Ride-Hailing Pricing War: Inside The Dilemma Faced By Drivers In The Lucrative Business

Taxi-hailing apps in Kenya have been engaging in a pricing war for a long time; this has been manifested through various strikes which almost goes unnoticed since the cab drivers eventually return to work with the hope that new policies will be implemented effectively.

The pricing issue remains unresolved within the digital taxi sector. Many of the Uber drivers are faulting their dominant app companies for setting very low prices for their clients (riders) at the expense of the driver.

Fierce Competition: Market Share For Drivers Remain Competitive

The digital taxi business has become attractive and thus saturated with very many players, the market share for the driver remains very competitive.

Each digital taxi wants to entice its drivers with fair rates, but is it enough for these drivers?

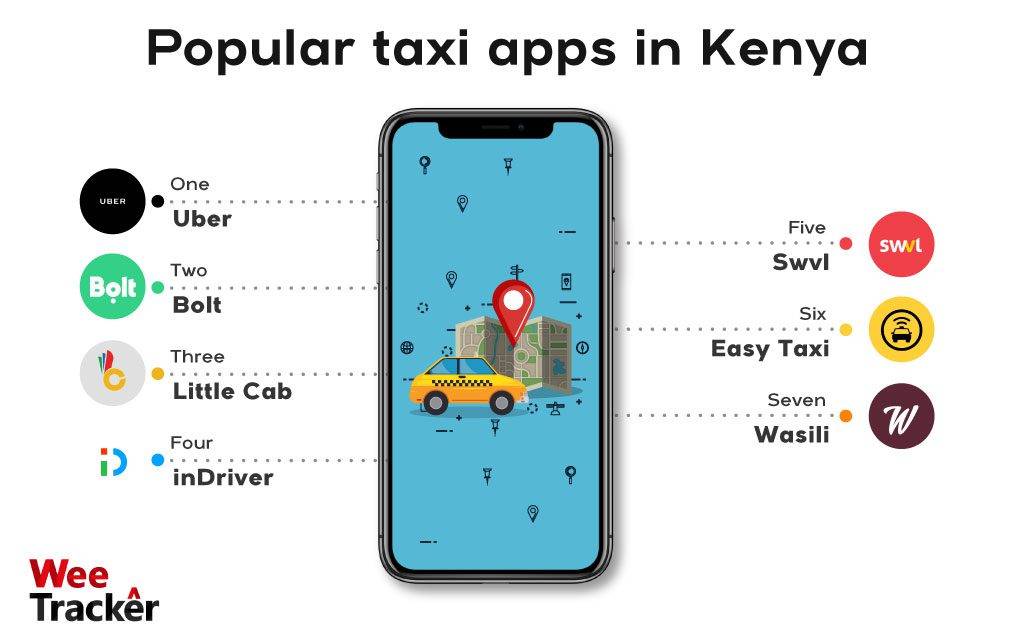

In Kenya, for instance, there are dozens of players including, Uber, Little Cab, Taxify, Mondo Ride, InDriver, Wasili Cab, and the latest entrant Swvl, which is slowly capturing a larger market of commuting passengers.

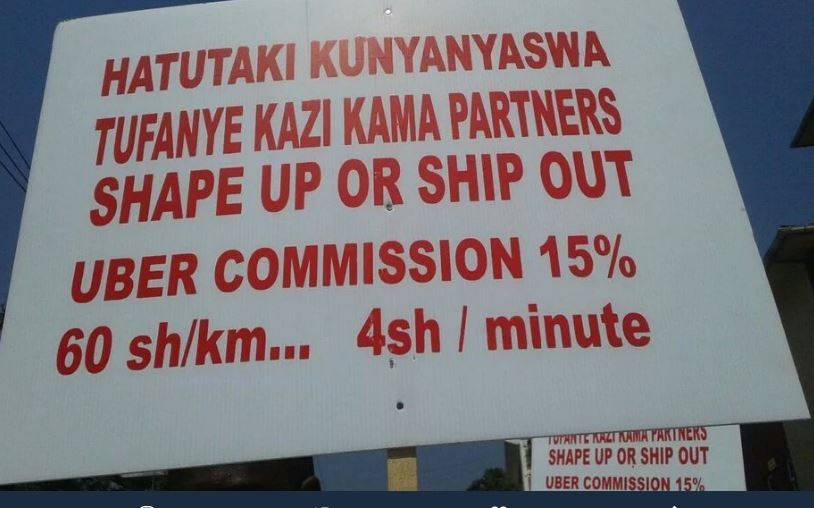

Uber offers a commission of 25%, Bolt (formerly Taxify) and Little has a lesser rate of 15% while InDriver, the latest entrant has a 10% commission rate.

The varying options put the driver on the edge while deciding which app to use as it struggles to maximize profit from the business.

The constant challenge facing these riders is their employer; the drivers are bearing the brunt of the price cut.

Poor Working Conditions & Terms Of Service By Digital App Taxi Firms

Two months ago, Kenyan taxi drivers took to the streets to demand among other things, the standardization of commission at 10 percent in order to cushion them from parent firms who take up to 15 percent of total earnings.

This formed part of the concerns raised by the drivers who were fronting for the implementation of the terms of the deal agreed in July 2018.

The MoU entered between the Ministry of Transport, the Digital Taxi App companies (Uber, Bolt, Little Cab, and others) and the Digital Taxi Forum, sought to create and establish a workable solution to end the conflict.

So far, nothing substantial has come out of the MOU.

Poor working conditions and terms of service by digital app taxi firms have also been faulted by the drivers who spend the majority of their time responding to customers hailing requests.

However, in response to the huge concerns about the state of drivers, Uber told WeeTracker that the San Francisco-based firm is focused on the drivers saying, “Uber has a flexible earning opportunity, Uber wouldn’t be what it is without drivers—they are at the heart of the Uber experience.”

“There is a wide range of drivers who use the Uber app and therefore it would be difficult for any group to holistically represent every driver on the app.

“Over the past four years, we have made a number of changes to offer a better experience with more support and more protection, including through advanced safety features and access to business rewards that help drivers reduce costs and keep more of their earnings,” the firm noted.

Saturated Market With New Entrants

Just like many other services, there have been entrants who want to have a slice of the lucrative business. As of now, there are many Uber-lookalikes around the world and across the continent.

With the main agenda being profit-making, parent firms may be forced to lower prices to increase market share. This creates a problem for the riders, whose agenda is to maximize profit from the venture.

The squeezed space is stifled even further by the competition from ‘bodaboda’; a highly preferred option for most people, and it takes a larger market share. Owing to the fast life in Nairobi, the boda is gaining more traction as it offers cheaper rates besides being efficient and fast enough to beat the city traffic.

Cash Distress/Low Income

Another dilemma faced by the drivers is the demand to make good enough profits and pay up loans, In April, Stanbic Bank announced plans to auction cars belonging to Uber taxi operators who had defaulted on their loans.

While launching Uber Chap Chap, the American firm granted its qualifying drivers with loans up to 1 million to purchase 800cc Suzuki Alto whose resell value is very low and has received a myriad of critics.

However, this has turned a problem for the drivers, as most of them struggle with the lower rates, the drivers have to toe the line between repaying car loans versus making a profit to sustain a living.

A research done by Research firm Viffa Consult found that half of the drivers of taxi-hailing vehicles earn below minimum wage.

The report noted that 66 percent of the taxi drivers receive a gross income of over KES 20 K a week but eventually settled with 30 percent in net income as the rest was channeled to fuel, car-washing and other incidental expenses.

This remains clear in most strikes as drivers usually opt to resume working in a bid to maximize profits.

“Even if we boycott work for a week, it will still come back to haunt us, we have bills, car loans, and the business to sustain, so sometimes, this strike comes at a huge loss for us as the drivers,” one Uber driver told WeeTracker.

In response to this, Uber also divulged that “they [Uber] regularly conduct in-depth earnings review to ensure that the Uber app continues to be a reliable economic opportunity for drivers, as well as an affordable option for riders.”

Need For Effective Government Economic Policies

Standardizing fares across all cab companies operating in a given area has been fronted by many players as the best remedy.

Kenya could take the example of developed countries like the United States of America (USA’s) New York which has set the fare at a base rate of USD 3 at the beginning of the ride and USD 0.50 for every one-fifth of a mile or every minute the cab is sitting in traffic.

The digital taxi market remains a lucrative business for many firms, highly beneficial for the clients but everyone seems to forget the driver who is decrying abandonment and lesser recognition by parent firms.

Drivers matter too. They shouldn’t have to shut up and drive, especially as they put so much work in.

Featured Image Courtesy: The Fiscal Times