As Telkom Joins The Fray, SA Cements Its Position As Africa’s 5G Capital

Currently, South Africa is home to four mobile operators that have launched 5G networks, effectively placing the country ahead of its peers in Africa when it comes to the deployment of ultra-fast internet connectivity.

Telecommunications group Telkom, which is the third-largest telecoms operator in the market, has just launched a commercial fifth-generation network in partnership with China’s Huawei.

The company has been quietly testing and laying the foundation for the project in the past months, taking advantage of the market’s most pervasive fiber to deliver faster internet speeds.

The network was, to the surprise of the general public, unveiled at the DP World Wanderers Stadium in Johannesburg, making the facility the first 5G-enable stadium in South Africa. The service, however, will be available where the operator’s customers require it.

“The COVID pandemic has driven significant lifestyle changes for South Africans, due to work from home or school from home, online shopping, and an ‘always on’ kind of culture,” said Fortune Wang, Carrier Business Director for Huawei South Africa.

With this rollout, Telkom has become the fourth telecommunications provider to walk the country’s 5G path. The movement started with Rain, a data-only platform that launched 5G back in 2018.

In June 2020, MTN, the second-largest player in the market, in partnership with Ericsson, followed suit with a launch across 100 network towers in Cape Town, Joburg, and Port Elizabeth Bloemfontein among other smaller towns.

Around the same time, Vodacom, the biggest carrier, partnered with Nokia to install 5G stations in similar locations.

Last March, the Independent Communications Authority of South Africa (ICASA), which serves as the watchdog for the country’s telecoms industry, completed a rather delayed 5G auction.

During the exercise, ICASA sold spectrum across 700 MHz, 800 MHz, 2.6 GHz, and 3.5 GHz bands. While Rain and Vodacom acquired new low-band frequency assets in the 700 MHz band, Telkom and MTN bought theirs in the 800 MHz threshold.

Though the spectrum auction was recently completed, Vodacom and MTN had the opportunity to launch 5G services beforehand, using emergency/temporary allocations provided by the regulator in response to high data demand during the peak of the coronavirus pandemic.

The days are still early for 5G use in Africa, but South Africa is already taking the driver’s seat; Telkom joining the bandwagon effectively cements the country’s lead in this regard.

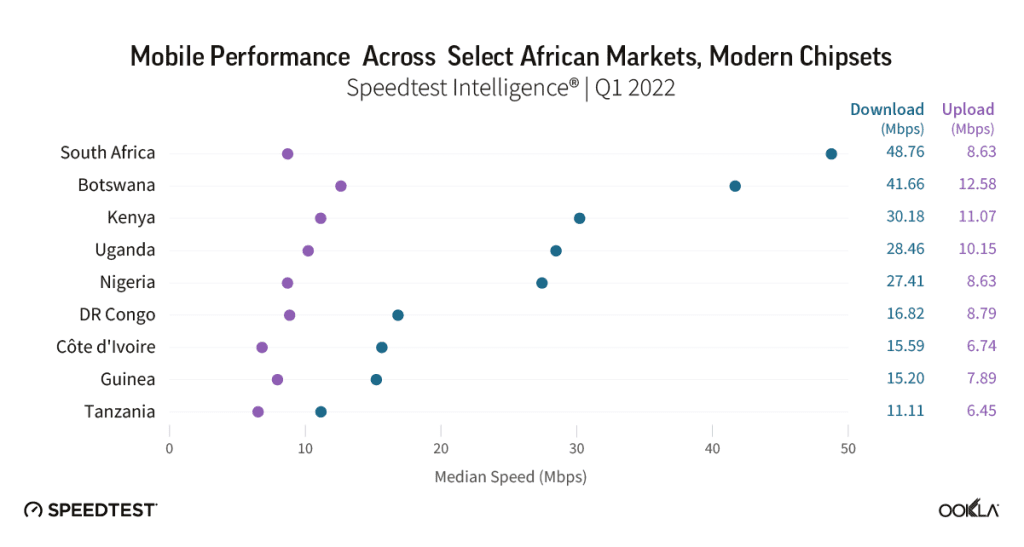

Moreover, per speed tests carried out by Ookla, Southern Africa ranked higher than other subregions with a median download speed of 37.89 MB/s. Northern Africa’s speed is 25.63 MB/s, Central Africa’s is 18.73 MB/s, Eastern Africa’s is 18.31 MB/s, and Western Africa averages 17 MB/s.

Since it has the most industrialized economy in the region, it makes sense that 5G is spreading faster in SA than anywhere else. Johannesburg, the nation’s economic hub, is the city with the fastest median download speed in Africa.

More importantly, Telkom’s 5G launch comes at an interesting time. Last week, MTN announced that it is walking away from talks to acquire the company; it was looking to acquire Telkom in order to overtake Vodacom as the biggest telco.

MTN threw in the towel on the basis of a lack of deal exclusivity. Rain also indicated an interest in tying up with Telkom and argued that its offer made more business sense. From the looks of it, Rain might very well win the Telkom takeover spat and use the medium to accelerate its 5G efforts in the market.

Well, South Africa was the first country to launch 5G in Africa. And, while other countries are increasingly taking steps to replicate, the continent generally faces hurdles when it comes to modernizing mobile networks.

The cost of base stations, technology backhaul, energy supply, and device affordability continues to hamper adoption.

According to a recent report by Africa Analysis, 5G subscribers in South Africa are projected to reach at least 11 million come 2025, with an expected population coverage of 43 percent; the country has 60 million people.

Elsewhere, Safaricom has finally commercialized 5G services in Kenya, while Airtel, which is still heavily vested in 4G, looks to emerge victorious in Nigeria’s second spectrum auction.