Rolling Funds & Micro LPs Unlock New Paradigm For African Startup Funding

The oft-discussed topic that is African startup funding is spotting a new look that might just be a better one too. Enter: rolling funds and the rise of micro LPs.

Indeed, there are new startup funding conduits that are democratizing startup funding in Africa. These novel investment vehicles are opening up startup investments to the average Joe, so to speak.

These conduits make it possible for just about anyone to buy into some of the continent’s most promising and exciting startups with as little as USD 100.00. Yes, just USD 100.00, or possibly even less.

In the recently announced Nkali Fund, Africa has scored one of its first rolling funds. A few months back, the continent saw the birth of the Future Africa Collective; basically the first effort at making Limited Partners (LPs) out of regular, middle-class individuals.

“Future Africa, in fact, was the first organisation to deploy the first rolling fund through the collective. Not only have we successfully raised the first rolling fund in Africa, we have deployed capital through it to 3 startups,” said Olabinjo Adeniran, co-founder of Future Africa.

Together, these initiatives (Nkali and Collective) offer a new, more accessible funding conduit for both funder and funded.

What’s this rolling fund?

A Twitter poll put up on August 14 by Victor Asemota, a Nigerian technology entrepreneur and investor who serves as a board member and advisor to leading fintech and investment firms across Africa, asked the following question:

“I have 120k+ followers here who are mostly African. If I start a rolling INVESTMENT fund with 10,400 members only to contribute 100 dollars a month into a pool to fund the best new African startups weekly. One new country per week for a year… Will you subscribe?”

I have a 120k+ followers here who are mostly African.

If I start a rolling INVESTMENT fund with 10,400 members only to contribute 100 dollars a month into a pool to fund the best new African startups weekly. One new country per week for a year.. Will you subscribe? #NkaliFund.— Osaretin Victor Asemota (@asemota) August 14, 2020

And that’s how Nkali Fund got off the ground. A novel concept, rolling funds are like cooperative societies for venture investments. It’s a bit of controlled crowdfunding for startups, open to the general public.

Historically, startups raise money from VCs and other investment networks that are basically fund managers that deploy and manage funds raised from institutional investors, also known as institutional LPs.

VC funds are typically built from big cheques (commonly USD 100 K and above) issued by institutions and when VCs raise, they do so privately and only begin to deploy the capital after hitting the targeted bulk sum. Quite commonly, it could take years of countless meetings to achieve the final close of a VC fund.

The rolling fund seeks to eliminate the rigidity around startup investments and ultimately expand the funding pool available to African startups which have historically suffered a paucity of local backers and have often been forced to dance to the tune of foreign investors.

In Kenya, for instance, the scarcity of local funders appears to be one of the factors pushing the bulk of startup investments to expat founders. Also, funding gaps and the preferences of foreign investors (who have the cash and are willing to stake it) are among the factors pushing African startups to be “foreign local firms.”

By this definition, “a rolling fund is a new type of investment vehicle that allows its managers to share deal flow with fund investors on a quarterly subscription basis while netting carried interest over a multi-year period (e.g. two to four years).”

Additionally, “a rolling fund is structured as a series of limited partnerships: at the end of each quarterly investment period, a new fund is offered on substantially the same terms, for as long as the rolling fund continues to operate.”

Further, “with this fund structure, rolling funds are publicly marketable and remain open to new investors. Hence the term, ‘rolling’.”

Quite recently, Gumroad founder, Sahil Lavingia, teamed up with AngelList to launch his debut USD 5 Mn rolling fund in a matter of days to invest in early-stage entrepreneurs. Twitter and Zoom helped him do the magic.

The perks of rolling funds

The newly unveiled Nkali Fund is an iteration of the aforementioned rolling fund definitions as it frees up the concept of fundraising and enables just about anyone to be a limited partner (LP).

Some would say it allows for the rise of the micro LP since individuals can essentially become VCs themselves — something that has hitherto been the prerogative of established, deep-pocketed organisations and considerably wealthy persons.

Think about it: a rolling fund that seeks a minimum of between USD 50.00 to USD 100.00 per month from individuals to invest in the continent’s best startups opens up a previously untouched pool of capital.

It’s a win for everyone — the LPs (micro investors), the founders, and the general partners (GPs; that’s the managers of the fund who do the most important work: finding and funding the best startups).

Unlike traditional VC funding where VC firms have to close a bulk sum before deploying (over a number of years, typically), the rolling fund structure allows fund managers to raise new capital commitments on a regular basis and invest as they go, hence the “rolling” aspect.

Micro LPs arise

Across the continent, startups are raising more money than ever before but historically, foreign investors have been the ones pouring in most of the cash.

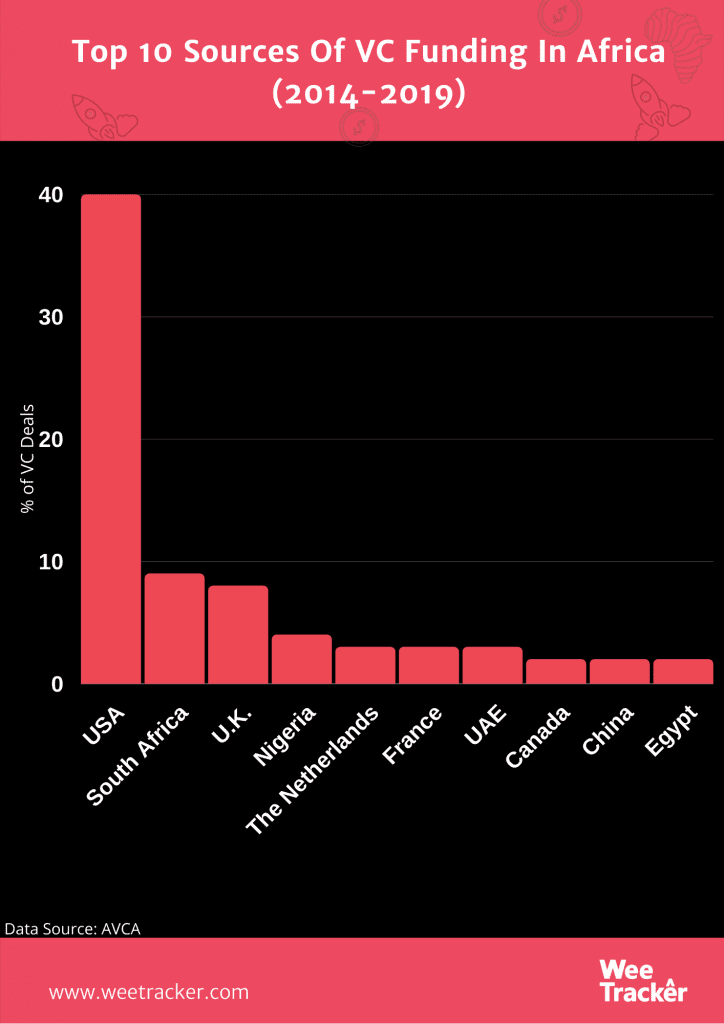

Indeed, recent data from African Venture Capital and Private Equity Association (AVCA) suggests that 40 percent of the total number of investors that took part in VC deals in Africa between 2014 and 2019 are based in the United States of America (USA).

Although it’s undeniable that there’s a growing crop of local venture capitalists (VCs) and angel networks getting in on the act, Funders based in African startup hubs like South Africa, Nigeria, and Egypt accounted for a combined 15 percent, per the report. The rest of the funding came from the United Kingdom, the Netherlands, France, China, Canada, and the United Arab Emirates.

Initiatives like Asemota’s Nkali Fund and Iyin Aboyeji’s Future Africa Collective are the next steps in plugging local funding gaps and, thus, creating a deep-rooted and more robust African startup ecosystem, less dependent on foreign capital and its quirks.

The Nkali Fund slogan: “For Africans by Africans” seems to have its head in the right place as around 5,000 people have already indicated their interest in less than 3 days.

On its part, the Collective that was unveiled by the celebrated co-founder of Andela and Flutterwave in April saw eight investors pool USD 100 K for the Collective’s first fully funded deal within three days and it received 400 applications from potential investors within the first week.

Unlike investment funds backed by institutional investors, the Collective’s model is about searching for startup investment opportunities and offering persons/groups (including “ordinary” individuals), who join, a chance to invest.

The Collective handles due diligence and investors who decide to fund any deals can follow through with the Collective’s US-based fund partner.

Both Nkali and the Collective are about unlocking a new path for African startup funding through the creation of new and sustainable early-stage startup funding sources for the ecosystem.

Correction: This article was updated on August 17 at 09:33 WAT to reflect that Future Africa, not Nkali as stated in an earlier version of this article, is the first organisation to launch and deploy a rolling fund in Africa through the Collective.

Featured Image Courtesy: Business Elites Africa Magazine