Telkom SA’s Lifeline For Covid-19’s High Tide Is The Sale Of Its Tower Assets

Telkom SA SOC Ltd. operates both wireline and wireless telecommunication service provider with operations in more than 38 African countries. But the semi-privatized and JSE-listed firm is looking to sell its tower assets to realize cash to stay afloat in the coronavirus pandemic.

As Usual, Financial Troubles

When one hears of a firm pivoting, laying off staff, or selling assets during a pandemic, it is logical to think the company is trying to survive financially. Telkom South Africa is no different, as the 39 percent state-owned telco, headquartered in Pretoria, has tangible reason to look towards a potential sale or spinoff.

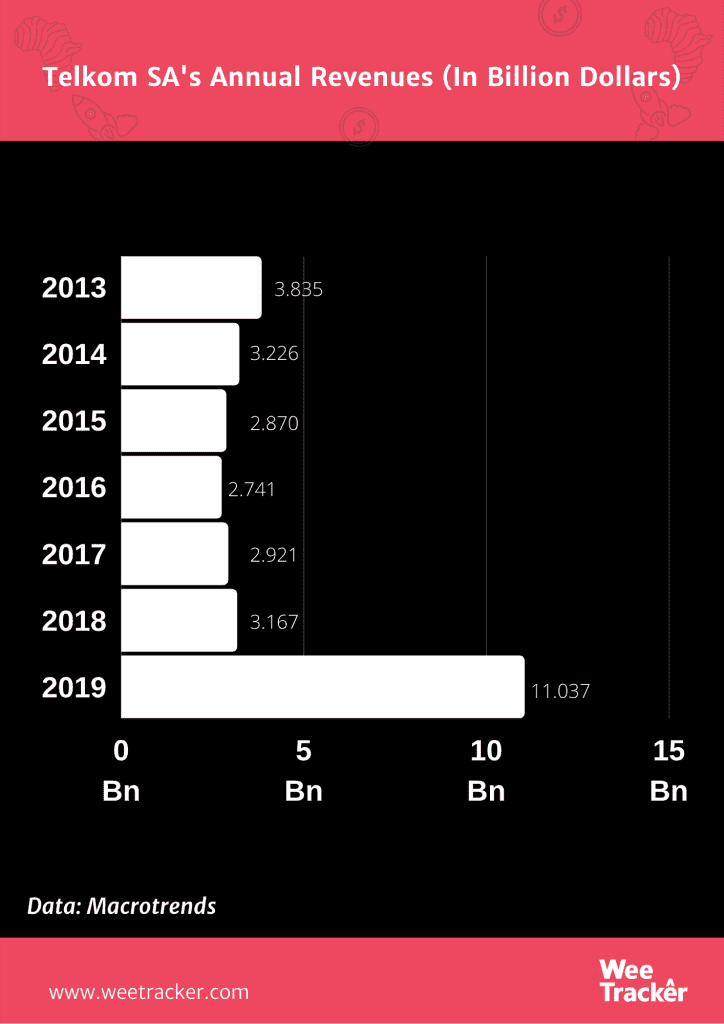

The telco’s latest financial report shows that it suffered a 66 percent slump in full-year earnings. Telkom SA took a USD 63.5 Mn provision as a result of the economic implications of Covid-19. About 2,300 of its employees have accepted voluntary redundancy packages.

The business suspended dividends for 3 years and withdrew some of its targets, as a result. The firm’s headline earning per share (HEPs) fell to 108.1 cents in the year that ended March 31st, 2020.

The previous year, its profit measure was 619.2 cents. As of Thursday (June 18th, 2020), Telkom shares went down by 5.4 percent in Joburg, extending a 12-month 73 percent slump.

Also, Telkom is in the middle of a business restructuring to deal with the decline in the performance of fixed-line voice services. It is also trying to make the most of the demand shift to mobile data and fiber networks.

The Tower-Balance Sheet Spectacle

Even in Africa, it is not new for telecommunications firms to consider selling their mobile phone towers in a bid to preserve cash. In the last 5 years, the continent has witnessed a series of telcos pulling this move to strengthen their balance sheets.

Telkom SA has 6,500 cell towers under its belt, a line of multi-tenant assets that has the potential to help it realize up to USD 425 Mn in additional value. From 2015 to 2018, tower sales in Africa have been worth over USD 6 Bn across Africa, a result of telcos cutting costs by divesting from infrastructure to channel into service delivery.

About 46 percent of the continent’s 120,00 towers are owned by independent firms, though state-owned counterparts were in the lead more than 10 years ago. In May 2018, Telkom Kenya sold 723 cell towers to the American Tower Corporation in a deal whose financials remain under wraps.

The deal was similar to that of Bharti Airtel. It sold offs its African tower vertical and listed a quarter of its operations in the continent to raise USD 1.5 Bn to chunk off a considerable portion of its USD 14.6 Bn debt. In 2018, Airtel Africa officially exited the tower business by divesting from Bharti Infratel.

As a result of the sale, the telecom giant’s African losses shrank to USD 91 Mn in September 2016, from USD 170 Mn during the same period in 2015. It experienced a 1 percent increase in revenue, equivalent to USD 3.4 Bn. Long story short, Airtel Africa is now nearly a billion-dollar business.

Tower Demand

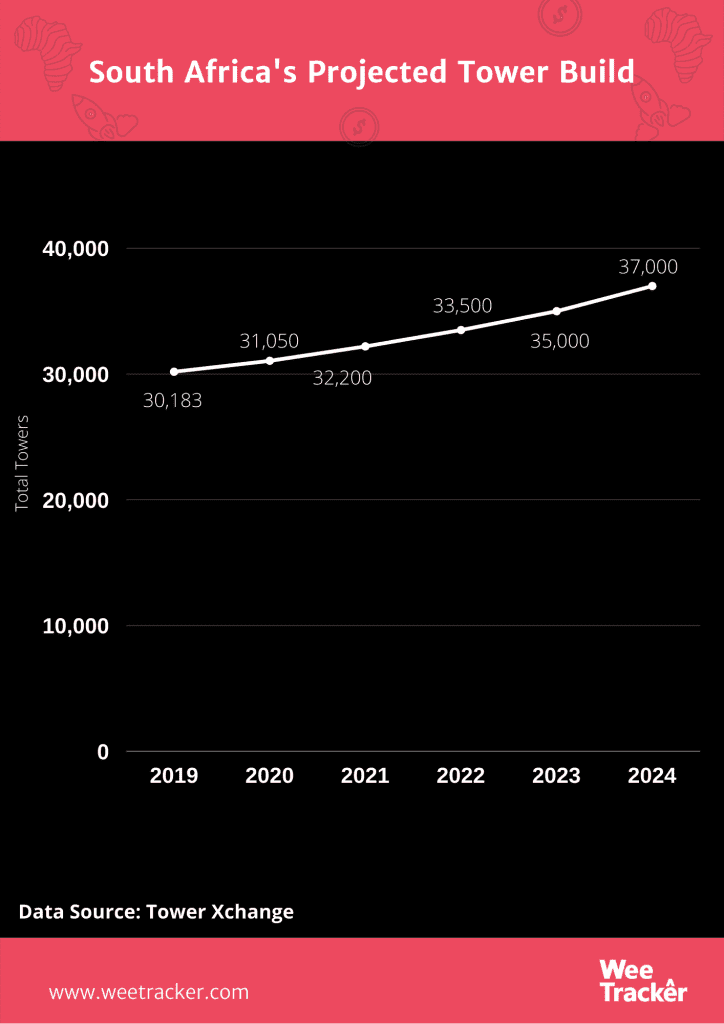

If there’s anywhere in Africa where 5G is currently experiencing the most success, it is South Africa. The fifth-generation network, however, cannot be rolled out without cell towers. That means the demand for cell towers is bound to increase. Liquid Telecom said that it is building a wholesale 5G network that would be available from early 2020 in major SA cities.

Recently, Vodacom launched 5G to become the second local provider in the country after Rain. It was in April that the Cyril Ramaphosa-led government permitted access to some of the radio frequency needed to 5G on an emergency basis, a criterion very well wrapped around the coronavirus pandemic. The allocation was meant to help operators meet demand.

As South Africa tries to meet 5G needs, operators will either need to buy or have to set up the required infrastructure. Selling off cell towers, in this regard, makes sense of both time and purpose. More so, Helios Towers, one of Africa’s largest towercos, is expanding in Africa and will buy mobile phone towers in the process. The million-dollar company already has USD 450 Mn to make the acquisitions.

Nevertheless, selling towers is not only done for the immediate cash benefit. Having a shared telecoms infrastructure offers improved operation and capital efficiency. Other benefits are reduced costs, increased accessibility, and more improved network quality of service. It can help operators meet growing consumer demand and achieve substantial network expansion.