Why The IFC Is Staking Big On Kenya’s Ailing Retail Sector

At a very telling time in the retail landscape in Kenya and East Africa, supermarket chain Naivas is teaming up with some high-profile investors to strengthen its top spot in a competitive market.

Judging by the kind of investors—French-owned fund manager Amethis, the International Finance Corporation (IFC), Mauritius Commercial Bank (MCB) Fund and Deutsche Investitions-und Entwicklungsgesellschaft (DEG), a German Development Finance Institution—Naivas is cementing a place for itself in Kenya.

On its part, the IFC picked up a minority stake in the retail chain for USD 15 Mn. The deal, which first teased in December 2019, somewhat underlines the struggles of East African retailers. Making the time of the funding more interesting, Kenyan retail giant Nakumatt is close to finalizing its shutdown.

Financial Muscle

It is no news that retailers in Kenya and other East African countries are hassled by the lack of finance to take on international players. The much needed financial muscle is mostly the stuff of global retailers like Garden City, Village Stores, and Choppies.

Naivas is majorly owned by the Mukuha family, who hail from Naivasha in Nakuru County of Kenya. As part of the transaction, they will be disposing part of their shareholding to special purpose vehicle owned by the IFC and other co-investors. Nevertheless, the family will remain as the business’s main shareholders.

The late Naivas Chair, Simon Mukuha, held a 25 percent stake in the supermarket’s ownership. His brother, Kimani, owns a similar 25 percent while two of their sisters, Linet Wairimu and Grace Wambui, own 15 percent each. The remaining 20 percent is owned by the estate of Peter Kago, their late father.

According to IFC, its investment is expected to help Naivas optimize business operations and further strengthen its corporate governance structures.

From empty shelves to the closure of stores, there appears to be an unavoidable collapse of the once-were leaders of Kenyan retail. Their foreign competitors have had the needed cash to capitalize more and extend their share of the middle-income and high-end market.

Long-Term Investment

When it comes to long-term investments in developing and emerging economies, Deutsche Investitions-und Entwicklungsgesellschaft (DEG) is concerned, providing private-sector companies with capital in the form of loans or equity.

The KfW Group subsidiary which has been around since the 1960s has been active in Africa for many years, with a portfolio worth USD 2.2 Bn. It’s unclear how much Amethis invested, but a Reuters report from last year said they were acquiring a 30 percent stake in the retailer.

On its part, DEG told WeeTracker that it is investing up to USD 10 Mn into Naivas, along which line it aims to support the retailer’s further development.

“The new capital will enable Naivas to develop its store-based services further and to expand its online offering. Investment will also be made in supply chains and business organisation to further enhance the quality of service and products,” the funder said.

During the ongoing coronavirus pandemic Naivas is also planning to make use of the new “BSS –COVID Rapid Response” programme, designed by DEG as part of its Business Support Services (BSS), in order to further adapt business processes to the new situation.

Monika Beck, member of the Management Board of DEG, explained: “By investing in Naivas our intention is to support the further development of a company that is using innovation to drive progress in the Kenyan retail sector and feed many Kenyans, while at the same time setting a course for sustainable growth.”

Supporting The Climb

Most of the retail markets in Africa are not formalized. Apart from Kenya and South Africa, a huge chunk of the market remains informal. Chains such as that of Naivas are trying to capture Kenya’s middle-income shoppers. To support, the IFC, a sister organization to the World Bank, is stepping in.

Nevertheless, this is not the first time the corporation is investing in an African retail business. Goodlife Pharmacy was its first investment in Sub-Saharan Africa’s retail sector, in which it funded invested in 2015, in conjunction with a third-party equity investment.

The pharmacy has since grown from a small enterprise with four stores to become the region’s largest pharmaceutical retail chain.

IFC continues to look for opportunities to add value in the sector, through direct and indirect investments. Alongside that, IFC seeks to help its partners in capacity building through its advisory programs.

For example, it will provide a food safety advisory program that will ensure that Naivas complies with the Global Good Agriculture Practice (GGAP) that is more stringent than local standards.

Explaining to WeeTracker why it is funding a business in Kenya’s not-so-smooth retail landscape, an IFC spokesperson said: “Like most emerging markets, a number of sectors are still underdeveloped and largely fragmented. Our role as a development institution is to not only attract private capital into this sector but also help in the consolidation and development process”.

Naivas

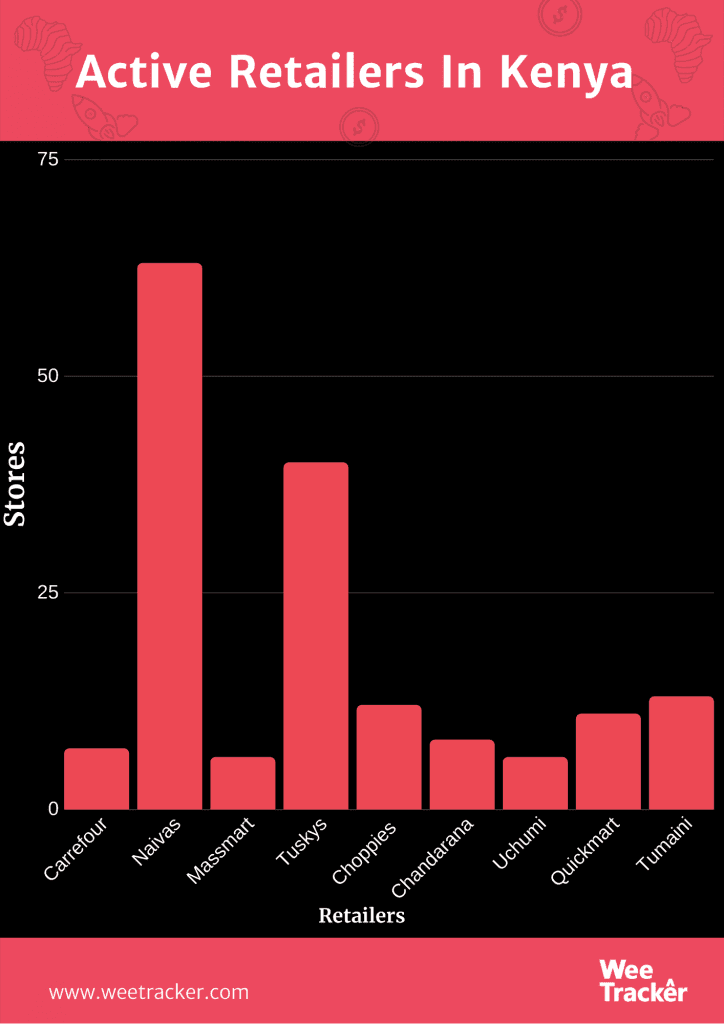

Naivas is one of Kenya’s leading supermarket chains, with more than 60 stores nationwide. IFC, Amethis and DEG are not the only ones who have had an eye for the firm, which became of the country’s top three retailers after the fall of once-dominating Nakumatt.

As Nakumatt is being dissolved, an opening is being created for other international retailers to make their mark. France’s Carrefour and South Africa’s ShopRite are two vivid examples, although the latter recently called quits on the market.

Recently too, Naivas outbade its rivals to bring 6 of Nakumatt’s stores under its control in a reported USD 3.9 Mn deal. Since then, it has been expanding in the local market, aggressively.

Its value proposition once caught the attention of South Africa’s Massmart, wbo in 2013 sought to buy a stake. The deal fell through after a row erupted among shareholders in the business. As such, Walmart’s plans to use Naivas as a launch pad for Massmart for its East Africa expansion was abandoned.

Interestingly, its capital comes months after rivals Quickmart and Tumaini merged following their acquisition by Sokoni Retail Kenya—a special purpose vehicle controlled by private equity firm Adenia Partners.

The new IFC backed capital is expected to help it run its new stores, apart from enabling it to open others. The supermarket business has attracted more players including foreign firms that are better-funded compared to local players.

Rebirth

Online retail, with the likes of Sokowatch, Copia, JUMIA, and Kilimall has become the go-to in the sector. The fall of Nakumatt, the ordeal of Botswana’s Choppies Supermarket and the backtrack on the part of SA’s ShopRite shook investor confidence in the market.

Even Game, another South African outfit, has struggled to make an impact on the Kenyan retail market. As such, online stores have pushed the e-commerce sales to an all-time high taking over customers that would have gone to the supermarkets. And, that push is winning investors over.

But to be able to survive and expand, the local supermarket operators have gone to investors in order to realise their market goals. In September 2019, Quickmart Supermarket and Tumaini announced a milestone union that would enable them become Kenya’s third-largest retailer by store network.

A year earlier, the same PE body completed an investment in Tumaini Self Service Limited through a special purpose vehicle, Sokoni Retail Kenya Limited. The transaction provided growth capital to Tumaini and was also structured through Adenia Capital (IV), a USD 230 Mn fund.

The investment in Naivas has joined to hint that the retail struggle in Kenya is again winning investors over. From here on, it seems easy to see that leadership and profitability in the sector would be determined by way the business is managed, invested in, and grown.