Africa’s Largest Bank Is Buying Back Its Own Shares In Angola

Over a decade ago when Standard Bank first opened halls in Angola, the government was not yet keen on giving non-native business too much breathing space. That was in 2009 when the country still kept foreign companies from having full ownership over their Angola-based operations.

Now, however, the country—which lies on the western edge of Southern Africa—is starting to warm up to some changes. One of its continent’s top five economies, Angola is in the middle of liberalization that will attract investments and give its private sector some shock therapy.

With this opportunity en route, Africa’s largest bank is buying back the shares of its own company in the country. Before now, Carlos Sao Vicente, a partner of the bank, had a 49 percent stake in the business. But upon being probed for fraud and detained by the authorities, the investor’s shares in Standard Bank were sequestrated.

That means, almost half the shares of Standard Bank’s Luanda-based unit needs to be retrieved. Thanks in part to President Joao Lourenco’s efforts to bring the graft perpetrators affiliated with the former presidency into the light and take the necessary measures to maintain the law-order balance.

Reportedly, Vincente’s role as director of the board of the bank’s Angolan arm has been discontinued—seemingly temporarily—until further decisions are made on the case. His assets with the bank were confiscated by IGAPE, the body tasked with state asset management in the country.

The changes to Angola’s business landscape are noticeable. In wee February (2021), the government sold a telecoms license to welcome the country’s fourth mobile network provider, Africell. State-owned Angola Telecoms and two other local players are longstanding carriers, some of which enjoy duopolies in certain segments of the market.

Nevertheless, to show just how much Lourenco wants to pilot Angola’s economic reforms the right way, in April 2019, he annulled the winning tender for the country’s was-supposed-to-be fourth telco’s license.

On the president’s orders, the process was rerun to ensure it’s “clean and transparent”. As it seems, the government isn’t new to radicality as it looks turbocharge its low-income economy.

Standard Bank is based out in Johannesburg, South Africa, but has operations in 20 Sub-Saharan African countries. The business has faced some major hurdles in its home market, but having fairly performing units in about 36 percent of the nations in the region has helped it make up for the financial troubles experienced in its main base.

Speaking of South Africa—especially as regards how the market has affected the bank—the country is in the middle of an economic recession, one which it officially entered before the breakout of the coronavirus pandemic.

With restrictions, spiking Covid-19 cases, a new variant of the virus on lose and many turmoiled sectors trying to survive, it’s obvious Covid-19 could further deepen the already bothersome recession.

Angola is one of Standard Bank’s top 6 markets. contributing immensely to the group’s non-South African operations. Though the country is yet one of Africa’s last closed economies for the most part, it is also the second-largest oil producer in the continent.

As the dome over the nation’s business tarmac gradually gives way to welcome competition and investment landings, there are even more opportunities for the bank in the market.

According to a 2019 research, Angola’s banking market grew so much in the past 17 years that it dwarfed that of every other Sub-Saharan African country besides Nigeria and South Africa. More so, the count commercial banks with an operating license increased from 9 in 2003 to 26 in July 2019.

Angola’s banking turf is majorly occupied by six major players, but Standard Bank isn’t one of them. Nevertheless, only 5 of the said 26 financial institutions—Banco Angolano de Investimentos (BAI), Banco Economico, Banco de Fomento Angola (BFA), Banco BIC Angola (BIC), and Banco de Poupança e Crédito S.A.R.L. (BPC)—sit on over 80 percent of the nation’s entire banking assets, deposits, and loans.

The commercial banks present in the Southern African nation are predominantly Angolan and Portuguese, showing more trust in local businesses while still having enough room in the market for its colonists (Portugal) to compete.

The IMF forecasts that Sub-Saharan Africa’s economy will grow by 3.4 percent this year—a fair enough rejuvenation judging from the perturbing metrics showered on the zone’s small to mid-sized economies due of the effects of the novel coronavirus. Standard Bank is on the lookout for more avenues to replicate its efforts in other countries of the region.

Like Angola, Ethiopia is also making moves to open up some of its sectors for private investors to participate. Though the main focus is on the East African country’s telecoms market for now, Standard Bank is as well looking to push even bigger to take advantage of the ongoing general Ethiopian economic reform.

However, for oil-dependent Angola, the push appears to be an effort to diversify its economy. Its national development initiative includes building on the resilience of its financial sector, recapitalising the weak banks, and making some administrative changes in the largest state-owned bank.

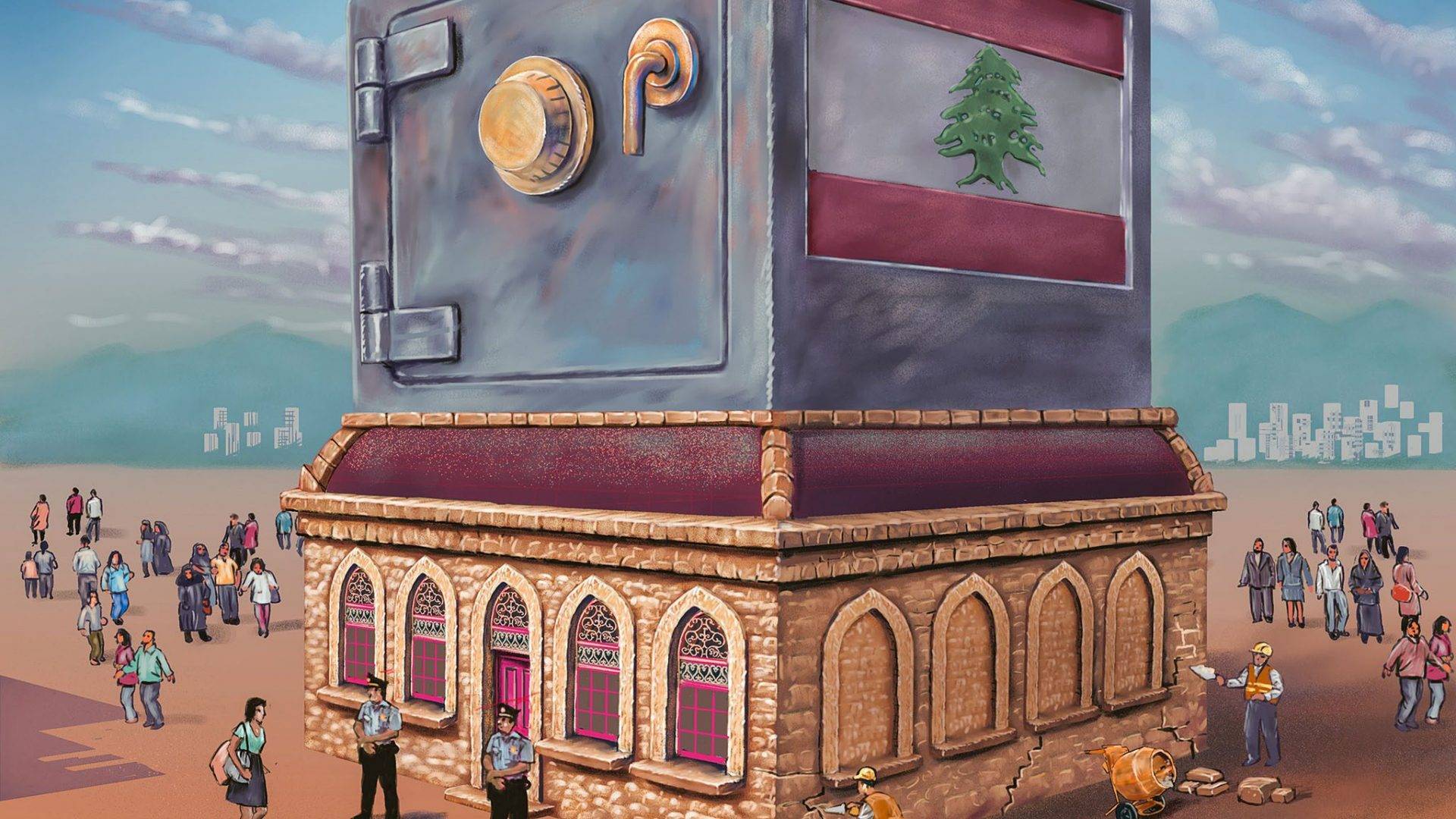

Featured Image: Financial Times