How A Strict Tax Regime Tears The Strength From South Africa’s Passport

The South African passport is one of the strongest in Africa, but all is not on the right side. A couple of tax-related factors appear to be ripping the strength off the laissez-passer, which is perhaps an unpopular knowledge.

New Ranking

Nomad Capitalist’s travel research experts recently published the 2020 edition of its passport ranking. The boutique tax and immigration consultancy firm’s index aggregated data from almost 20 unique sources, based on the priorities which the United States-based organization believes to be relevant to citizens and potential citizens of each given nation.

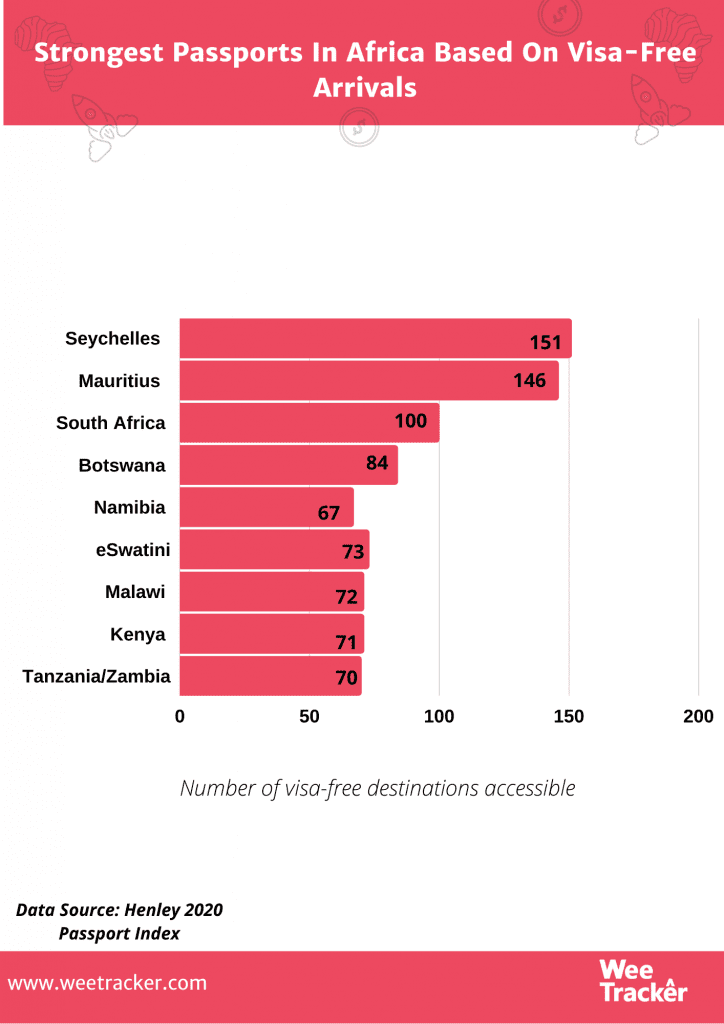

While a ranking like the Henley Passport Index puts the South African passport at the 56th position worldwide, Nomad Capitalist’s release says it is the 99th strongest globally. This ranking considers five factors: visa-free travel (50 percent), taxation of citizens (20 percent), perception (10 percent), dual citizenship (10 percent) and personal freedom (10 percent).

Based on these considerations, the passports of Sweden, Luxembourg, and Ireland have the rankings’ joint best in the world, while Belgium and Finland conclude the index’s top 5.

South Africa—which shares a position with the small island nation of Nauru—was ranked in a high place based on the fact that its holders have access to 100 countries visa-free. Nevertheless, the Southern African nation’s strict tax regime and lower government freedoms dragged down the ranking of the passport—as well as its supposed strength.

Taxation

Nomad Capitalist used data from its network of tax vendors, new sources, and tax authorities. To the countries that tax citizens irrespective of where they live, the ranking gave the lowest score of 10. Countries like Australia that allow citizens to relocate and avoid tax were given 20 or 30, while those that do not tax the foreign incomes of resident citizens were scored 40. Countries with zero tax go the general high of 50.

South Africa got a taxation score of 10, which means that the country taxes its citizens regardless of which country they reside in. For starters, foreign residents in the country commit the same amount of income tax as local citizens. Nevertheless, taxpayers that are non-resident only pay tax on income they earn in the country, not elsewhere.

The new expat tax, which effected on March 1, 2020, mandated that South Africans tax residents on international work will only be exempted from paying on the first ZAR 1 Mn they earn abroad. The rest of their earnings—including all fringe benefits such as housing, education, and flight allowances—will be taxed based on the typical tax tables for the year. In some cases, this could be as much as 45 percent on income.

This new tax affects South African tax residents outside the country for more than 183 days during any period of 12 months and a continuous minimum of more than 60 days. As a result of this new policy, Africa’s most industrialized economy is seeing an increasing rise of people who want to emigrate to cease their tax residency with the nation financially.

Adverse Effects

The effects of such a policy hurt South Africans in different ways. For one, those living in places like Asia can have their financial situations significantly impacted, especially if the specific country lacks a DTA in place with South Africa. With this, there is little wonder why South Africans living abroad are looking to immigrate from their country financially.

Through financial emigration, they can retain their citizenship and passport but will inform the nation’s authorities that they are are no longer resident in South Africa in an ordinary sense. If they do not return home after their wanderings, they are not subject to tax laws from the South African Revenue Service (SARS). Since the country’s Income Tax Act was announced, there has been an enormous fall in financial emigration demands.

If South Africa’s passport power can get its citizens to 100 destinations worldwide, its strict tax regime could be a bane on their traveling after all. Expatriates from South Africa who fear the worst of the tax crackdown are most likely to apply for a second passport through golden visa schemes in Europe. If this happens and continues, there is no telling how much value the South African passport would loose.

Xpatweb, an immigration firm, revealed that the number of South Africans applying for second European Union passports has increased by 364 percent since 2018, marking a record high. With the pending tax changes in South Africa due to being enforced from March 1, 2020, the EU second passport scheme is an attractive and enticing proposal for South Africans, Xpatweb Director, Marisa Jacobs, said.

Logging Off?

“In Q1 2020, South Africans were able to visit 99 destinations visa-free or visa-on-arrival. However, the 56th position on Henley’s ranking remains unchanged because other destinations are higher up on the index due to having more visa-free destinations.

Generally, African countries have seen the power of their passports decline over the last decade due to political instability and conflict that have affected travel freedom,” Vuyiseka Giaz, Head of Public Relations, Henley & Partners South Africa, told WeeTracker.

South Africa’s 56th position on Henley’s ranking is three places down from the previous ranking and is currently at the worst performance since the 2006 introduction of the Henley Passport Index. So far, the country’s best ranking was in 2008 and 2009 when it achieved the 35th position.

Over the last decade, the South African passport has been on a steady decline, recording a cumulative loss of 10 positions over the period. According to Henley, the passport’s holders can presently access 100 destinations, but that figure is low when that of Japan (191 destinations) is taken into perspective.

Christian H. Kaelin, chairman Henley & Partners and the inventor of the passport index concept, nevertheless, said: “As public health concerns and security rightfully take precedence over all else now, even within the otherwise borderless EU, this is an opportunity to reflect on what freedom of movement and citizenship essentially mean for those of us who have perhaps taken them for granted in the past”.

Photo by Mpho Mojapelo Via Unsplash.