A Look At Fintech Funding In Africa From 2018 – 2021

Fintech is a startup buzzword used to refer to financial technology companies. These use technology to improve and automate the delivery and use of financial services. Fintechs can be subdivided into payments, credit startups, digital banks and investment startups. Some fintechs provide more than one service.

According to the World Bank, 66 percent of the adult population in Africa is unbanked. Fintechs have stepped in to fill the role that the physical banks failed to do. The increasing mobile and internet adoption rates across the continent make fintechs the perfect solution to financial inclusion in Africa.

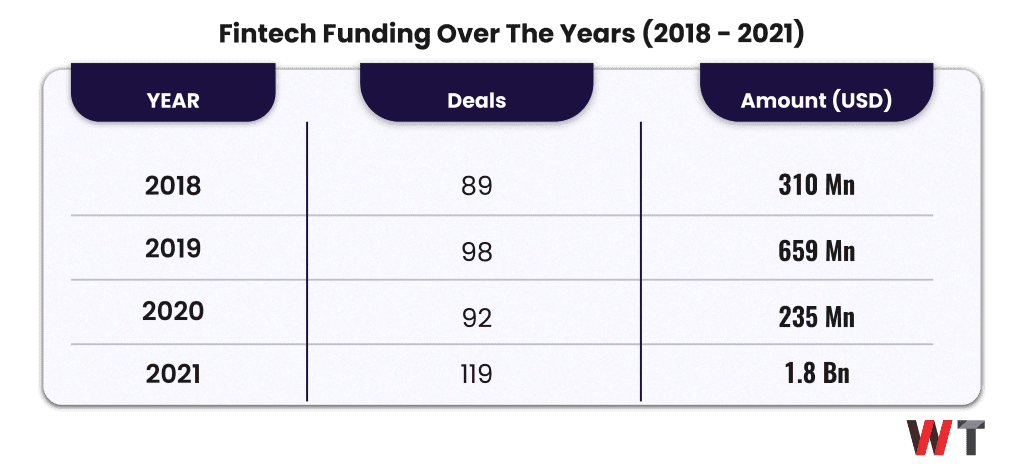

Investors have recognized this opportunity and poured money into African fintechs. From 2018-2021 so far, fintechs have raised USD 3 Bn across 398 deals which accounts for 43 percent of all startup funding during that time.

In 2018, fintechs raised USD 310.9 Mn across 89 deals which accounted for 39 percent of all funding that year. This share jumped to 42 percent in 2019 when fintechs raised USD 658.8 Mn from 98 deals. 2019 was the first year African startups raised more than USD 1 Bn.

African startup funding contracted by 54 percent in 2020 due to the pandemic, so it was no surprise that fintechs could only bring in USD 235 Mn from 92 deals which was just 28 percent of the funding that year.

2021 has overtaken 2019 as the most funded year in African startup history with USD 3.8 Bn raised already from 454 deals. Fintechs, alone have raised USD 1.83 Bn across 119 deals which is more than the total funding all startups raised in any other year, even battering the record USD 1.56 Bn raised in 2019.

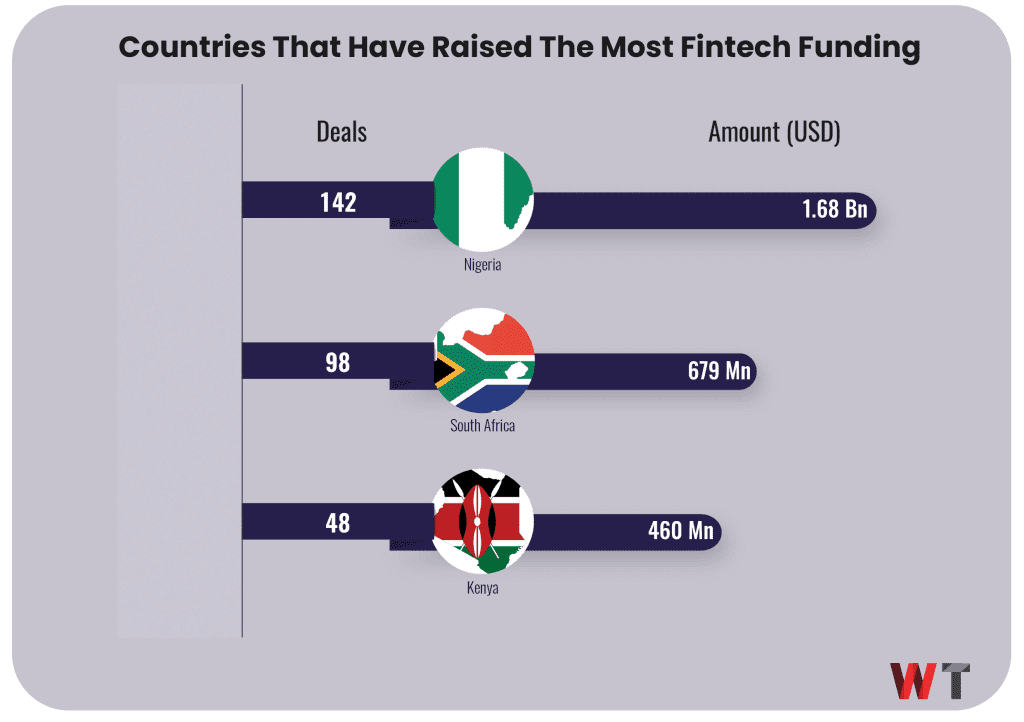

Fintechs in Nigeria alone has raised USD 1.68 Bn from 2018-2021 followed by South Africa with USD 679 Mn and Kenya with USD 460 Mn. These three countries accounted for 94 percent of all fintech funding. Ghana (USD 54.94 Mn) and Egypt (USD 37 Mn) were the best of the rest.

Nigeria was still the leader in terms of deals with 142 deals, way ahead of South Africa (98) and Kenya (48). Egypt was a distant fourth with 25 deals.

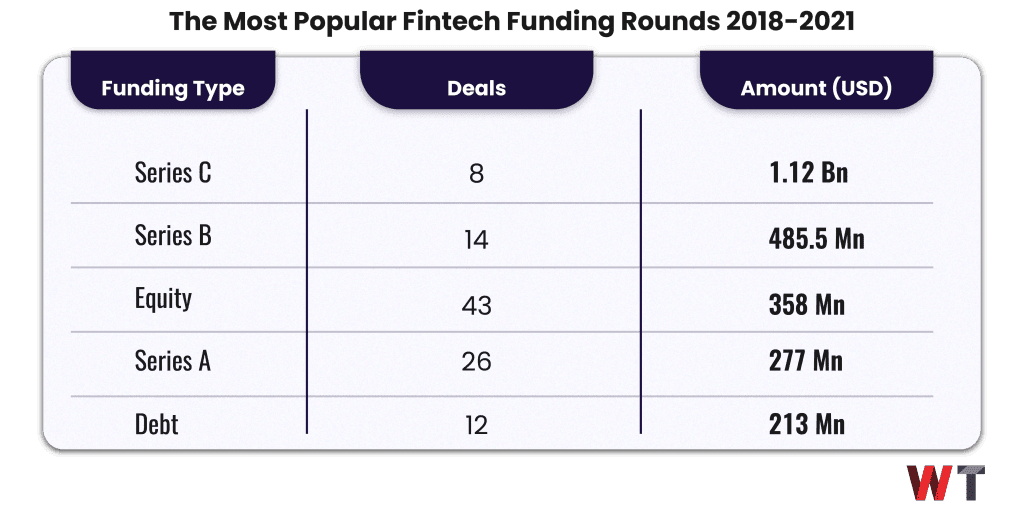

As expected, seed deals (115) were the most popular followed by grants (56) and equity deals (43). Accelerators were also represented with 40 deals. There were just 8 Series C, but they raised USD 1.12 Bn (37 percent).

The 14 Series B raised USD 485.5 Mn while equity deals were USD 357.9 Mn. Debt deals (USD 213.46Mn), Series A ( USD 277.4 Mn) and Series E ( USD 145 Mn) were the only other funding rounds to cross the USD 100 Mn mark.

The Most Funded Fintechs in Africa

The 10 most funded fintechs in Africa have raised USD 2.12 Bn, which is 71 percent of funding raised by fintechs. 4 of the startups (Opay, Chipper Cash, Flutterwave and Interswitch) are headquartered in Nigeria. South Africa also has 4 startups (Jumo, TymeBank, MFS Africa and Yoco) in the top 10. Kenya rounds up the top 10 with Branch International and Tala.

1. Opay (USD 570 Mn)

The Chinese backed, but Africa-focused fintech is Africa’s most funded after it raised a monster USD 400 Mn Series C in August that valued the startup at USD 2 Bn. This investment saw Masayoshi Son’s Softbank Vision Fund 2 make its first African investment. Opay had earlier raised USD 50 Mn and USD 120 Mn in 2019.

2. Chipper Cash (USD 298 Mn)

The cross-border and remittances app catapulted into second place on the back of closing its USD 250 Mn Series C, first raising USD 100 Mn in March and a further USD 150 Mn in November.

3. Branch International (USD 245 Mn)

Branch International is a fintech that offers financial services in emerging markets through instant loans with no documentation. Branch has raised equity financing (USD 155 Mn), debt financing ( USD 20 Mn) and a Series C (USD 70 Mn).

4. Flutterwave ( USD 215 Mn)

Flutterwave is a payments company that makes it possible for Africans to receive money from any part of the world. Founded in 2016, it raised USD 10 Mn in two Series A in 2017 and 2018 before following this with a USD 35 Mn Series B in 2020 and a USD 170 Mn Series C earlier this year.

5. Interswitch ( USD 200 Mn)

Interswitch is one of Africa’s oldest startups, having been founded in 2002. It has raised funding only once, an equity deal in which VISA paid USD 200Mn for a 20 percent stake.

6. Jumo (USD 187.5 Mn)

JUMO, based in South Africa, partners with banks and other financial players to provide loans to customers in Africa and Asia. Jumo’s last funding round was USD 120 Mn from Fidelity Investments, VISA and Kingsway Capital in November. This came at a USD 400 Mn valuation.

7. Tala ( USD 145 Mn)

Tala’s mission is to provide digital financial services for the next billion through making credit simple. Users apply for loans in minutes. In October 2021, the startup raised USD 145 Mn for its Series E in a funding round led by Upstart at a valuation north of USD 800 Mn.

8. MFS Africa ( USD 118.5 Mn)

MFS Africa is a Pan-African digital payments startup with operations in almost 25 countries. It raised USD 100 Mn in November in its Series C with USD 70 Mn Equity and USD 30 Mn Debt. The funding round was led by AfricInvest FIVE with Goodwell Investments and LUN Partners Group.

9.TymeBank (USD 110 Mn)

TymeBank is a South African fully digital bank that is owned by the African Rainbow Capital, an investment firm founded by the billionaire Patrice Motsepe. It secured a USD 110 Mn investment from new investors in the UK and Philippines in February this year.

10. Yoco ( USD 99 Mn)

Yoco has raised USD 99 Mn across 4 funding rounds, with the first being a USD 1.7 Mn seed round in 2014 from CRE Ventures. Its last funding round was a USD 83 Mn Series C in July 2021 led by Dragoneer Investment Group.

*The data used in this article for 2021 was from 1st January up to 30th November.