Funding for African Female Founders, a Rounding Error in Global VC Space?

Has the hoopla around diversity really brought about change? Well the numbers say otherwise. The global VC pie for 2020 was USD 300 Bn. But 0.01% or USD 41 Mn made it to African women CEOs in Africa as funding.

Bringing the spotlight back on African women CEOs, Eloho Omame, founder of pre-seed VC for women, FirstCheck Africa, says “Hardly anyone is talking about the fact that Africa’s female founders are a rounding error in global startup funding.” She points how — “Of roughly USD 300 Bn in global funding last year about 2% (USD 55 Bn) went to female-led startups and about 1% (USD 3 Bn went to black founders). Closer to home USD 1.3 Bn came to Africa.

Even the USD 41 Mn that came to 24 African startups with female CEOs isn’t something to get too elated about, says Eloho Omame — as the lion’s share (70%) of this went to three American women CEOs. A pittance of USD 11.3 Mn was what native African women CEOs managed to raise. “Fewer than 100 black women globally raise USD 1 Mn or more for their startups. Most of them were American.”

One cannot however, deny that momentum has been building. While in the initial years, it was only Y-Combinator that had a clear Africa Focus, now other players too have entered the continent. Google has a Black Founders Fund and the Google for Startups Accelerator programme. Facebook last year announced USD 200 Mn in funding for black-owned businesses; as part of its USD 1.1 Bn social justice commitment.

There are dozens and dozens of accelerators and incubator programmes in Africa such as Founder Institute, Betraton, Changelabs, Openner, Mastercard’s Start Path Accelerator, Flat6Labs, Catalyst Fund, Maersk, FoodTech Africa, FRAGG Impact. But similar to FirstCheck Africa there are only a few — F-Lane Accelerator, “I’M IN” Accelerator, Greenhouse Lab, She Leads Africa — that are women focused.

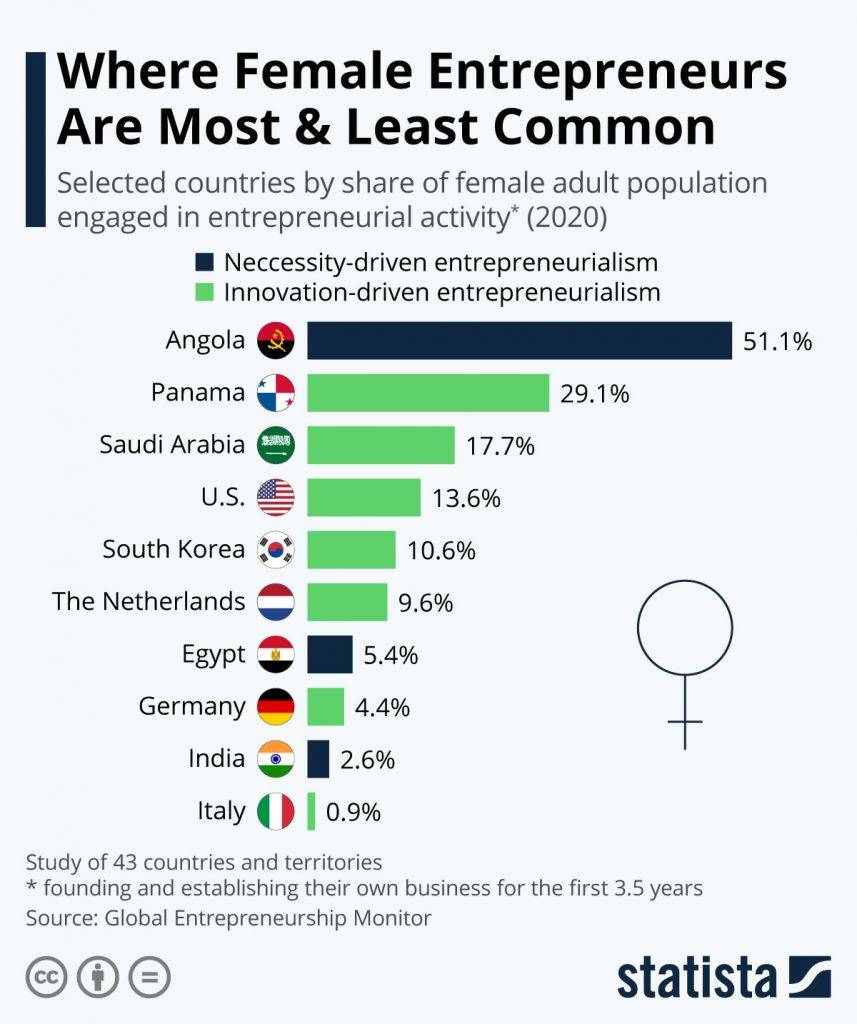

Another way of looking at female representation in the work force would be to look at how many women have made it to the top. African woman do seem feistier than their global counterparts as 23% made it as executives, compared to worldwide average of 20%. At CEO level, its 5% of African women, compared to a 4% global average, according to a McKinsey report. Another positive is that in its Global Gender Gap Report 2018, the World Economic Forum found that South Africa has the 19th smallest gender pay gap out of 149 countries.

But, while women are making it to the top ranks are they being paid on par with men? A 2019 PwC report found that South African men are consistently paid more than women; and that 86% of SA CEOs are white. So for African women CEOs and startup founders – the dice seems doubly-loaded with both racism and patriarchy.

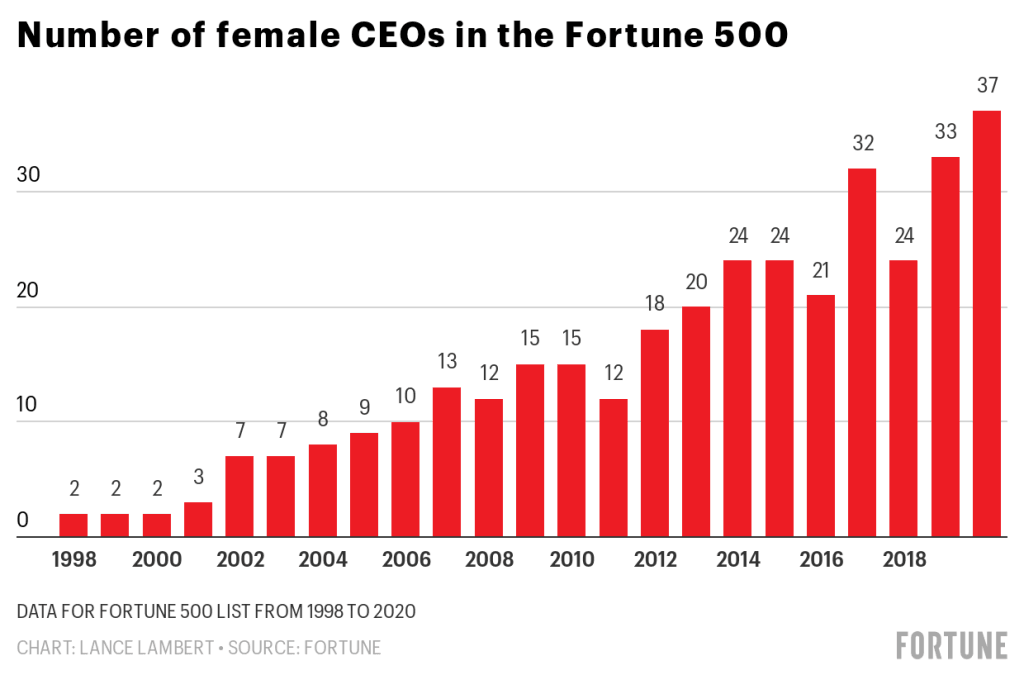

But with “diversity” and “inclusion” being taken more seriously globally, we can hope that African women CEOs might have it easier going forward. For instance this year, the Fortune 500 list had a record-breaking 41 woman-run companies; of which 2 had black female CEOs — Rosalind Brewer of Walgreens Boots Alliance and Thasunda Brown Duckett of TIAA. Compare this to a decade ago – when there were only two black women at the helm on Wall Street. Ursula Burns headed Xerox from 2009 to 2016, and Mary Winston was the interim CEO of Bed Bath & Beyond for six months in 2019.

“As inspiring as the global DE&I conversation is the reality is that its unlikely to change much for Africa’s female founders, who are sit at a frustrating intersection of niche after niche after niche, in an industry that is not just white male dominated, but also ultimately Euro-centric,” says Eloho Omame, adding, “Its an exciting time for diverse founders. But not if you’re an African woman building your startup in Africa.”