Nigerian Startups Secure The Maximum Number of Deals in Africa – WeeTracker VC Report 2018

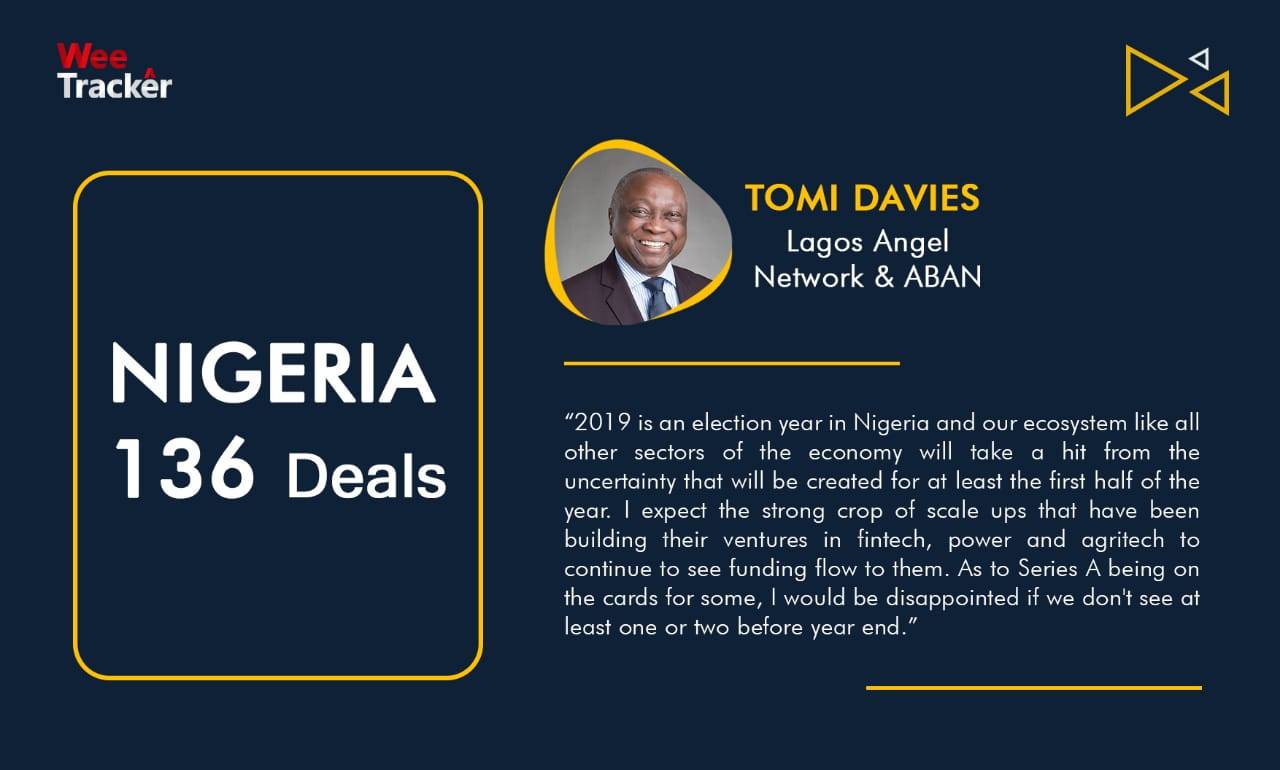

The results are out and this year NIGERIA led the way with the maximum number of deals. As per WeeTracker’s 2018 Annual Report on Venture Investments in Africa, this West African country stood first with 136 deals out of the 458 closed across.

This year, African growth companies overall raised USD 725.6 Mn with Fintech sector witnessing the maximum number of deals.

![]()

Some of the biggest Series A deals were closed this year with the top deal being USD 40 Mn. The expectations with Nigeria will remain high in 2019 in spite of being the election year. Out of our list of FOCUS 30, Nigeria holds a fair share.

“2019 is an election year in Nigeria and our ecosystem like all other sectors of the economy will take a hit from the uncertainty that will be created for at least the first half of the year. I expect the strong crop of scale-ups that have been building their ventures in fintech, power and agritech to continue to see funding flow to them. As to Series A being on the cards for some, I would be disappointed if we don’t see at least one or two before year-end, ” added Tomi Davies of Lagos Angel Network & ABAN.

It appears that the country is producing the maximum choice for investors to put in cash when it comes to technology companies creating innovative and viable products. Like the general trend in Africa, Nigeria too had maximum deals in Fintech amounting to 50 percent of the overall deals in the sector.

Note: This article is part of WeeTracker’s Annual Venture Investments Report 2018 – Africa. Please download the complete report for in-depth analysis of this year’s performance.