Living Hand To Mouth? Almost 80 Percent Of Zimbabweans Have No Savings

Experts advise everyone to have an emergency fund, and which they say is more necessary for people without other savings.

While this is highly recommended , a new report has shown that close to 80 percent of Zimbabweans neither have savings nor an emergency fund.

The survey dubbed Employee Spending Patterns Survey Report conducted by Industrial Psychology Consultants (IPC) indicated that 76 percent of the participants reported that they did not have savings. According to the survey, an equal percentage of contributors reported not to have an emergency fund.

Based on the report, people who are paid with US dollars tend to save more with only 56 percent of the participants not having savings while a bigger percentage (84 percent) of those paid in RTGS dollars lacking savings.

Since it was made the legal tender in June, the Zimbabwean dollar has quickly dropped its value against the US dollar as inflation which is estimated to be close to 300 percent takes a toll on the already weak economy.

While most civil servants are paid in Zim dollar, Non-governmental organizations, and medicine and pharmaceuticals still receive their salaries in US dollars, this is according to the report. Interestingly, even as the prices of commodities and services continue to soar while salaries remain constant, 48 percent of the participants spend most of their salaries on groceries.

Even after the government outlawed the use of foreign currency after introducing the Zim dollar making it the sole legal tender, many Zimbabweans prefer to use the US dollar because of the convenience that comes with it. The report revealed that 76 percent of participants in the survey got their foreign currency from the black market with only 6 percent obtained forex from a bank.

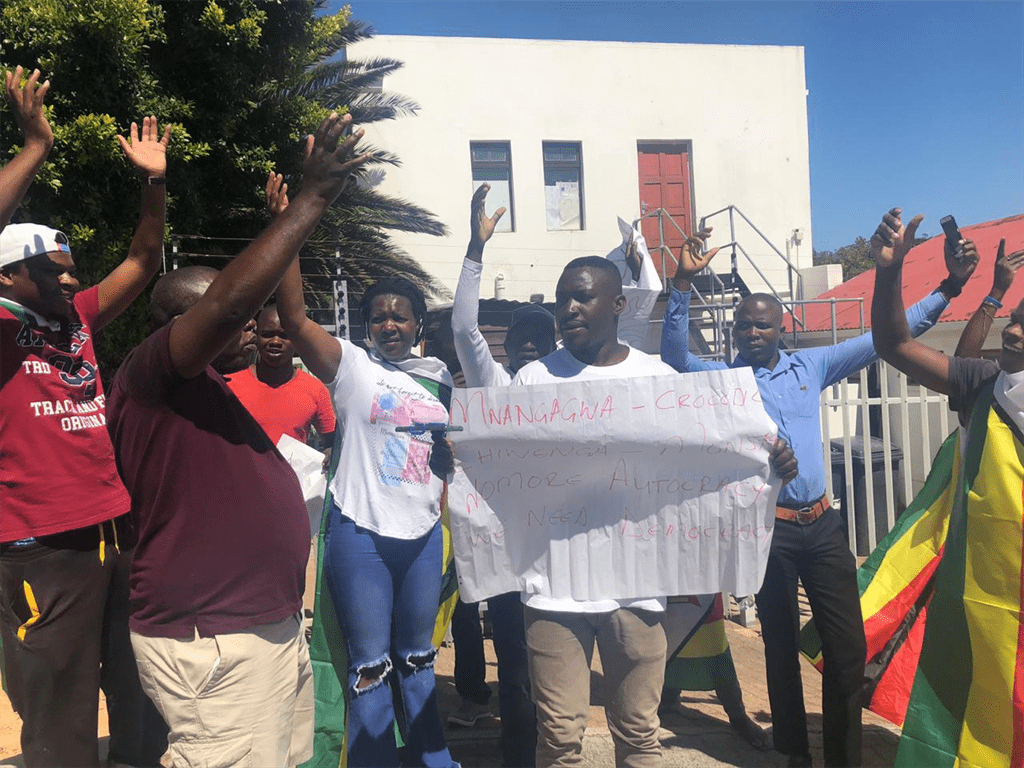

Featured Image Courtesy: News24