A Light At The End Of The Tunnel For Affordable Housing In Kenya

There are approximately 2.5 million slum dwellers in about 200 settlements in Nairobi representing 60 percent of Nairobi population and occupying just 6 percent of the land. Kibera, the biggest slum in Africa and one of the biggest in the world houses about 250,000 people.

Basically, the numbers of slum dwellers in Kibera paint a grim picture of the general availability of low cost houses in Kenya. The number of low-income units is dwindling with the market shifting to focus on the middle class. Efforts to address the crisis has not yielded tangible fruits yet the number of slum residents continue to rise.

Statistics from the World Bank depict a depressing scenario of the situation with six out of 10 households living in slums. There is a deficit of over two million houses countrywide as annual production remains at a paltry 50,000 units, way below the targeted provision of 250,000 units.

The rental cost for the middle and upper class market continues to rise and it is becoming the new normal. The high costs have majorly been attributed to exorbitant prices of land, high cost of construction and high population growth as a result of rural-urban migration.

In a bid to meet the rising demand for affordable housing, Pan African housing development financier, Shelter Afrique has invested USD 2 Mn in the Kenya Mortgage Refinance Company.

While confirming the firm’s contribution, Andrew Chimphondah, Shelter Afrique CEO stated that there are many Kenyans who would want to own houses but the challenge remains access to affordable finance.

“We are encouraged by the formation of the Mortgage Refinance Company which provides long term lending to commercial banks, micro-finance banks and Saccos to allow them to extend mortgage loans to eligible mwananchi over a longer period and at a lower cost. That is important because that enhances affordability and boosts uptake of housing. I am happy to announce that Shelter Afrique has invested USD 2 Mn in the Company to stimulate the demand for affordable housing,” Mr Chimphondah said.

Notably, he pointed out a lack of affordability as the reason why there were only 24,000 active mortgages in Kenya despite the country having a housing shortage of over 2 million units.

“If 100 Kenyans apply for mortgages only five will qualify because of lack of affordability; 10 might be due to high credit risk, but the majority will be disqualified on the basis that they wouldn’t be able to the mortgage repayment terms”.

Kenya Mortgage Refinance Company operates as a private sector-driven company implementing the government’s affordable housing plan.

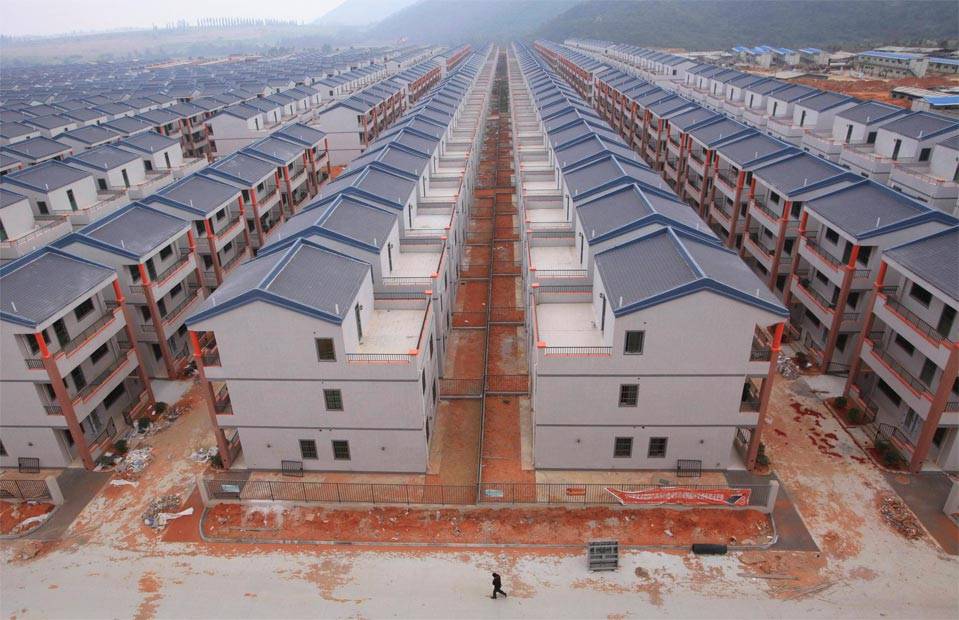

Featured Image Courtesy: independent.ng