The Fate Of Uber Cash In Africa As e-Hailing Giant Dumps Fintech Dream

By now, it’s no longer news that global ride-hailing giant, Uber Technologies Inc, has abandoned or, at least, suspended the original plan that would have seen it become a fintech player, in addition to e-hailing.

Uber’s decision to ice its fintech plans was reported only five days ago, barely three weeks after the company launched its Uber Cash digital wallet feature in Sub-Saharan Africa through a partnership with Nigerian fintech startup, Flutterwave.

But Uber now appears to be walking back its fintech plans and there are concerns over what becomes of the newly-launched Uber Cash which is supposed to be Uber’s very own digital wallet, enabling riders to top-up at their convenience and pay for trips on Uber and even food on Uber Eats with less friction.

Before now, Uber Cash was one of the financial products deployed and managed by Uber through an in-house financial services arm known as Uber Money, which is understood to have been disbanded recently as Uber Money head, Peter Hazlehurst, has stepped down.

Last Thursday, Chief Executive Officer, Dara Khosrowshahi, reportedly said in an email cited by Bloomberg News that Uber will “deprioritize” several of its finance-related projects, which included credit cards, a digital wallet and instant payments for drivers.

What does this mean for Uber Cash which was only just rolled out in Sub-Saharan Africa?

An official close to the company told WeeTracker that Uber Cash can be expected to progress smoothly as the financial product is largely unaffected by the internal shakeup due to the partnerships that birthed the product.

“Uber is no longer focusing on internalising financial services and will continue with options such as Uber Cash as their partnerships facilitate these services, such as Flutterwave for Uber Cash in SSA,” the official said.

Uber has been operating in Africa since 2015 and it boasts up to 36,000 active drivers in a number of countries including South Africa, Kenya, Nigeria, Uganda and Ghana, Ivory Coast, and Tanzania.

Uber seems to be in a never-ending tussle with Estonian-founded Bolt (formerly Taxify) for the lion’s share of the local market, but Africa’s mobility sector is becoming a hotbed for local players too as homegrown startups and local/international venture capitalists (VCs) get in on the act.

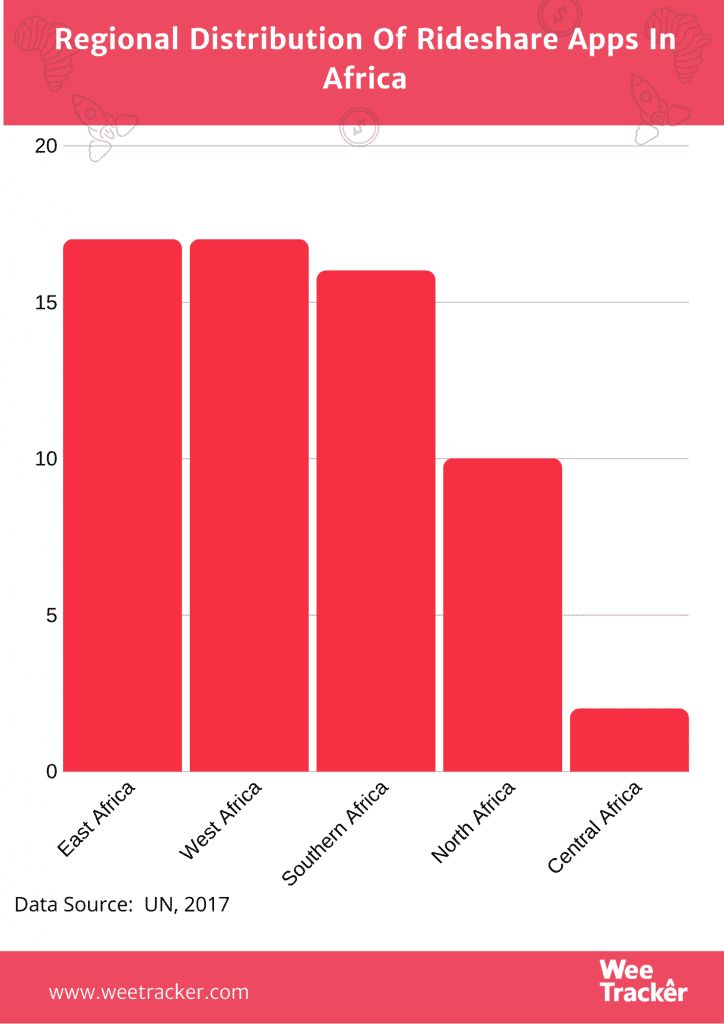

A United Nations (UN) estimate from 2017 suggests that, in total, Africa hosts nearly 60 ride-sharing services across 21 countries.

Payments have historically been a tricky spot for Uber on the African continent which has one of the world’s largest unbanked populations, though giant strides have been made on financial inclusion through mobile money.

In Africa, Uber has continued to expand its services and operate in ways that it is not known to consider in many major markets. One case in point is Uber first allowing cash payments on the continent in 2016 — something Uber hopes the introduction of Uber Cash will help reduce. Another is Uber dabbling into bike-hailing, tricycle-hailing, and boat-hailing.

Currently, Uber still accepts cash payments in Africa, which may be somewhat convenient for both riders and drivers but inherently problematic for the company’s revenue collection efforts.

The newly-launched Uber Cash digital wallet feature is touted as a gamechanger as it could fix the challenges associated with making cashless payments and collecting funds, though it might be a nightmare for drivers on the platform.

Last month, Uber cut 23 percent of its workforce and said it will focus on its core businesses and planned to reduce investment in several “non-core projects” to weather the impact of the pandemic on its business. Earlier, the company’s CEO revealed there had been a 70 percent drop in global ride volume.

Lockdowns and curfews in key African markets like South Africa, Kenya, and Nigeria also forced the e-hailing company to completely halt operations in those countries in the months of March and April, further shrinking revenue.

Feature Image Courtesy: Uber