Shutting Down A Stock Exchange Amidst A Crisis Is A Bad Idea

In what the government said is a move to save its currency, the Zimbabwean Dollar, Zimbabwe shut down its stock exchange alongside mobile money transactions close to the end of June. For a country whose economy has been on a rollercoaster ride for the better part of a decade and is currently battling the Covid-19 pandemic, halting stock trading is a decision that may come back to bite.

History Repeating

The Southern African country’s continued struggles with currency devaluation did not begin today, neither does shutting down its stock market come all too new. In 2008, the bourse was shut down for three months, at which time annual inflation reached 79.6 billion percent. Trading stopped after a crackdown on banks and stockbrokers by the Zimbabwe Reserve Bank, amidst accusations that they allowed traders to use fraudulent cheques to buy stocks.

Since the Zimbabwean Dollar (ZW$) was also collapsing at the time, the ZSE sought permission from the government to resume trading in foreign currency, and the central bank approved it. As much as the country’s economy has long struggled to remain stable, its stock exchange often surges, providing a haven for both local and foreign investors.

Nevertheless, the government has been somewhat encouraging sudden takeover of white-owned commercial farms since 2000, forcing investors to deal with the violent seizure of their assets as well as repeated and increased hyperinflation. The currency regime, which has since abolished Zimbabwe’s local legal tender, has more or less been a colossal worry for just about everyone, including investors.

But in as much as Zimbabwe’s problems with currencies and stock markets did not begin today, a repetition of the oddities of the country’s financial/economic histories with both, at this point, does not bode well, even for a nation that has one of the world’s highest inflation rates.

Covid-19 Matters

So far, Zimbabwe has recorded 885 cases of the coronavirus infection, including 9 fatalities and 206 recoveries. In Africa and around the world, the global pandemic has had drastic ripple effects on stock markets and international trading, leading to exceptional market volatility. But despite the impact of individual performance of pensions and investments, real-world economies, and even jobs, stock markets have not just remained open but also created initiatives to best the storm.

Even if markets have sharply fallen, the essence of keeping stock exchanges open during the pandemic could not be overemphasized. It can support companies who will continue needing access to capital and go a long way in making sure that pricing is conducted fairly and transparently for retail and institutional investors who need unfettered access to liquidity.

Temporary suspension for a stock exchange is no new phenomenon around the world. In March, coronavirus cases at the New York Stock Exchange forced the bourse to temporarily close its historic trading floor and move entirely to electronic trading. In 2013, Nasdaq dealt with an unexpected afternoon shut down for about 3 hours.

The London Stock Exchange, for example, has never suspended trading due to market volatility, because it has a range of measures to ensure that the market is both orderly and fair. From price monitoring functionality, price monitoring and other initiatives make it possible to remain on its feet, even in Covid-19. The same may go for bourses across Africa, who so far reported no coronavirus-inspired sabbaticals.

Shutting down a country’s bourse, is seldom the right call as it projects high levels of risk and uncertainty which investors take into consideration when picking investment destinations. Additionally this is likely to weigh down investor confidence in the market and the country as a whole.

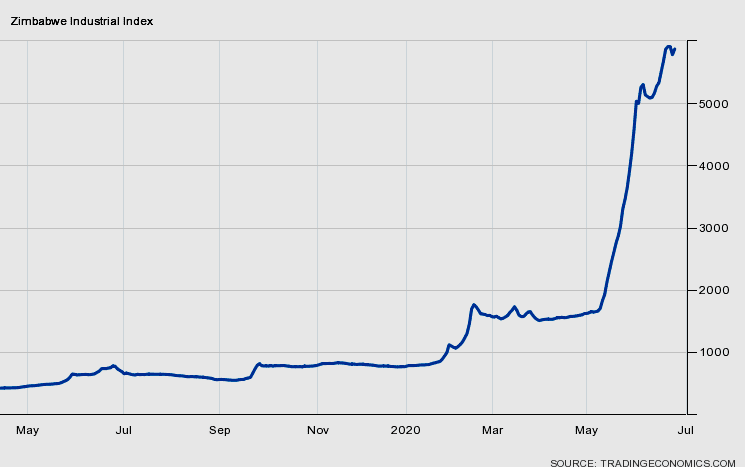

In the case of Zimbabwe, amidst surging inflation (786 percent year-on-year as at May 2020) investors had turned to the equites space on the ZSE as a value preservation method as they provided a hedge against local currency devaluation with returns outpacing inflation.

The ZSE has yielded 672.10 percent YTD, while top gainers YTD achieved returns between 1500 percent and 4000 percent. Suspending the exchange has left many investors in limbo, having to contend with RTGS bank balances whose value is being eroded on a daily basis.

Worst Possible Time

Zimbabwe has been in a challenging economic position for years, now exacerbated by COVID-19. The government is attempting to strengthen the local currency by shifting away from its reliance on foreign money, including the USD. It is now a nightmare for stockbrokers trying to calm clients and explain what has happened to their money.

“Any move that reduces liquidity in the market is precarious. We know that when people can’t access funds or make payments to buy goods, they panic. Businesses won’t be easily able to provide services, and people may start to stockpile out of fear or even hoard money. These scenarios are terrible news for an economy and the stock market, says Kylie Purcell, Investment Editor at Finder, a New York-based team of money experts.

“A stock exchange closing for days on end is a frightening scenario for any investor. Traders rely on a stock exchange to remain liquid so that they can access their funds quickly. This move tells investors that they can’t trust the Zimbabwe Stock Exchange to do what it’s supposed to do,” she told WeeTracker.

The benchmark industrial index of the ZSE has gone up over sevenfold this year to a record high. For investors, the domestic bourse is a haven from the country’s collapsing currency and inflation of 786 percent, the highest for the country in a decade. Investors with cash prefer buying shares to prevent their money from losing value. During Covid-19, when the currency devaluation became worse, the stock exchange is supposed to be a safer haven. But, not if it was shut down.

Unfortunately, this has signalled to the market that interference from government authorities is likely to be a recurring theme and will therefore remove the notion of free market operations. It could be a huge blow to the local capital markets especially as the new bourse was set to be denominated in foreign currency. However, with such tough stances by authorities, foreign investors are unlikely to be motivated to invest in the country given such high levels of country risk, consequently keeping much needed foreign currency away from the country.

Scares

It appears that investors, companies, and stockbrokers are not the only ones scared. The government, too, seems worried, which is why it accused Ecocash—Zimbabwe’s top mobile money platform—of running a ponzi scheme and investors of undermining the country’s efforts to end its economic crisis. Movements in domestic stock prices track the parallel currency markets on Harare’s streets, where the ZW$ changes hands at about 100 per USD, against a 57.35 official rate.

A spokesperson for Sigma Securities Ltd., a stockbroking and investment services firm, agreed that shutting a stock exchange during—and even outside—a crisis is a bad idea. “Investors need quick access to money around these times, and being unable to right now creates both problem and panic, especially for the ones to whom ZSE is a darling exchange. Nevertheless, the government may have its own tangible reasons, like protecting its own capital markets, but no one is sure yet,” he told WeeTracker.

The Zimbabwe investors who have switched from the ZW$ to equities on the ZSE did so because they wanted to hedge against inflation. After all, the stock exchange serves as a proxy to parallel market rates. That proxy being shut down for an indefinite amount of time in a debt-strapped, economy-tumbled, and financially-constrained nation amid a Covid-19 outbreak spells all too grim a future.

“Once the ZSE reopens, there’s a strong possibility that investors will flee to safer shores, and some stockbrokers will lose business. From the response we’ve seen by local investors and businesses, this move came with little warning. Typically, when a black swan event occurs, it results in panic selling by shareholders. We might see funds move from ZSE to other exchanges in the region or overseas,” Kylie explained.

IHS Securities, a licensed member of the Zimbabwe Stock Exchange, believes that investor confidence has been on the decline for some time now with activity on the markets, essentially driven by last ditch options to retain a store of value in the investors RTGS balances. Policy missteps, varying from the suspension of trading fungible shares to now the suspension of the entire bourse is likely to weigh down already dangerously low confidence levels.

Before the announcement of the suspension, some securities firms were experiencing investor flight from the market, with the majority of sellers in recent weeks being foreigners. One can anticipate an even greater exodus from the market once the suspension has been lifted.

Future

Perhaps it is not quite a common knowledge that Zimbabwe intends to open another stock exchange at Victoria Falls. The new bourse will be dominated in foreign currency and aimed to attract foreign investors and global capital, especially in the mining sector.

But with the present turn out of things, it is uncertain how the country’s tainted history with the Zimbabwe Stock Exchange will affect investor confidence and undermine its future ambitions.

Unfortunately, this has signalled to the market that interference from government authorities is likely to be a recurring theme and will therefore remove the notion of free market operations, says Balamanja Sepiso Mande, Equities Research Analyst at IH Securities, a securities trading company facilitating trade on the Zimbabwe Stock Exchange.

“We believe this is a huge blow to the local capital markets especially as the new bourse was set to be denominated in foreign currency. However, with such tough stances by authorities foreign investors are unlikely to be motivated to invest in the country given such high levels of country risk, consequently keeping much needed foreign currency away from the country,” he told WeeTracker.

Featured Image: Biznews