Nigerian fintech startup, Moniepoint, is on a growth tear demonstrated by news of last year’s impressive showing despite extended periods of turmoil in the country’s financial services sector. At the heart of Moniepoint’s boom, WT gathered, are timely manoeuvres that have proved shrewd, and yet more fresh bets aimed at future-proofing the business.

About this time a year ago, Nigeria was plunged into chaos as botched banknote reforms by the Central Bank of Nigeria triggered a four-month cash crunch, leaving Nigerians grappling with limited access to currency notes.

During this time, fintech startups whose bottom lines rely on powering agency banking services largely based on cash-in/cash-out (CICO) transactions, endured a torrid time as the cash crisis bit hard.

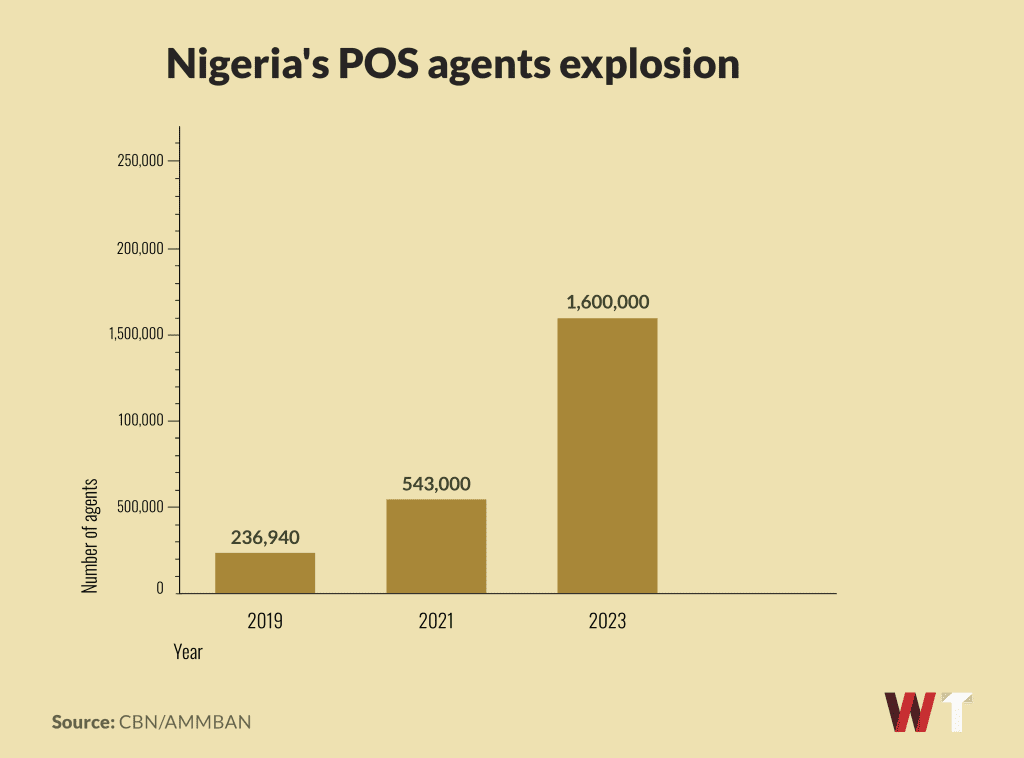

The cash scarcity meant less business for Nigeria’s near-ubiquitous POS agents; the country’s version of mobile money agents numbering 1 million+ currently, and therefore depleted earnings, as locals also opted out amid the transaction fees surge at POS agent posts.

Having evolved from a little-known banking software development company led by ex-banker Tosin Eniolorunda into a key player in the agency banking space since 2019, Moniepoint had plenty to lose amid a cash scarcity likely to cripple much of its 300,000-strong POS agent network across Nigeria.

“When agency banking started, it was one of the things we used to build for banks, we built a lot of their back office settlement systems. But then we realised the banks are dealing with urban areas and there's the opportunity to take it upon ourselves and go down into where loads of people need it,” Edidiong Uwemakpan, VP - Global Marketing, at Moniepoint, told WT in a wide-ranging interview that took place at the back end of last year.

“We started as an agency banking business, offering debit cards, insuring terminals, providing savings products, and even overdrafts to agents. As we expanded, we realized that agents were essentially businesses selling cash, and what if we transformed our products for agents into something we could sell to other businesses” she explained.

Thus, the company would be cushioned and propelled by a strategic move it had completed a year prior: Expanding its product suite to offer business banking solutions following the receipt of a banking license in February 2022.

“The [cash] scarcity issue changed things. Moniepoint was in a unique position. On one side, cash scarcity affected the cash-in, cash-out aspect of the agent business. On the other side, Moniepoint also had a robust business banking operation. Lots of people were coming on board to receive payments and stay in business,” Uwemakpan said.

“So even though there was a decline on one side, it was offset on the other side of the business banking environment,” she added.