Developing Nations Find That Affordability Is No Kryptonite For Internet Gaps

Turns out affordability isn’t exactly boosting mobile penetration

The world over, the fees charged by network operators on average for mobile voice, mobile data, and fixed broadband services have been decreasing steadily over the last decade. And in some places, these reductions have been more telling than others.

But there’s a problem: many regions, especially those in the developing world, are finding that there’s more to boosting mobile/internet penetration than making the services very affordable.

The earlier statement about cheaper telecom services is not some offhanded comment drawn from shallow observation.

It’s the message from a report released only two days ago by the International Telecommunication Union (ITU); the 153-year-old United Nations (UN)-anointed agency for information and communication technology (ICT) and the official source for global ICT statistics.

In its latest report titled: “Measuring Digital Development: ICT Price Trends 2019”, the ITU emphasizes that mobile/internet services have generally become significantly cheaper.

The reduction in price relative to income is even more dramatic, suggesting that, globally, telecommunication and information and communication technology services are becoming more affordable.

However, the world is learning that affordability and increased mobile/internet penetration do not exactly work hand-in-hand. Cheaper cost trends haven’t quite translated to rapidly increasing mobile/internet penetration rates, especially in the developing world.

This indicates that there are other barriers to internet use, concludes the ITU in its new statistical report.

What do the numbers say?

As stated in the report, an entry-level mobile-voice basket remains broadly affordable in most countries.

In 70 countries studied, a low-usage mobile-voice plan was available for less than 1 percent of gross national income (GNI) per capita. And in a further 37 countries, it stood below 2 percent.

Although causality is difficult to prove, price reductions have undoubtedly helped contribute to the rapid rise in the mobile-voice penetration rate, alongside growing competition and better price monitoring and evaluation by regulators. But price reductions can only cause so much.

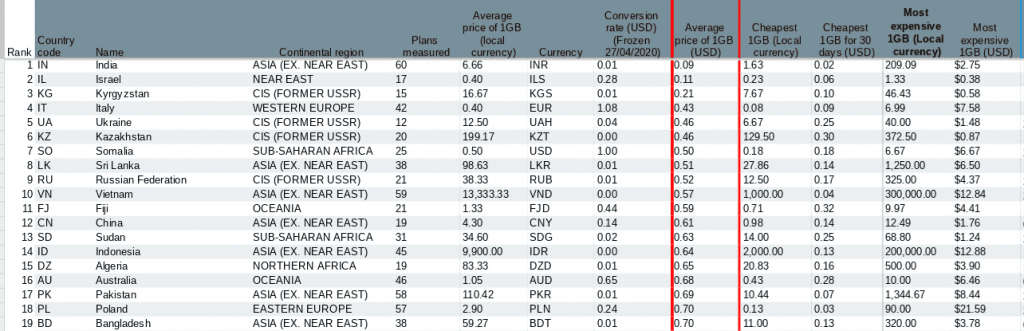

Source: Cable, 2020

Furthermore, the expansion of bundled services has further reduced prices, as combined data-and-voice baskets are generally less expensive than the sum of the two separate baskets in most markets.

As the ITU found, prices have decreased from 2013 to 2019 relative to GNI per capita. The global average price of a mobile-data basket of 1.5 GB shrank from 8.4 percent of GNI per capita in 2013 to 3.2 percent in 2019, at a compound annual reduction rate of almost 15 percent.

When uniformly expressed in U.S. dollars, the global average price of a mobile-data basket of at least 1.5 GB dropped by 7 percent on average annually between 2013 and 2019.

All these suggest that the affordability trend is on the rise, even in developing countries. But how has that impacted the extent to which mobile/internet services are now used in those parts?

Examining the facts

Fast rewind to 2005, the global population was 6.5 billion, and only 16 percent of the world was connected to the internet. The developed world accounted for 51 percent of those internet users and users in the developing world stood at just 8 percent.

By 2010, the world’s population had risen to 6.9 billion of which 30 percent were internet users. However, 67 percent of internet users were in the developed world while the developing regions took 21 percent.

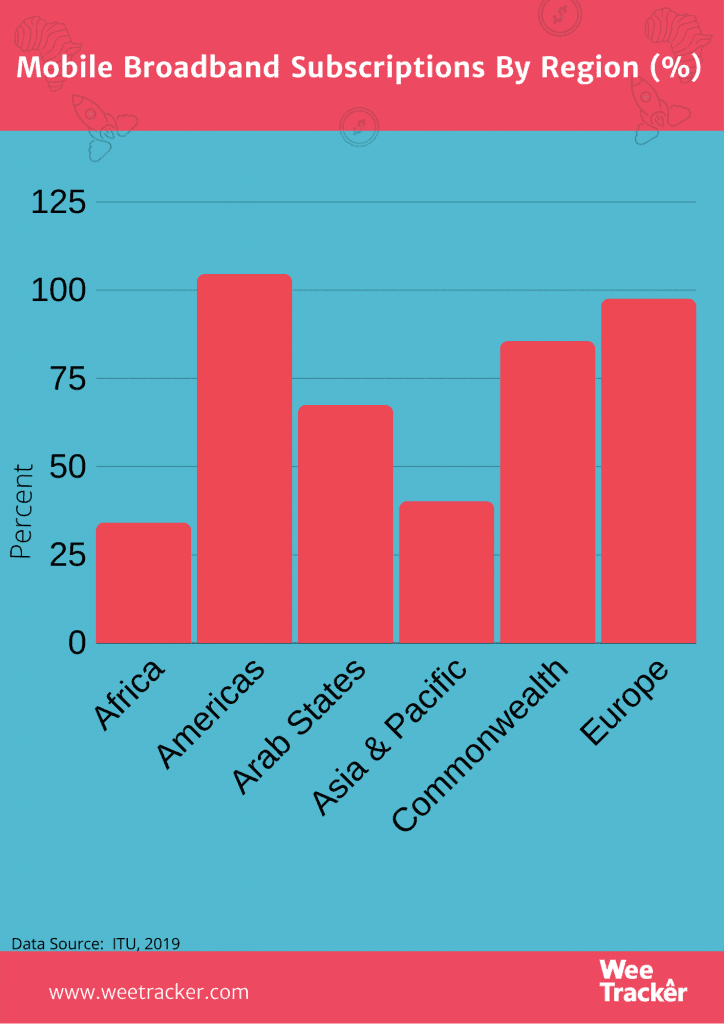

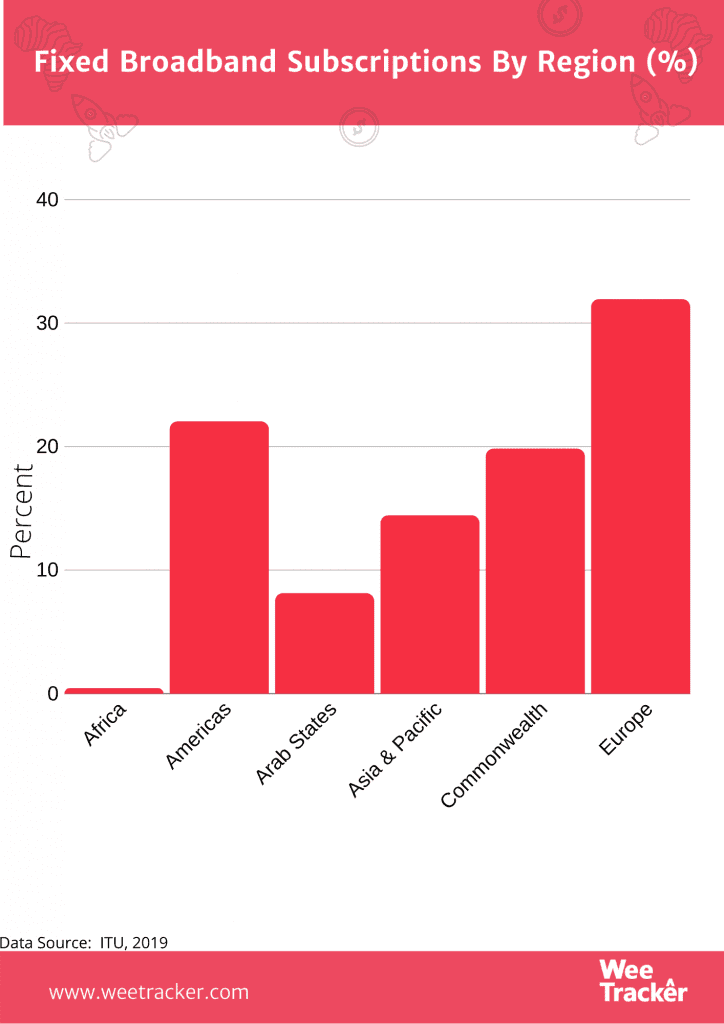

As of 2019, 86.6 percent of the developing world is connected. In the developing regions, that figure is 47 percent. Although costs have uniformly and progressively become cheaper in all regions over the years, there is a gulf between the rates of penetration.

In Sub-Saharan Africa, for instance, mobile penetration currently stands at 44 percent and only 23 percent of the population (239 million) are able to access the internet. Those figures are well below the global average for both metrics.

And that’s yet another testament to the notion that affordability is not fuelling penetration as much as it has been touted.

In truth, telecom services in Sub-Saharan Africa and some other parts of the developing world can be cheaper, but there’s no denying that they have become a lot more affordable than they get credit for.

The gist is, therefore, in identifying why the significant drop in prices hasn’t quite resulted in the massive adoption of those services in some parts but not in others.

What the ITU found

Measuring Digital Development: ICT Price Trends 2019 monitors the affordability of ICT services by analysing and comparing price data for mobile-voice services, mobile data, and fixed broadband for analysts, telecom operators, policy-makers and economists.

The report provides analysis in terms of dollar price, exchange rate-adjusted prices, and affordability for mobile-voice, mobile and fixed broadband according to internationally agreed baskets for services, including bundled services.

The latest statistics from the ITU suggest that affordability may not be the only barrier to internet uptake. It posits that other factors such as low level of education, lack of relevant content, lack of content in local languages, lack of digital skills, and a low-quality internet connection may also prevent broad use.

“The COVID-19 crisis has clearly shown us that nobody is safe until we are all safe. By the same token, we will not be able to use the full potential of digital technologies until we are all connected,” says Doreen Bogdan-Martin, Director, ITU Telecommunication Development Bureau.

“To connect all, we need to address all factors that may prevent meaningful connectivity,” she adds.

The ITU also says significant progress has been made towards the Broadband Commission for Sustainable Development’s target of achieving affordable broadband costing 2-5 percent of GNI per capita by 2025, though there’s more work to be done.

According to the agency, there are still 9 developing countries and 31 Least Developed Countries (LDCs) are still some way off from the 2025 target.

Featured Image Courtesy: The National