Blindsided, Crippled, Outlawed? – Crypto Startups Get The Axe In Nigeria

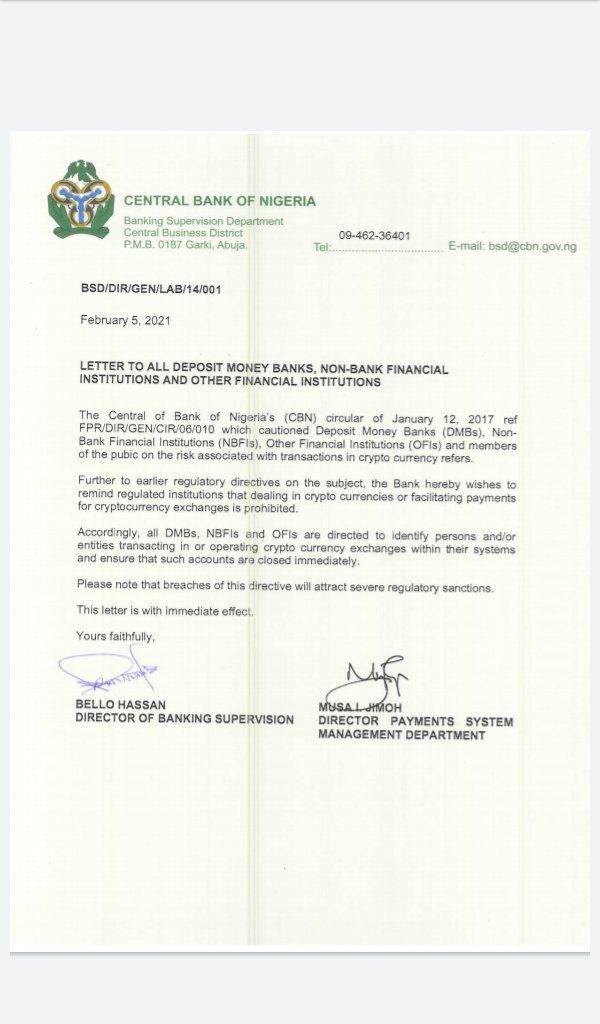

A leaked document purportedly from Nigeria’s financial industry regulator, the Central Bank of Nigeria (CBN), currently has the country’s entire media space agog. That document is a five-paragraph writeup that obliterates cryptocurrency startups with operations in Nigeria.

Nigerian regulators have in the past skirted around the subject of cryptocurrencies, hinting at certain regulatory moves without appearing to outrightly endorse or denounce crypto.

But around noon on Friday, February 5, the CBN effectively outlawed or essentially crippled formal crypto trading platforms in Nigeria.

In a letter addressed to Deposit Money Banks (DMBs), Non-Bank Financial Institutions (NBFIs), and Other Financial Institutions (OFIs), and members of the public, the CBN “reminded” the regulated institutions that that dealing in cryptocurrencies or facilitating payments for cryptocurrency exchanges is prohibited.

“Accordingly, all DMBs, NBFIs, and OFIs are directed to identify persons and/or entities transacting in or operating cryptocurrency exchanges within their systems and ensure that such accounts are closed immediately,” reads a part of the letter.

“Please note that breaches of this directive will attract severe regulatory sanctions,” were the words in the concluding part of the letter which appears to have been signed by Bello Hassan, Director of Banking Supervision, and Musa Jimoh, Director of Payments System Management Department.

Going by the contents of the letter which is currently seeing a lot of circulation, the CBN has barred all financial institutions in Nigeria from working with or supporting any platform that deals with cryptocurrencies like bitcoin, ethereum, ripple, and others.

This means that banks and fintechs are now forbidden from enabling all forms of financial transactions involving crypto platforms.

As an example, users on crypto exchanges often have to buy or sell crypto on those platforms using their bank accounts or some mobile wallet. The new CBN order effectively bans this practice.

Some fear that the implication of the new directive is that it will now be impossible to fund crypto transactions on crypto exchanges or withdraw from crypto exchanges into bank accounts.

To put it simply, a lot of the transactions on formal crypto exchanges operating in Nigeria are facilitated by the rails provided by the legacy financial setup in the country. And the CBN has moved to sever this connection.

Nigeria’s bubbly crypto scene is the world’s second-largest bitcoin market (after the U.S.), by Paxful’s estimates, and first in Africa.

According to BuyCoin’s internal estimates, Nigeria’s total crypto trading volume across all channels is well over USD 200 Mn per month. In fact, on its own, BuyCoins claims to have facilitated up to USD 170 Mn worth of crypto transactions last year.

Although a sizeable chunk of crypto transactions in Nigeria is believed to still be happening informally via WhatsApp, Telegram, WeChat, Instagram, and Twitter, formal crypto exchanges have cleaned up the scene.

Formal crypto exchanges (now numbering more than 10 in Nigeria) have done an excellent job of building online marketplaces (websites and apps) where one can sign up to buy or sell crypto with fiat currency — with ease and in a secure manner.

Some of the local crypto exchanges like BuyCoins, Busha, Bundle, Patricia, and Quidax, as well as international exchanges like Binance and Luno, are quite popular in Nigeria.

Besides that, there are also notable peer-to-peer exchanges (p2p) like Remitano, Paxful, and LocalBitcoins where one can trade directly with other people. Peer-to-peer trading volumes are reportedly as high as USD 18 Mn per week in Sub-Saharan Africa, with Nigeria accounting for 50 percent of these volumes.

Also, informal crypto trading via social media and social messaging channels is believed to make up more than half of the USD 200 Mn volumes traded across all channels monthly in Nigeria.

The unrelenting economic malaise, policy instability, currency devaluation and instability, rising inflation, low investment yields on the local front, high cross-border transfer cost, and a general disconnect between government and people, are among the factors that are fuelling crypto adoption in Nigeria.

With the CBN’s latest directive, it is feared that formal crypto exchanges will be significantly stymied.

However, there are concerns that in suffocating the business of formal players, a big underground crypto market that is informal and unregulated — not unlike the one in China — will spring up in Nigeria.

UPDATE: Since this development became public, crypto startups like BuyCoins, Luno, Bundle, and Yellow Card have put out statements mentioning awareness of the situation and adjustments being made. Nigerian fintech, Flutterwave has also informed users that it has withdrawn support for transactions involving crypto platforms. Binance has made some changes too.

Featured Image Courtesy: Investopedia