-lead mine both in the DRC.

CITIC Metal specializes in the importation and distribution of copper, zinc, platinum-group metals, niobium products, iron ore, coal and non-ferrous metals; trading of steel products; and investments in metals and mining projects.